Posts Global Market US 3307 31 March 2025

New protective measures limit opportunities for importing metal products

The overseas market has been the main export benchmark for European metallurgy over the past decade. Therefore, the resumption of the 25% duty on the import of all metal products to the United States from March 12 will hit the foreign sales of EU metal companies. GMK Center investigated how serious the consequences will be.

Vicious circle

Donald Trump first introduced an additional 25% duty on steel imports on March 9, 2018, during his first presidential term. His successor, Joseph Biden, agreed on November 1, 2021, to replace this tariff for the European Union with a quota of 3.3 million tons per year. The decision came into force on January 1, 2022.

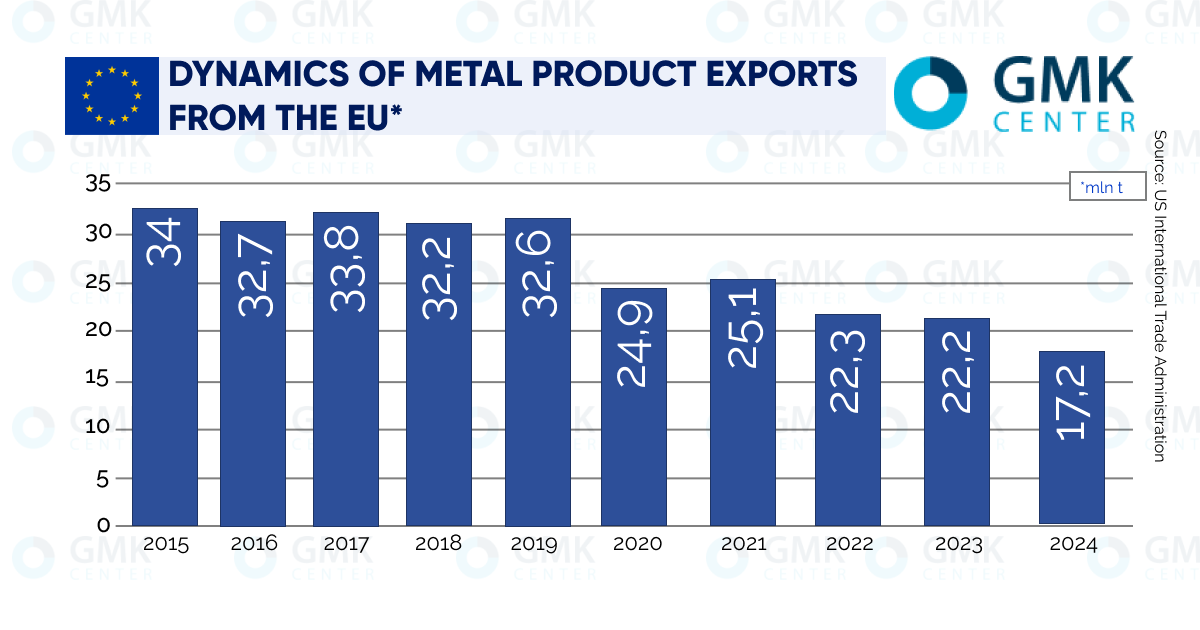

As the infographic below shows, this did not help the Europeans increase their overall metal export volumes. It is also clear that the most sensitive blow to their foreign sales was not the trade war with the United States, but the coronavirus crisis. It can be stated that its consequences have not yet been overcome, and previous economic ties have not been restored.

In recent years, the United States has ranked second in terms of the total volume of European metal exports in monetary terms. Turkiye is in first place. But it mainly buys steel scrap from the EU. In terms of imports of finished products, the United States is the undisputed leader. And if we consider the impact of additional duties directly on exports to the United States, then it certainly took place. But, again, it was “undermined” much more by the corona crisis.

