Posts Global Market electricity prices 6764 08 May 2025

Blackouts in Spain and Portugal at the end of the month highlighted the problems of the EU energy grid

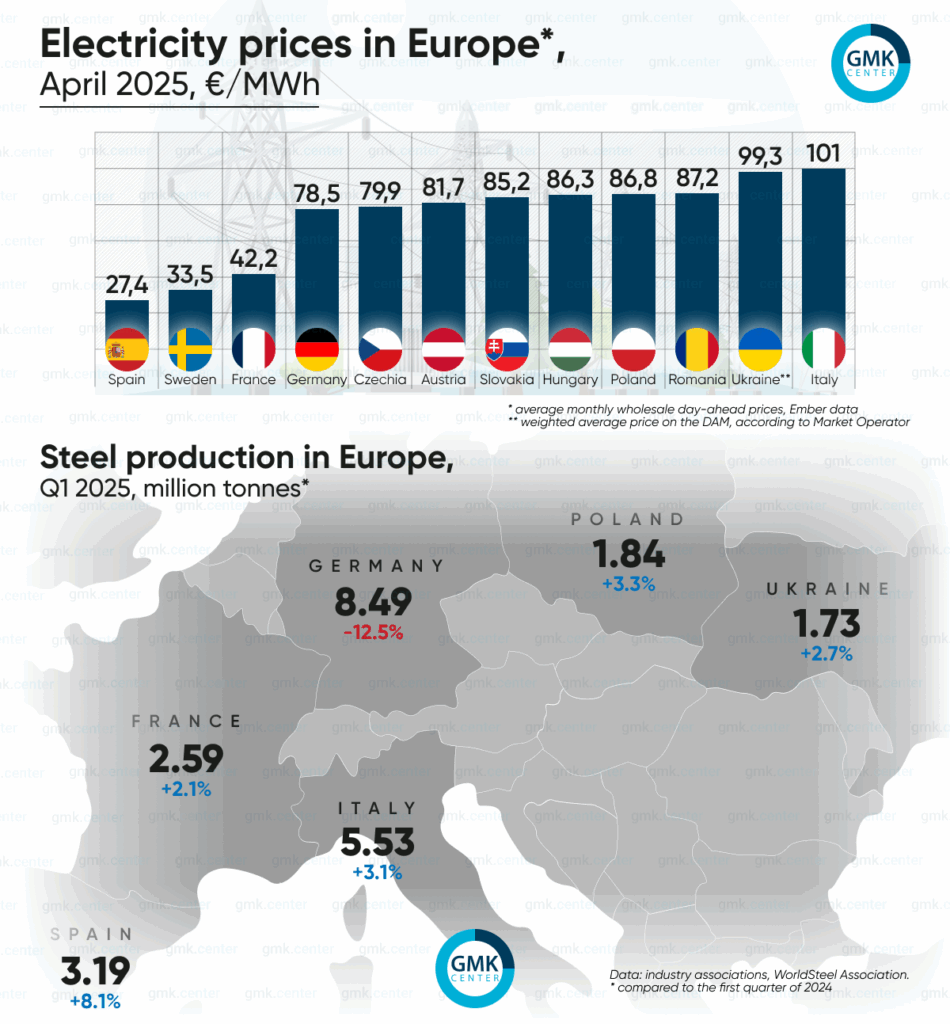

In the EU, average monthly wholesale day-ahead prices fell significantly in April 2025.

According to Ember, they amounted to:

- Italy – €101.01/MWh (-16% m/m);

- France – €42.21/MWh (-45%);

- Germany – €78.51/MWh (-15%);

- Spain – €27.44/MWh (-48%);

- Sweden – €33.46/MWh (-18.4%).

In Poland last month, the average monthly wholesale day-ahead price amounted to €81.7/MWh, in Slovakia – €85.15/MWh, in Hungary – €86.35/MWh.

Last month’s weekly prices fluctuated depending on the volume of renewable energy generation, and most markets saw a drop in electricity demand.

During the first half of the month, electricity prices in most European markets, according to AleaSoft, remained below €75/MWh, which was facilitated by record volumes of solar generation. During this period, Germany, France, and Italy reached certain production records.

In the third week of April, most major European electricity markets – excluding Italy, the UK, and the Nordic countries – saw zero or even negative prices, particularly over the weekend. Portugal, for instance, set a new record low on April 20 with a price of €4.99/MWh. Several countries also recorded negative hourly prices during the final week of the month.

Europe’s electricity market in April was also heavily influenced by falling natural gas prices. At the start of the month, Dutch TTF gas futures (according to ICE data) were priced at €42.65/MWh, but by April 30 had dropped to €32.30/MWh.

Gas prices fell due to several factors. In particular, the euro strengthened against the dollar amid financial market volatility caused by US tariffs. In addition, Trump’s tariffs led to a drop in demand for LNG in China (analysts had expected a 20% year-on-year decline in imports to the country in April), which provided relief to European buyers. The European gas market was also affected by Germany’s decision to ease its target thresholds for gas storage injection levels.

European blackout

On April 28, a large-scale power outage swept across the Iberian Peninsula, severely impacting Spain and Portugal. The blackout disrupted infrastructure, banking operations, communications, and other critical services, resulting in significant economic losses.

