Posts Global Market rebar prices 2143 18 June 2025

Declining scrap prices and weak demand in key regions drive market conditions

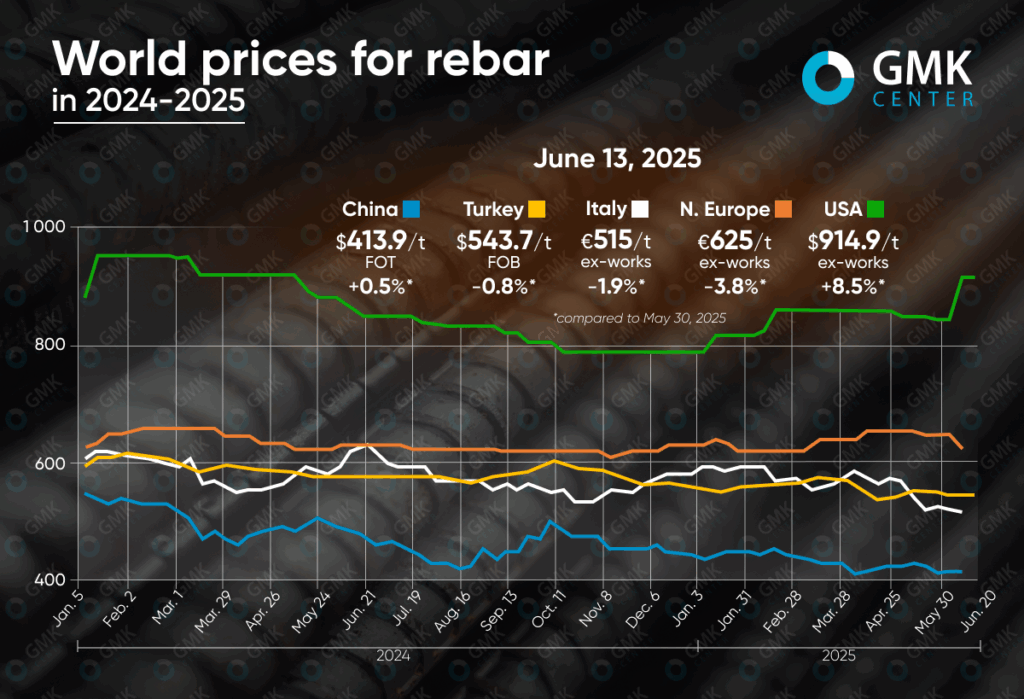

The global rebar market showed mixed dynamics in early June 2025. Although prices in most regions are under pressure due to seasonal slowdown and weak demand, the US market saw a sharp rise in quotations due to new tariffs and producer activity. Chinese prices remained almost stable, while in Turkey and the EU, the market continued to decline.

Turkey

In the first half of June 2025, the rebar market in Turkey saw a 0.8% decline in prices to $543.75/t FOB. The main factors weighing on the market were low demand in both domestic and export markets, as well as macroeconomic difficulties in the country.

Demand from key regions remained limited – in particular, buyers in Europe refrained from contracting due to uncertainty about July quotas. Sales to Syria and Northern Cyprus picked up slightly, but did not offset the overall weakness in global demand. Demand from Latin America, Africa, Palestine, and Yemen was almost non-existent.

Activity in the domestic market was held back by factors such as high key rates, financial constraints, and the Eid al-Adha holiday period. Wholesalers refrained from purchasing, awaiting a change in monetary policy. In the raw materials segment, high scrap prices and lower quotations for Chinese billets forced Turkish mills to switch to imports from Asia.

The forecast for the second half of June remains cautious: demand is likely to remain weak and price dynamics restrained. The only factor that could potentially stabilize the market is the Turkish Central Bank’s expected decision on June 19 to lower interest rates, but its effect will be limited in the short term.

EU

The rebar market in Europe showed a clear downward price trend during the period. The largest decline in quotations was observed in Northern Europe, where prices fell by 3.8% to €625/t ex-works, the lowest level since March. In Italy, the decline was 1.9% to €515/t ex-works.

The main drivers of this decline were weak demand, especially from private residential construction, as well as a correction in scrap prices. In Germany, despite prolonged stability, prices also fell: base values dropped below €400/t, and aggregate prices, including surcharges, fell to €645-655/t. One of the reasons is low buyer activity, with buyers postponing purchases in anticipation of further price declines.

The situation is similar in Italy: after the May decline, rebar prices continue to fall, despite signs of growing demand from the infrastructure sector. Consumers are taking a cautious approach amid market uncertainty.

Against the backdrop of weak domestic demand, competition between European suppliers is intensifying. Import offers from Algeria, Turkey, and Spain are putting additional pressure on local producers. This is already affecting the markets in France and Austria, where buyers are actively demanding discounts.

The market will remain volatile in the coming weeks. A slight upward correction is likely if scrap prices stabilize and infrastructure projects pick up. However, overall, sluggish dynamics are expected to continue, with a possible further decline in prices due to weak demand.

USA

Since the beginning of June, the US rebar market has seen a noticeable increase in prices – by 8.5% to $914.9/t. The main factors influencing this were political decisions, actions by manufacturers, and seasonal fluctuations in demand.

After President Donald Trump announced a doubling of steel import tariffs to 50% (under Section 232), major producers – Steel Dynamics, CMC, Gerdau, and Nucor – almost simultaneously raised prices for new rebar orders by $60/t, with some also adding another $40/t for standard 20-foot bars.

This led to a rapid jump in spot prices from $750-780 per short ton to $810-850/t. Prices for imported rebar arriving in the US also rose, partly due to new tariffs and delays amid anti-dumping investigations against suppliers from Egypt, Bulgaria, Vietnam, and Algeria.

At the same time, overall demand remains unstable. Commercial and residential construction are showing weakness, partly due to high interest rates and limited financing. On the other hand, infrastructure projects, such as road construction, are supporting local demand.

In the short term, the US rebar market is likely to stabilize within the current price range. Trade policy, scrap demand, and seasonal slowdown in July-August will remain decisive factors.

China

In China, rebar prices rose slightly, by 0.5%, to $413.9/t FOT. This happened against the backdrop of generally weak demand and a seasonal slowdown in construction activity.

The market remained under pressure: low demand caused by rains in the south and heat in the north of China limited the volume of transactions. Buyers mostly purchased only what was necessary, reflecting the cautious mood of the market. Speculative activity remained low, despite short-lived optimism about US-China negotiations.

On the supply side, producers are in no hurry to cut production: blast furnace profitability remains positive thanks to lower coke and coal prices. Some steel mills have shifted to producing more profitable special steel, which has slightly reduced the volume of rebar on the market. At the same time, the largest mills, such as Shagang and Yonggang, have left prices unchanged and are providing subsidies to buyers.

The market will remain sluggish in the near future. Without a significant recovery in demand or government stimulus, prices will fluctuate around current levels.