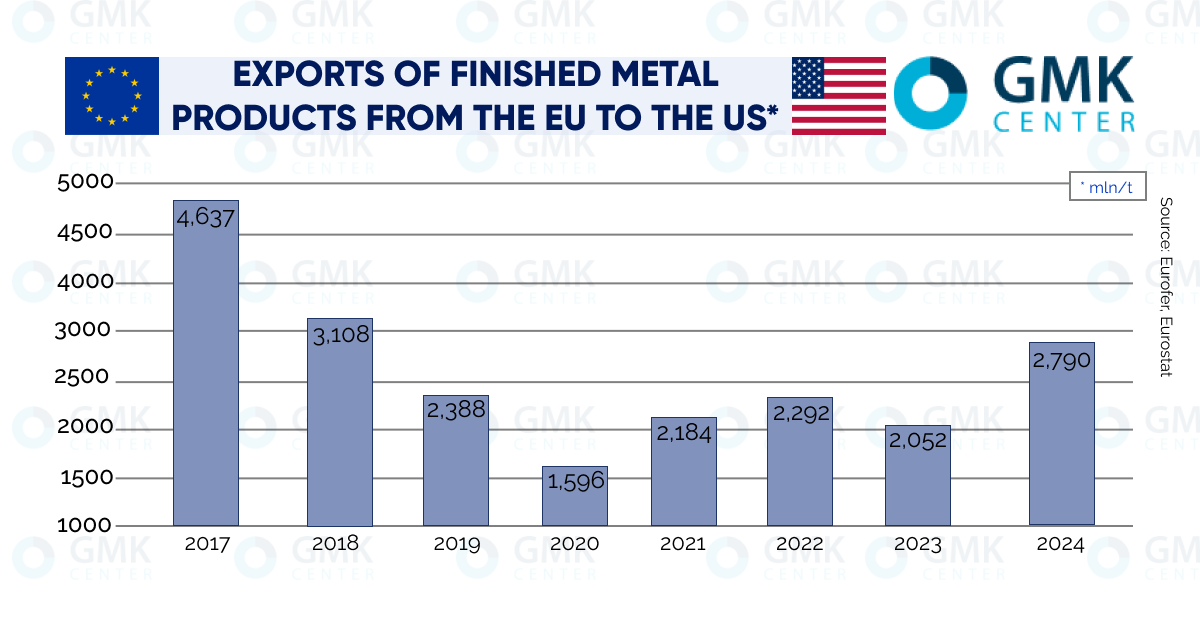

And under the quota conditions, Euro-metallurgists managed to almost completely recoup their positions in metal sales in kind. In monetary terms, the picture is even rosy. In 2024, steel exports from the EU to the US grew by 45% compared to 2019, reaching €8 billion. It follows that the statement by European Trade Commissioner Maroš Šefčovič on February 22 about the probable damage to the EU from Trump’s tariffs of €28 billion contains a very broad estimate. It includes not only steel itself, but also products made from it, including cars. Plus aluminum and its derivatives.

Speaking about the consequences, it is worth noting that the export of rolled metal from the EU is quite diversified. In the flat products segment, the US share is only 17% (data for 2024), the category «other countries» accounts for 38%. Similarly, for long products: 14% and 39%, respectively. The main European exporters of rolled products are the transnational concern ArcelorMittal SA, the German ThyssenKrupp AG and the Swedish SSAB AB.

World Steel Dynamics believes that the American import duty will have a moderate impact on EU exports and the capacity utilization there. Since the price gap between the EU and the US is more than 55%. For example, for hot-rolled coils the ratio is $900/t versus €640/t. «This justifies exports, despite the 25% tariff,» WSD emphasizes.

In this sense, the Trump administration’s protective measures resemble a vicious circle. First, after the introduction of the duty, domestic steel prices rise. Since local producers no longer have to compete with cheaper supplies from outside. The rise in the price of metal products brings back importers, since the duty loses its protective effect.

But much depends on consumer demand. If it is unstable and weak, the price surge observed in February-March on the US market will be short-lived. American metallurgists will have to reduce their appetites. Accordingly, the possibilities for imports will begin to narrow.