Short-term outages were also recorded in neighboring regions of Andorra (for a few seconds) and some parts of southwestern France (less than 20 minutes).

Gradual restoration of power supply in certain regions of Spain and Portugal began in the evening of April 28, and was fully completed the next morning.

The causes of the outage are still under investigation. In particular, on April 30, the Spanish power grid operator Red Eléctrica ruled out a cyberattack, but the company confirmed that the Spanish High Court of Justice is still looking into this possibility.

On May 1, the European Network of Transmission System Operators for Electricity (ENTSO-E) announced the creation of an expert group to investigate the incident. The team is required to deliver a final report within six months of the event, including interim updates with analyses, findings, and recommendations. Spain and Portugal have three months to provide their national data, while RTE will handle submissions from the French side.

Industry experts, according to Reuters, believe that whatever the cause of the incident, the massive power outage and previous smaller local cases indicate that the Spanish power grid is having problems amid a boom in renewable energy sources. The risks of such situations are increasing as the planned closure of coal, gas and nuclear facilities reduces its balancing capacity.

Earlier, Prime Minister Pedro Sánchez and the head of the grid operator Red Eléctrica, Beatriz Corredor, said that renewables were not the cause of the blackout.

In general, this large-scale incident has raised the discussion about the urgency of strengthening the EU energy system and its readiness to increase renewable generation.

During this year’s Easter, for several days, AleaSoft notes, the Spanish power industry operated with only two active nuclear reactors out of seven, which was a milestone for the country. Due to high renewable energy production and low demand, the country was able not only to cover its consumption but also to export electricity. Spain plans to decommission all seven nuclear reactors between 2027 and 2035.

The situation in Ukraine

In Ukraine, the weighted average day-ahead price for electricity in April 2025, according to Market Operator, decreased by 15.7% m/m – to 4611.22 UAH/MWh (€99.3/MWh at the average monthly exchange rate of hryvnia to euro).

Demand for the day-ahead market in April decreased by 10.08% compared to March, while supply decreased by 0.83%.

Last month, according to ExPro Electricity monitoring, Ukraine reduced electricity imports by more than 30% compared to the previous month – to 187 thousand MWh. Hungary accounted for the largest share in its structure in the period under review (44%), followed by Slovakia and Poland (both countries – 18%). Imports peaked on April 11 (over 20 thousand MWh).

At the same time, in April, Ukraine almost doubled its electricity exports compared to March – to over 150 thousand MWh. The largest volumes were exported to Hungary (38%) and Moldova (35%).

On May 1, the Ministry of Energy reported that the maximum capacity of electricity exports from Ukraine and Moldova to the EU countries was increased to 650 MW. This decision was made by the ENTSO-E expert group on commercial electricity exchanges. As noted, the country currently trades with all neighboring European countries – Slovakia, Romania, Hungary, Poland and Moldova. Exports traditionally increase in the spring, while imports decrease.

At the same time, as of the end of April, Ukraine’s Energoatom, according to the IAEA, was carrying out scheduled repairs at three of the nine power units at Ukrainian-controlled nuclear power plants.

Fullness of gas storage facilities

According to the AGSI platform, European gas storage facilities were 39.9% full as of May 1, 2025 (compared to 62.7% as of the same date in 2024).

According to Bloomberg, in April, France added the most gas to its reserves compared to other EU members, as its reserves declined sharply last winter. According to Gas Infrastructure Europe, France injected more than twice as much gas into its underground storage facilities last month as Germany did, and around 70% of the volume injected by Italy. France, according to the agency, was also the first country in the bloc to auction off all of its storage capacity for the year.

Germany, without waiting for the EU’s decision, lowered the country’s legally binding natural gas storage targets by November 1 from 90% to 80% in April. Cavernous storage facilities, which are more responsive to supply shortages, are to be 80% full by November 1, while porous tanks, including the country’s largest in Reden, are to be 45% full, except for four facilities near the Swiss-Austrian border (80%).

According to Anders Opedal, CEO of Equinor – the leading gas supplier in Europe – the continent’s need to refill its storage sites this season will keep market conditions tight and require an additional 200–300 LNG cargoes compared to last year.

At the same time, on May 5, the European Commission proposed the «REPowerEU Roadmap,» which outlines a plan to halt imports of Russian gas and oil, along with a gradual phase-out of importing Russian nuclear energy.

In particular, the document stipulates that in June the EC should submit a legal proposal to ban gas and LNG imports from Russia under existing long-term contracts. It should come into force no later than the end of 2027. The EU executive body will, in particular, ensure that the proposal is based on an adequate assessment of the legal and economic consequences.

In addition, next month, a draft decision will be presented to prohibit the purchase of Russian gas on the spot market and the signing of new contracts, with the ban set to take effect by the end of 2025.

As noted, in 2024, the EU imported 52 billion cubic meters of Russian gas (32 billion cubic meters of pipeline gas and 20 billion cubic meters of LNG (19% of total imports of this fuel).

According to the sources, the timing of the campaign to abandon Russian gas will depend on the EU’s ability to establish alternative LNG supplies from the United States, Qatar, Canada, and Africa. Purchases from the United States are being discussed as part of trade negotiations with the Trump administration.