Posts Global Market China 4067 08 April 2025

China's metallurgy will continue to face systemic problems this year

China began to take its first steps towards world leadership in steel production 30 years ago. The ambitious goal has been achieved. But much has changed over the years. Both in the Chinese economy itself and in the international trade conditions. Excess steelmaking capacity has generated a crisis of overproduction. And Beijing will not be able to overcome this challenge in the short term.

The source of all troubles

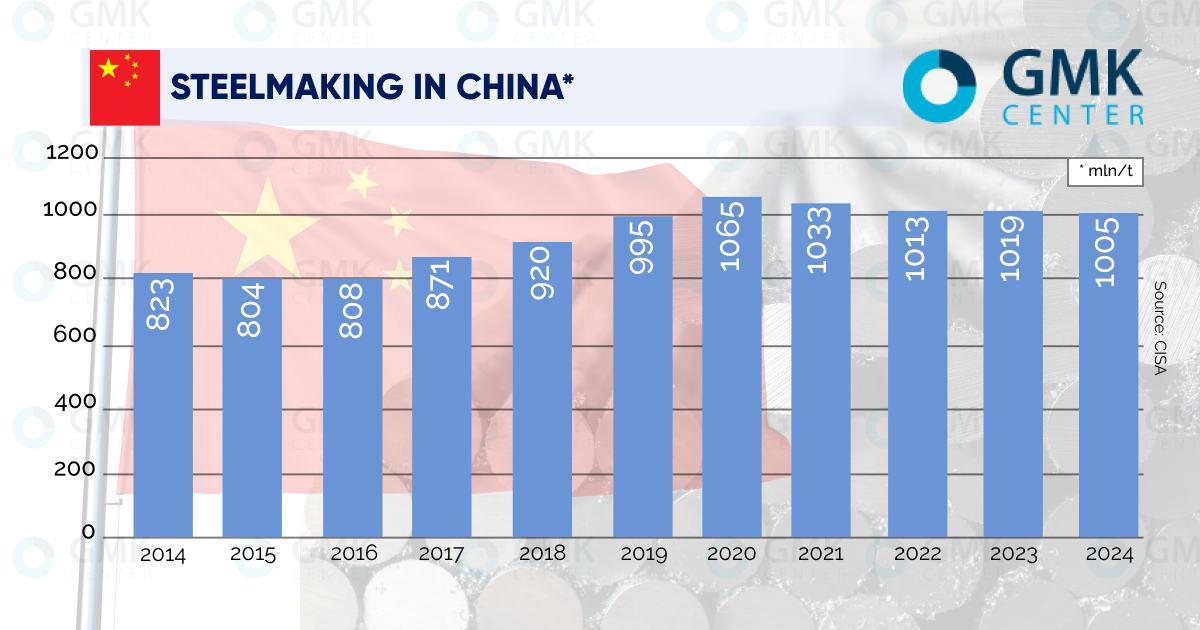

In January-February, steel production in China decreased by 1.5%, to 166.3 million tons. Without sensations, the dynamics fit into the S&P Global forecast, according to which in 2025 the annual figure will decrease by 1%, to 996 million tons. Something else is interesting. The downward trend has been observed since 2021 and it is usually explained by the crisis in the housing construction sector.

But, as analyst Xinyi Shen from the international Center for Research on Energy and Clean Air (CREA) notes, the real estate sector in China accounts for only 20% of metal consumption. Another 30% is taken by infrastructure. And the largest share of 50% is industry. That is, problems with housing construction should be compensated by the manufacturing sector. But this is not happening.