Automotive industry: cross out

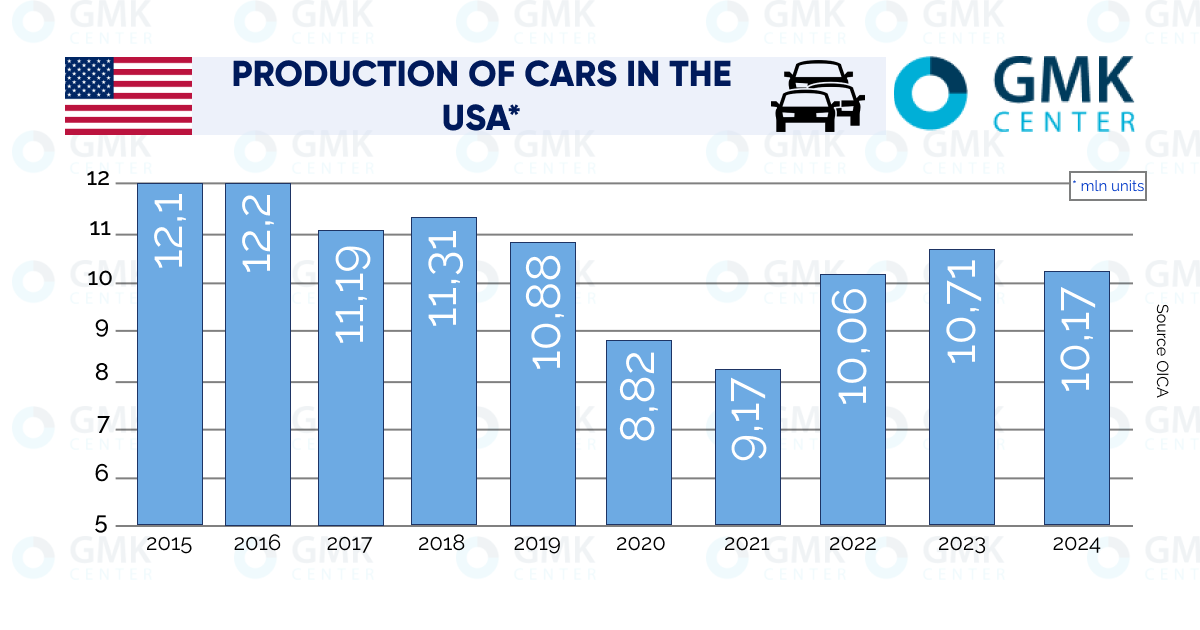

By the mid-2020s, the US auto market had only partially regained the positions lost due to the coronavirus crisis. Moreover, last year the dynamics again became negative.

For the current year, Cox Automotive analysts expect sales to grow by 2.5%, to 16.3 million units, including light trucks. According to S&P Global, the figure will be 16.2 million units. So far, these optimistic forecasts have not come true. In January-February, new car sales fell by 3.1%, to 2.33 million units, excluding trucks.

The market will be greatly affected by the additional 25% duties on imports of all cars and spare parts, which are to come into effect no later than May 3. The United Auto Workers union welcomed this decision, saying that «it could bring thousands of well-paying auto jobs back to the United States». However, the automakers themselves are not so optimistic.

The Stellantis alliance warned that the duties will ultimately increase buyers’ costs. «Because the industry in North America is highly integrated, these tariffs will disadvantage Stellantis’ flagship brands – Chrysler, Dodge, Jeep and Ram – compared to Korean, Japanese and European companies,» the alliance noted. This refers to the fact that almost 60% of parts for cars assembled in the United States come from abroad.

Therefore, according to the head of the association «Automotive Innovation» (which unites all major US companies except Tesla) John Bozzella, some models may become 25% more expensive. Cox Automotive gives more conservative estimates. According to its calculations, the new tariffs will add $3,000 to the cost of cars made in the United States and $6,000 to cars from Canada and Mexico. In any case, one can agree with Bozzella’s statement that «the negative impact on prices and availability of cars will be felt almost immediately».

And let’s not forget about American auto exports, which have been steadily falling over the past 10 years. If in 2014, 4.3 million cars assembled in the US went to foreign buyers, then in 2024 – only 1.43 million units. Now the US risks falling out of the top 5 largest global auto exporters. Since China and the European Union will undoubtedly respond to Trump with mirror duties on the import of cars from the US. Other countries may follow their example. This means that the auto industry is a very weak candidate for the drivers of steel demand.

