Key volumes of raw materials were sent to China, Slovakia, and Poland

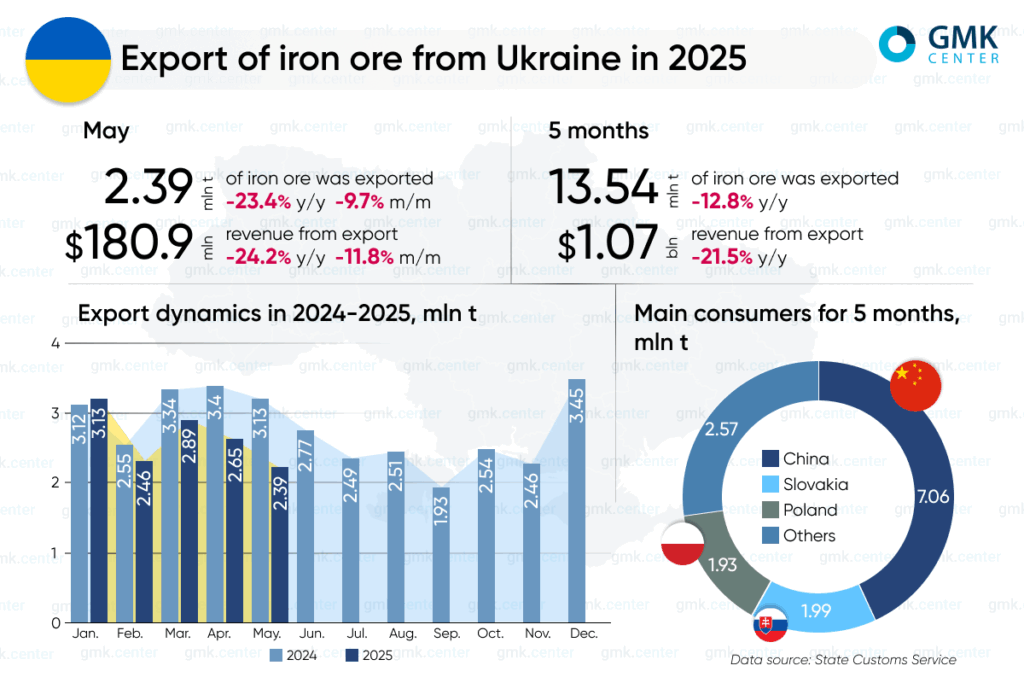

Ukraine’s mining industry reduced iron ore exports by 12.8% year-on-year in January-May 2025 compared to the same period in 2024, to 13.54 million tons. This is evidenced by GMK Center calculations based on data from the State Customs Service.

China is traditionally the largest consumer of Ukrainian iron ore. During this period, shipments of raw materials in this direction amounted to 7.06 million tons (-4.3% y/y). Slovakia received 1.99 million tons (-8.8% y/y), and Poland received 1.93 million tons (-5.6% y/y).

In May, Ukraine exported 2.39 million tons of raw materials, which is 9.7% less than in the previous month and 23.4% less than in May 2024. Year-on-year, the figure has been declining for the fourth month in a row, and month-on-month for the second month. 1.05 million tons (-27% m. /m.; -15.6% y/y) of raw materials were sent to China, 426.61 thousand tons (+5.3% m/m; +25.3% y/y) to Slovakia, and 387.4 thousand tons (+0.9% m/m; -29.8% y/y) to Poland.

Revenue from mineral resource exports in May amounted to $180.9 million (-11.8% month-on-month; -24.2% year-on-year), and in January-May – $1.07 billion (-21.5% year-on-year).

As of June 20, 2025, September iron ore futures on the Dalian Commodity Exchange (DCE) fell by 0.2% compared to the previous week, to $97.9/t. At the same time, the level of offers increased by 0.2% compared to the end of May, indicating overall stability in the market. July contracts on the Singapore Exchange came under greater pressure, falling by 1.1% compared to the previous week and 2.8% since the beginning of the month, to $93.6/t, the lowest level since April.

The current dynamics of iron ore exports and prices indicate that Ukraine’s mining industry is under double pressure – both from external market factors and internal economic and administrative difficulties. Declining demand from key trading partners, volatile commodity prices, high logistics costs, and tax distortions are complicating the operations of companies that traditionally provide a significant share of foreign exchange earnings to the budget.

In particular, the problem of non-refund of value added tax (VAT) on exported products has a significant negative impact on the industry. Ferrexpo has suspended two pellet production lines since May this year due to the state’s VAT refund debt of more than $25 million.

«We have an external enemy and now more than ever we need to be united for the sake of victory and the future. Non-refund of VAT to Ferrexpo leads to a decrease in the company’s production volumes, lower shipments to our railways and ports, lower revenues from exports of Ukrainian products, curtailment of investments in our economy and a decrease in Ukraine’s GDP,» said Oleksandr Kalenkov, President of Ukrmetprom.

In the context of the war and the difficult external economic situation, government support for strategic industries, such as iron ore, should be a priority. Otherwise, the country risks losing one of the key sources of foreign exchange earnings and national currency stability.

As GMK Center reported earlier, in 2024, Ukraine increased iron ore exports by 89.9% compared to 2023, to 33.699 million tons. Shipments increased mainly due to the opening of the sea corridor in August 2023. Revenues from iron ore exports from Ukraine in 2024 amounted to $2.8 billion (+58.7% y/y).

The main producers of iron ore in Ukraine are Ingulets Mining, Kryvyi Rih Iron Ore Enrichment Plant, Poltava Mining, Yeristovo Mining, Northern Mining, Central Mining, Southern Mining, ArcelorMittal Kryvyi Rih, Sukha Balka, and Rudomine.