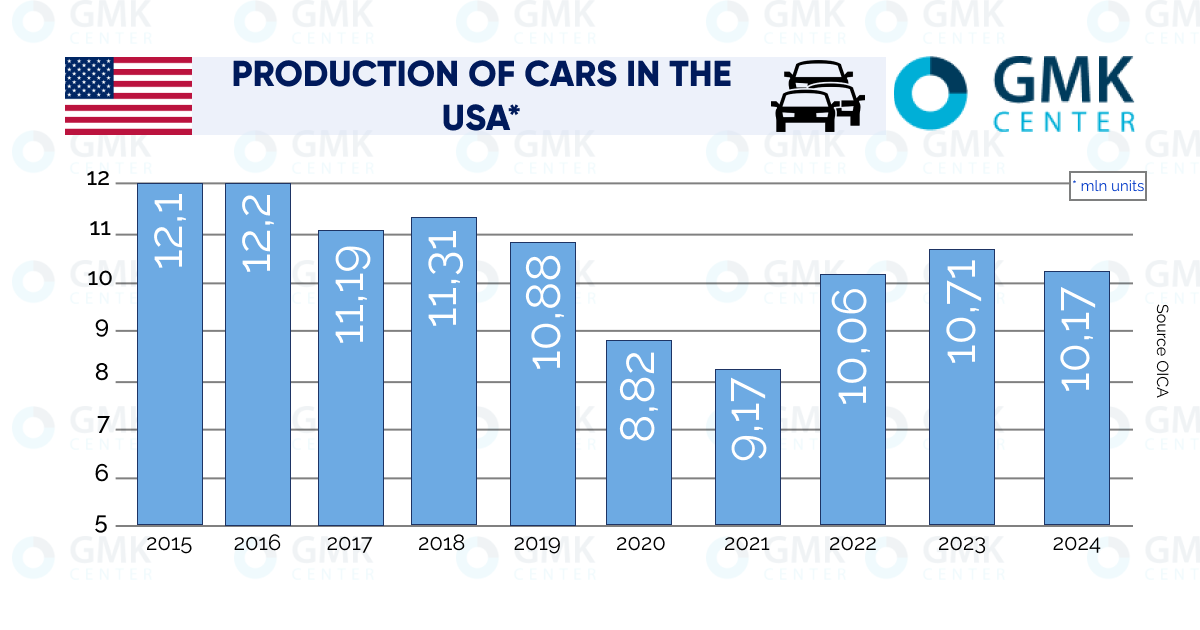

In 2024, new car sales in China increased by 4.1%, to 31.436 million units, according to the China Association of Automobile Manufacturers. At the same time, steel production decreased by 1.7%, to 1.005 billion tons. This year, in January, car production increased by 3.6% y/y, to 2.11 million units. In February, the indicator even soared by 39.6% y/y, to 2.1 million units. But at the same time, steel smelting and, accordingly, rolled product output showed a decline.

Infographics show that in recent years, the Chinese auto industry has been on the rise. This means that its demand for steel is only increasing. But this does not help the metallurgical industry stop its “slide”.

This also suggests that, in general, the policy of official Beijing aimed at stimulating consumer demand in the country is yielding results. In general for the economy. But not for Chinese metallurgy.

The “phenomenon” has a simple and only explanation. Excess steelmaking capacity. It is this that prevents the industry’s dynamics from being synchronized with the consumption sectors. And the authorities understand this.

In March, the National Development and Reform Commission announced the closure of metallurgical plants with a total capacity of 50 million tons of steel by the end of the year. By 2030, it is planned to reduce 200 million tons. That is, in 2025-2029, metallurgical plants with a total production of 50 million tons will be decommissioned annually.

The NDRC estimate can be considered close to reality. According to the China Metallurgical Industry Planning Research Institute, domestic steel consumption in 2024 was 863 million tons. Production was 1.005 billion tons. That is, approximately 200 million tons are “excess” – taking into account the MPI forecast for a further decline in metal consumption by 1.5% in 2025.

Support options are exhausted

Of course, in addition to domestic consumption, there is also export. And in 2024, it soared by 25.1%, to a record 117.06 million tons. Everything is logical: in conditions of overproduction, send the surplus to foreign markets. But there, to put it mildly, they are not very happy about the influx of cheap Chinese metal products. And they are trying in every possible way to convey this to official Beijing.

According to the China Iron and Steel Association (CISA), 29 major trade investigations have been launched against steel imports from China from the beginning of 2024 to February 2025. In comparison, 15 investigations were opened in 2020–2023. That is, the figure has doubled. This means that the export opportunities for Chinese steelmakers are significantly narrowing.

Already in January-February of this year, Vietnam, South Korea, Colombia, the EU and Malaysia imposed anti-dumping duties on Chinese steel products with a total supply volume of 5 million tons per year. As part of another 19 investigations, which are currently being conducted in 14 countries, another 9.44 million tons of steel exports from China are subject to additional duties, according to S&P Global.

Thus, in 2025, China’s foreign sales of steel products have every chance of decreasing by 12%, to 102.6 million tons. But who said that there will be no new investigations? This is why the NDRC does not take into account export potential when assessing excess capacity. By and large, its capabilities have been exhausted. Nevertheless, decisions have been made that can improve the situation.

Five key government departments of China jointly issued a new regulation in the second half of March aimed at strengthening steel export management and compliance with tax laws. Now, when filing a customs declaration, tax registration will be checked.

The document also strengthens state control over the closure of companies. Previously, quick registration and closure were used as a loophole. In general, these measures minimize tax evasion. Which allowed steel to be exported at reduced prices. Moreover, fraudulent export activities are subject to strict punishment, including criminal liability.

If the new mechanism proves effective, official Beijing will probably be able to drop accusations of steel dumping in third-country markets. And thereby reopen the corridor of export opportunities for bona fide manufacturers and traders.