Bet on construction

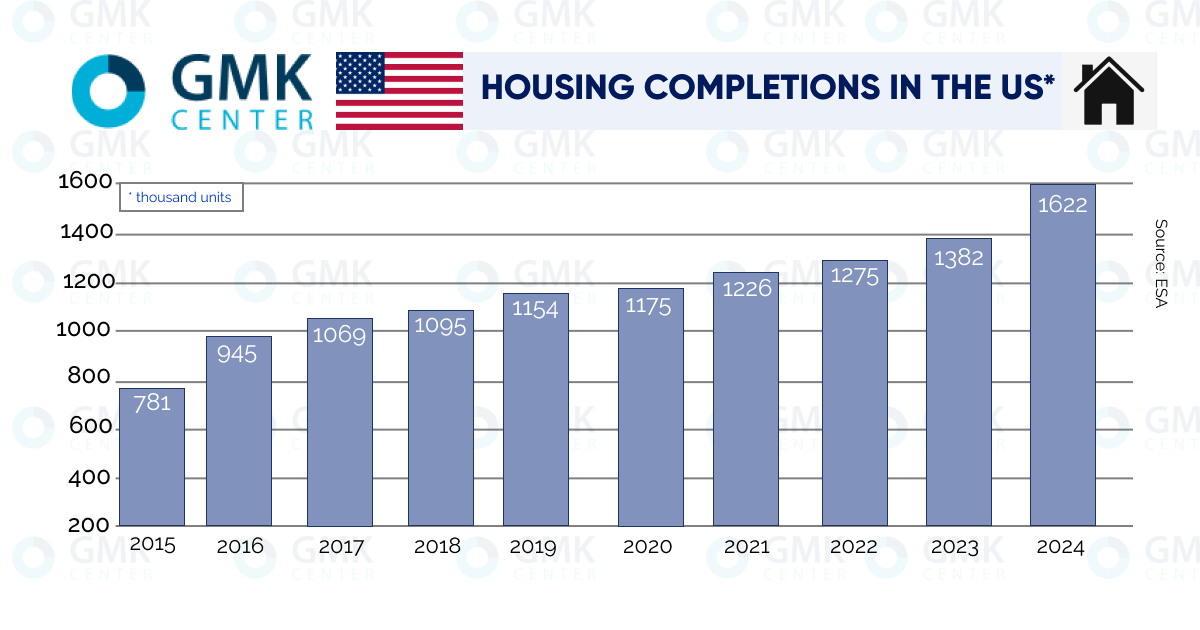

The housing construction market in the US tested the “bottom” in 2012 at 545 thousand units of housing commissioned. After that, a steady rise began. By the end of 2024, the indicator increased by 5.9%, to 1,592 thousand units.

As of January 1 of this year, 1,350 thousand units of new housing construction projects were recorded in the country. This corresponds to the average value over the past 5 years. In January-February, the indicator grew by 11.2% at once, to 1,501 thousand units. By the end of 2025, the National Association of Realtors expects growth of 14%, mainly due to the construction of compact and affordable houses. The forecast is based on the assumption that the average mortgage rate will decrease to 6% compared to 6.65% in 2024.

It is true that not all market participants are so optimistic. The Mortgage Bankers Association predicts a decrease only to 6.5%, and Redfin (provides mortgage brokerage services in more than 100 regions of the United States and Canada) expects the average rate to increase to 7%.

Obviously, the final and decisive word here belongs to the US Federal Reserve. The American regulator has previously declared its intention to reduce its base rate to 3.4% by the end of 2025 compared to 4.75-5% in September 2024. This will help lower mortgage rates and, as a result, increase demand for housing. But plans may change.

The introduction of 25% duties on imported steel and cars, as well as other similar measures by the Trump administration, are pushing up domestic prices in the American market. That is, they are accelerating consumer inflation. And it is precisely the acceleration of inflation that can force the Fed to abandon the easing of monetary policy.

Mordor Intelligence estimates the US infrastructure and industrial construction market at $171.26 billion by the end of 2024. By the end of 2029, the figure will reach $203.5 billion at an average annual growth rate of 3.51%. The main driver for the sector is government investment based on the law adopted in 2022. It provides for the allocation of $550 billion for the construction of new infrastructure and the repair of existing infrastructure until 2027 inclusive.

There is great potential for construction in the energy sector. The demand for electricity is growing in parallel with the creation of new data centers needed to service AI-based processes. In 2024, solar power plants with a total capacity of 21.4 GW and wind power plants with a capacity of 2.8 GW were put into operation in the United States. The Federal Energy Regulatory Commission predicts that another 93.8 GW of solar power plants and 23.3 GW of wind power plants will appear in the country by September 2027.

Industrial construction can make a significant contribution to stimulating steel demand. Trump’s tariff policy is aimed at forcing large foreign corporations to create production facilities in the United States. And it is already yielding results. Among them, we can highlight the plans of Taiwan Semiconductor Manufacturing Company, the world’s largest chip manufacturer, to invest $100 billion in the construction of three plants in the United States. Of this, $65 billion will be spent on the creation of a plant in Arizona. Its launch is expected in 2028. The other two plants should start operating in 2030.

At the end of March, the South Korean concern Hyundai announced the construction of a metallurgical plant in Louisiana with a capacity of 2.7 million tons of steel per year. The cost of the project is $5.8 billion. Its implementation will allow the American branch of Hyundai to produce and sell automotive steel in the United States without paying a 25% duty, which foreign suppliers have to pay.

For the same purpose, in order to avoid duties, the pharmaceutical corporation Johnson&Johnson is investing $55 billion in the construction of four plants in the United States. At the end of March, the corporation announced that the first plant worth over $2 billion will be built in North Carolina. Their competitor, the corporation Eli Lilly&Co, promised in February to spend $27 billion on the construction of plants in the United States by 2030.

Thus, high demand from the construction industry is capable of supporting steel prices on the American market. Their current level allows European manufacturers to maintain margins when exporting to the United States.