Posts State discount rate 1605 18 March 2025

To fight inflation, the National Bank raised the key rate to 15.5% per annum from March 7

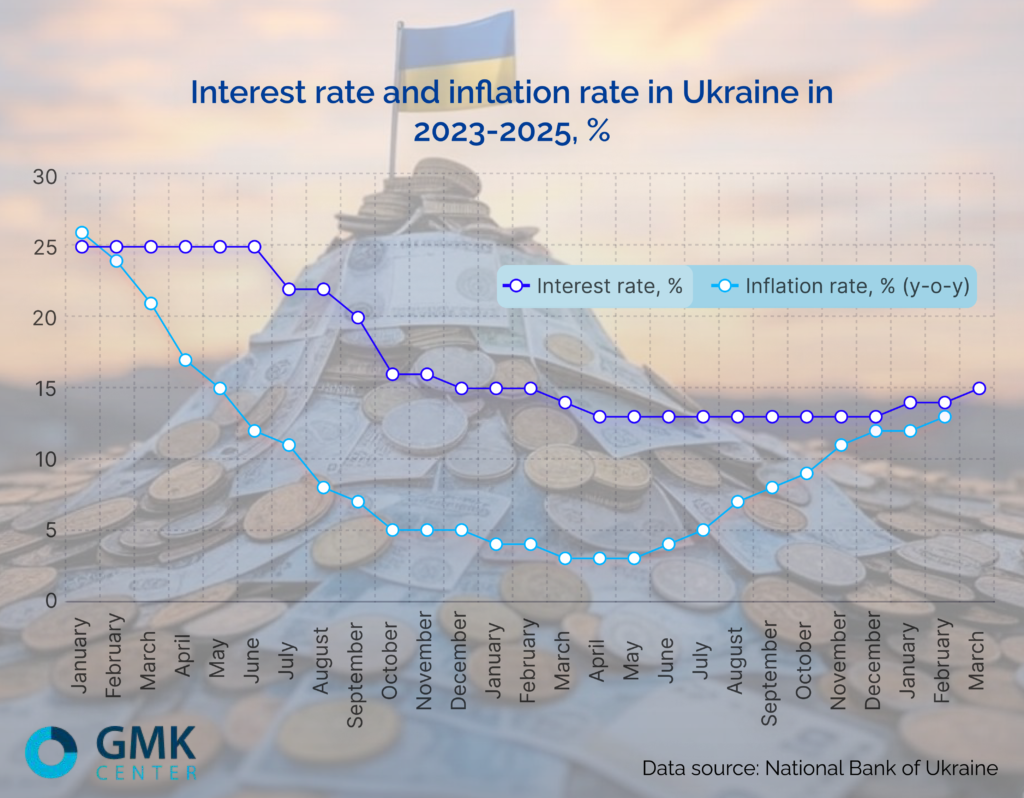

Since the beginning of the year, inflation in Ukraine has sharply intensified and reached 12.9% and 13.4% year-on-year in January and February, respectively. This was due to both temporary factors and fundamental factors in the form of increased business costs for energy and labor, as well as the persistence of fairly high consumer demand. All this led to the fact that the National Bank raised the discount rate to 15.5%. Experts believe this decision creates risks for the economy and the fight against corruption.

Fighting inflation

From the very beginning of this year, the National Bank of Ukraine expected an increase in inflation. At the end of January, the regulator worsened the inflation forecast for 2025 from 6.9% to 8.4%. At the end of February, inflation in annualized terms rose to 13.4% from 12.9% in January. Its rise in inflation is due to several key factors:

- Increase in utility tariffs for households.

- Increase in production costs, including energy and labor costs, which affects final prices for consumers.

- Lower crop yields last year contributed to higher food prices.

- Weakening of the hryvnia exchange rate, which made imported products more expensive.

In such cases, the National Bank traditionally uses regulation of the discount rate to fight inflation. According to Dmytro Taranenko, an economist at Dragon Capital investment company, raising the discount rate is one of the NBU’s tools to curb inflationary pressure through such channels as increasing the attractiveness of hryvnia assets and curbing the imbalance of inflationary expectations. Therefore, the NBU expectedly raised the discount rate from 14.5% to 15.5% on March 7.

“In fact, the NBU signed its helplessness both in terms of bringing inflation to the 5% target (if this target was underestimated during the war – why was it not revised to 8-10%?) and in terms of increasing lending. The minimum that the NBU lowered its rate during the war was 13%, which was clearly insufficient to boost lending,” says Oleksiy Kushch, an analyst at the United Ukraine think tank.