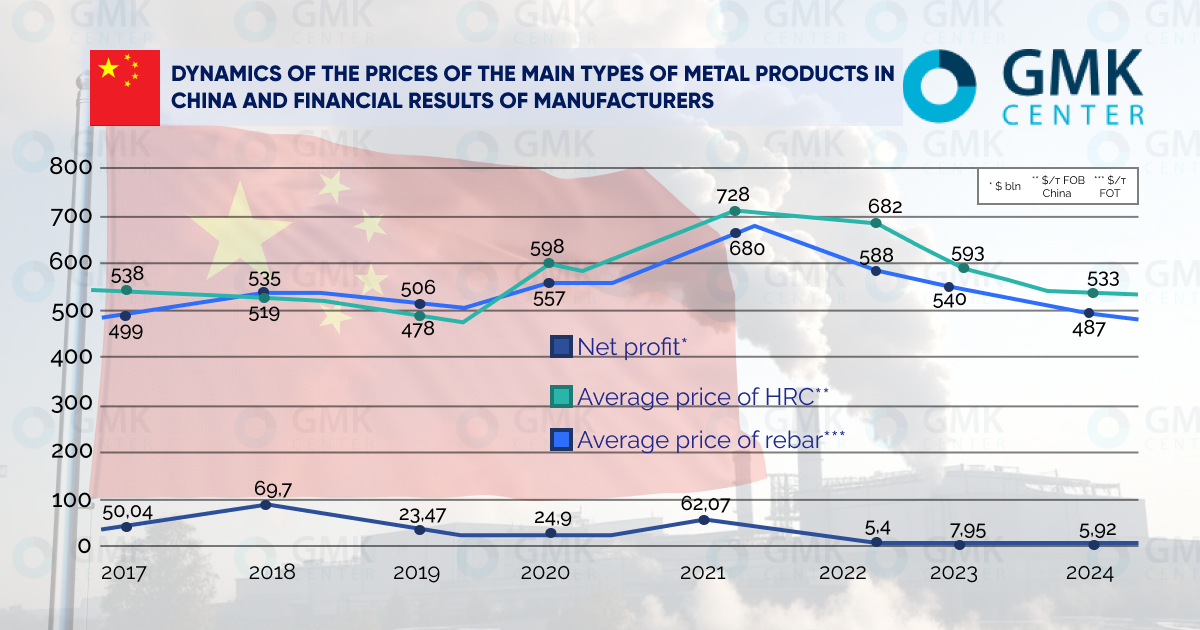

It is worth mentioning separately the financial position of Chinese metal companies, as production prospects depend on it. According to CISA, the consolidated net profit of the association members in 2024 fell by 50.3%, to $5.92 billion. Everything seems logical. During this time, the cost of the main products, hot-rolled coil and rebar, on the Chinese market fell from $555/t in January to $481/t FOT in December and from $532/t to $449/t FOT, respectively. Where does profit growth come from?

But if you look at the medium-term retrospective, domestic prices for metal products in China have been steadily falling since 2021. While the financial results of metal companies resemble a «roller coaster».

Where did such a jump come from by the end of 2023? Everything is very simple. According to Usha Haley, a professor at Wichita University, Chinese steelmakers report subsidies received from central and local governments as profit in their financial statements. Therefore, subsidies account for up to 80% of the declared financial result.

In this context, the results of CISA member mills in January-February 2025 are noteworthy. During this period, the net loss in annual comparison decreased by 9 (!) times, to $213 million. At the same time, domestic prices for hot-rolled coil increased from $ 464/t to $ 470/t FOT, for rebar – fell from $ 449/t to $442/t FOT. That is, there are no market prerequisites for such a rapid improvement in financial indicators.

This means that at the beginning of the year, the Chinese steel sector was intensively pumped with money from the state pocket. A perfectly working recipe, but… In the prospectuses of the issue of targeted bonds, provincial governments often indicated that these issues were intended to pay off their debt to companies for past years. That is, huge debts had already arisen from the authorities to subsidize metallurgical plants. And now they are simply being closed at the expense of new debt obligations. It is clear that this cannot continue indefinitely.

Forecasts for 2025

China will not be able to overcome the housing construction crisis this year. In January-February, investment in housing construction fell by 9.8%, to $111 billion, according to the National Bureau of Statistics. The volume of new buildings sold decreased by 5.1%, to 107.46 million m2.

Negative trends have also emerged in the infrastructure segment. Investments in road construction in January-February decreased by 7.2%, to $35.4 billion. This is a very bad signal for producers of rolled sections and rebar.

More favorable forecasts for flat rolled products. The China Passenger Car Manufacturers Association expects new car sales to grow by 4.4% in 2025, to 32.66 million units. But, as noted, the presence of excess capacity will not allow metallurgists to benefit from the growing demand from the auto industry. Perhaps it will soften the negative effect.

Interestingly, back in 2016, the then director of MPI Li Xinchuan said that the industry was faced with a serious problem of excess capacity. «In the near future, it will be difficult to mitigate the issue of excess supply on the market,» he emphasized. 10 years have passed. But the problem has not been solved. Three years later, in 2019, China State Broadcasting Corporation noted in a story that «China’s steel core still has some margin of safety.» Today, 6 years later, we can say that this thesis is still relevant. Chinese metallurgy still has some margin of safety, and quite a bit. But it is decreasing every year.