Posts Global Market electricity prices 6679 07 November 2024

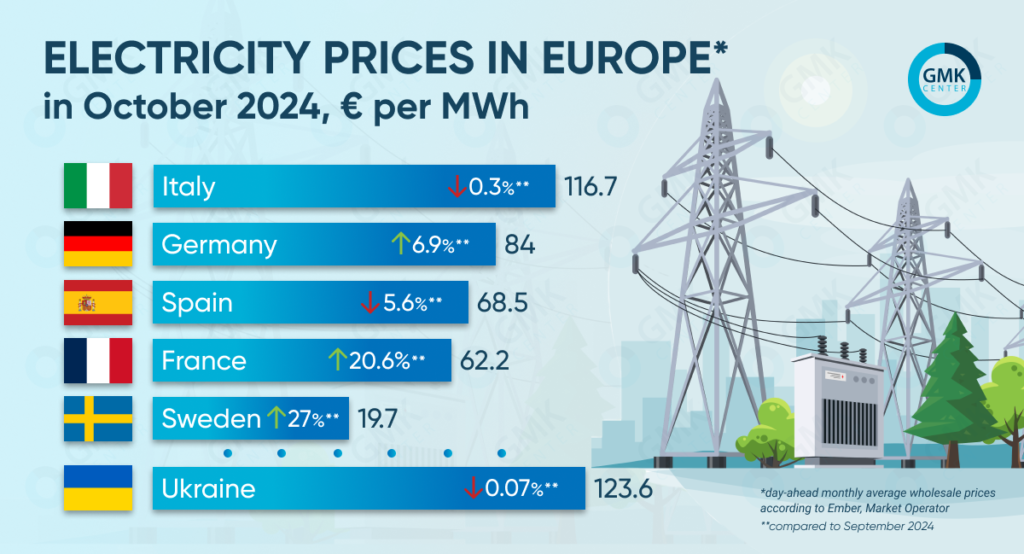

In Ukraine, the weighted average price of electricity on the DAM amounted to €123.6/MWh

In the EU, average monthly wholesale day-ahead prices in October 2024 showed a mixed trend.

According to Ember, they were as follows:

- Italy – €116.72/MWh (-0.3% m/m);

- France – €65.25/MWh (+20.6%);

- Germany – €83.98/MWh (+6.9%);

- Spain – €68.49/MWh (-5.6%);

- Sweden – €15.49/MWh (+27%).

October trends

Last month, electricity prices on European markets fluctuated depending on the volume of renewable energy generation, changes in demand, current prices of gas and carbon emissions. A weekly decline in electricity prices was observed only in the second decade of October.

On October 4, the price of TTF futures for the month ahead crossed the €40/MWh. On October 25, it reached its highest level since November 2023, reaching €43.7/MWh, as the market, despite the high level of reserves in Europe, feared the impact of the Middle East conflict on supplies.

As of November 1, The European Energy Exchange (EEX), a central European exchange for electricity and related products, forecasts that the basic settlement price of electricity futures on the German market in December 2024 will be €89.42/MWh, on the French market – €79.5/MWh, on the Spanish market – €77.7/MWh, on the Italian market – €116.53/MWh.

European steelmakers continued to lobby for the sector’s interests at the EU level. The crisis in the industry was discussed during a plenary debate in the European Parliament on October 23. One of the points of the industry’s rescue strategy listed in an open letter by steel company CEOs on the eve of the meeting is to reduce energy costs for energy-intensive sectors, such as steel, which are facing fierce global competition.

The requirements for electricity and its competitive cost go hand in hand with the availability of raw materials and the preservation of steel scrap within the EU. These issues are related to the transition of European producers to low-carbon production and electric arc furnaces, while maintaining competitiveness in the global market. For example, WV Stahl noted that German electricity prices for the industry are not competitive even compared to Europe. According to the European Steel Association (EUROFER), the European steel sector currently consumes about 75 TWh of electricity per year. The green transition could increase this consumption to around 160 TWh by 2030.

The situation in Ukraine

In Ukraine, in October this year, the weighted average price for the purchase and sale of electricity on the DAM, according to Market Operator, slightly decreased compared to September. It amounted to UAH 5659.97/MWh (€123.6/MWh at the average monthly exchange rate of UAH to EUR) compared to UAH 5664.16/MWh last month. Demand for the DAM in the period under review increased by 21.74% compared to September, while supply increased by 30.7%.

According to the analysis of D.Trading, last month Ukraine remained a net importer of electricity, but its total imports fell by 58% month-on-month – to 182 million kWh. It was the lowest since March 2024. The main factors that influenced the dynamics of electricity imports in October were the completion of the repair campaign at Ukrainian nuclear power plants and the dynamics of spot prices in Europe.

Overall, the utilization of the provided cross-section increased to 72% last month (71% in September). The largest volumes of electricity in October came from Hungary, followed by Slovakia and Romania.

At the end of the month, Ukraine and the EU agreed to increase the possibility of importing electricity in winter to 2.1 GW from the current 1.7 GW starting December 1. Ukraine will also have an additional 250 MW of guaranteed capacity for emergency power flows from the EU.

At the same time, according to various estimates, the electricity shortage in Ukraine in the winter of 2024-2025 could be significant. In its September report, the International Energy Agency noted that it could reach 6 GW (the IEA took into account the possibility of 1.7 GW imports from the EU.

“Finally, after Mario Draghi’s report, the EU is beginning to understand what all experts have been saying – the European Commission’s energy policy leads to losses in economic competitiveness and negatively affects the welfare of all EU citizens. Each EU country has its own unique energy system, energy balance and economic structure, and therefore they have very different electricity prices. Unfortunately, Ukraine has remained the leader in terms of electricity prices for industry among European countries for more than 4 months. This means that we need to develop all types of generation and increase electricity production using all available opportunities to have a future in the EU,” comments Stanislav Zinchenko, CEO of GMK Center.

Fullness of gas storage facilities in the EU

In late October, the European Commission reported that EU gas storage facilities were 95% full. As noted, during the energy crisis, EU countries agreed to a legally binding target of filling their gas storage facilities to 90% of capacity by November 1 each year to ensure security of supply and market stability during the winter months.

At the end of October, about 100 billion cubic meters of gas were stored in EU storage facilities, which is about a third of the bloc’s annual gas consumption.

According to European Energy Commissioner Kadri Simson, Europe is entering the winter with healthy levels of gas in storage across the region, diversified energy supplies, a greater share of renewables and a new commitment to energy efficiency and conservation.

European gas prices are still under pressure from rising Asian demand and concerns about future Russian gas and LNG supplies, said Anders Opedal, CEO of Norway’s Equinor.