The current increase in the discount rate is the third since mid-December 2024. Before that, the National Bank kept it for six months at the level of 13%, to which it was reduced from 25% from July 2023 in 7 stages.

Reference: The discount rate is one of the monetary instruments, which is a basis relative to other interest rates of the NBU and is used as a benchmark for the cost of borrowed and placed money. It is used to regulate the cost of money in the banking system and to restrain price growth in the economy.

Consequences of a rate increase

The main problem is that the National Bank follows the policy of keeping inflation within certain limits, which is relevant for peacetime, but does not take into account the needs of supporting the economy in war conditions. For example, banks do not lend to the defense sector, and continue to do so (or rather not to do so), although the NBU is able to correct the situation. It is hard to imagine a more important task in war conditions than the comprehensive development of the defense industry.

According to Vitaliy Shapran, a former member of the NBU Council, the NBU’s explanations that raising the rate to 15.5% is necessary to make deposit rates in banks more attractive for households and businesses and to stabilize the currency market look worthless and are designed for an unprepared audience. As a result, the increase in the discount rate will lead to the following consequences:

- worsening of credit conditions, especially prime-segment borrowers will feel it;

- tougher conditions for new borrowings of the Ministry of Finance through government bonds;

- reduction of the NBU’s profit;

- decrease in tax revenues due to a decline in business activity, which occurs under the pressure of rising credit rates;

- growth of the Ministry of Finance’s expenditures on government bonds, the yield of which is linked to the discount rate.

“This decision of the NBU and the widening of the interest spread between the discount rate and the yield of three-month certificates will lead to the fact that the yield on government bonds from 15-17%, will rise to the level of 18-19%, and this is an increase in expenditures on servicing the national debt of the country and additional burden on the budget,” adds Oleksiy Kushch.

On the other hand, even maintaining a low discount rate to improve lending conditions does not guarantee the activation of loan issuance. The level of risks in the economy under the war conditions is extremely high, there are very few quality borrowers, so banks prefer to buy low-risk government bonds rather than to lend to the real economy. This trend was in place long before the war, and it even intensified during the war, as the financial condition of borrowers deteriorated significantly.

Beneficiaries of the NBU decision

The main beneficiaries will be commercial banks, which will be able to earn 19% per annum on 3-month NBU certificates of deposit when the hryvnia is stable. Since March 7, with the discount rate of 15.5%, overnight certificates of deposit will earn banks 15.5%, 3-month certificates of deposit – 18%, and overnight loans will cost 18.5%. From April 4, these rates for banks will be 15.5%, 19% and 19.5% respectively.

“The income on these instruments is paid by the National Bank. On UAH 1 billion is UAH 190 million per year, and on UAH 100 billion is UAH 19 billion. At the beginning of March, there were more than UAH 500 billion in certificates of deposit (overnight and 3-month). The amount that the NBU will pay to banks at the end of the year under the scheme with certificates of deposit will be about UAH 80-90 billion, that is, more than $2 billion,” says Oleksiy Kushch.

According to economic expert Daniil Monin, the increase in rates on 3-month certificates of deposit up to 19% will increase parasitization of the banking system at the expense of the budget and will increase the profitability of the banking system for the year estimated from 200 to 250 billion UAH.

“At the same time, the increase in the rate will not particularly affect the reduction of inflation, since loans in the economy are not issued much as it is, and deposit rates are not growing much either. In addition, inflation is mainly non-monetary in nature in the form of a 2-fold increase in the cost of electricity over the past two years and rising labor costs, as well as increasing taxes on labor,” Daniel Monin told GMK Center in a commentary.

For its part, the NBU is confident in the effectiveness of the measures taken, but is ready to take additional actions in case of strengthening risks to price dynamics and inflation expectations. It is expected that in the second half of this year the discount rate will go down to 14.5% and 13.1% on average in the III and IV quarters. This will be facilitated by improved crop yields, stabilization of the exchange rate and the above monetary policy measures.

“In combination with exchange rate policy, as well as other factors that do not depend on the National Bank such as future harvests and gradual reduction of fundamental inflationary pressure due to slowing growth of business costs, such actions will contribute to the reversal of the inflationary trend from the second half of 2025, to about 8% at the end of the year”, – said in a commentary GMK Center Dmytro Taranenko.

In the fourth year of the war and the Ukrainian economy has not been transferred to “military rails”, and the National Bank pursues a monetary policy of virtually peacetime. On the one hand, it makes debt servicing more expensive for the state budget, which is completely deficit and goes to defense needs. On the other hand, after the increase in the discount rate, it makes business loans even more expensive and less accessible.