In January-August, shipments of products abroad fell by 19.8% y/y

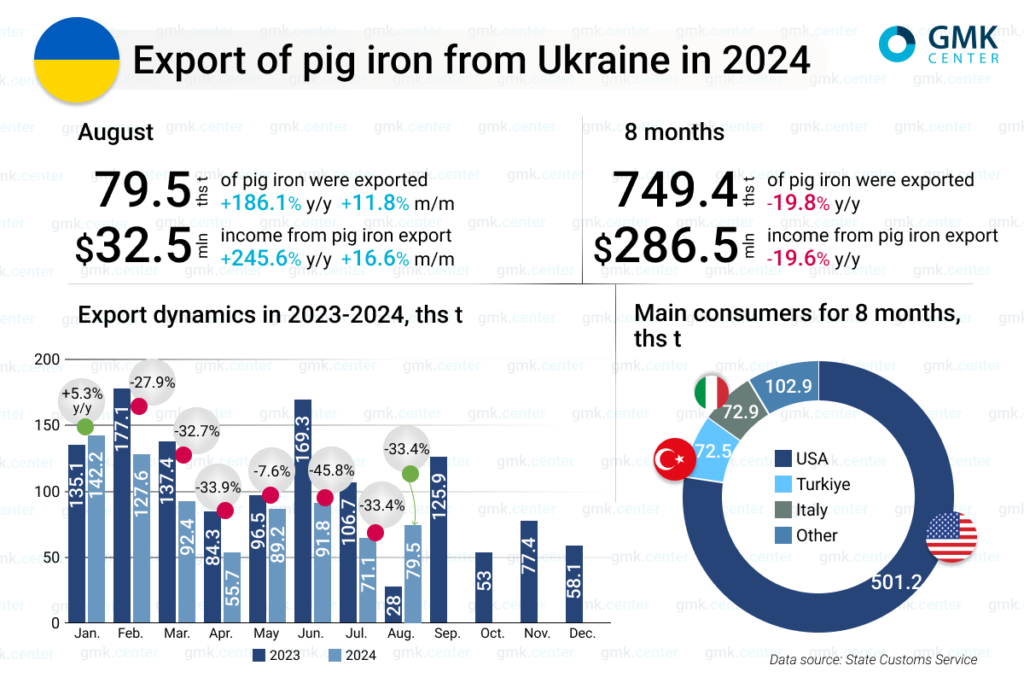

In August 2024, Ukrainian steelmaking companies increased exports of commercial pig iron by 11.8% year-on-year – to 79.47 thousand tonnes. The figure increased by 186% compared to the same month in 2023. This is evidenced by data from the State Customs Service.

The main destination for pig iron exports in August was the United States – 49.55 thousand tonnes. In August, total exports were boosted by the resumption of shipments to the US (no exports were made in July). At the same time, shipments to other key consumers decreased – Turkey – 5.51 thsd tonnes (-84.7% m/m), Italy – 15.27 thsd tonnes (-27.1% m/m), Poland – 4 thsd tonnes (-3.5% m/m).

In January-August 2024, pig iron shipments abroad totalled 749.45 thousand tonnes, down 19.8% compared to the same period in 2023. During this period, 501.2 thousand tonnes of the product were shipped to the United States, 72.46 thousand tonnes – to Turkey, 72.92 thousand tonnes – to Italy and 38.17 thousand tonnes – to Poland.

Pig iron exports from Ukraine have been gradually slowing down since the beginning of 2024. This is due to an increase in its processing in the domestic market to produce value-added products, which is a priority. Metallurgical companies are increasing production of finished products amid the opening of new markets through exports via the sea corridor.

At the same time, the industry’s performance may deteriorate by the end of the second half of the year due to a number of negative factors, including lower demand for products, problems with energy supply and higher energy prices, shortage of staff due to mobilisation, higher logistics costs, etc.

The increase in production costs is leading to a sharp rise in production costs, making it uneconomic to continue production, and some mining and metals companies warn that this could lead to a complete shutdown of production.

Revenue from pig iron exports in January-August 2024 decreased by 19.6% compared to the same period in 2023 – to $286.45 million. In August, it was $32.53 million, up 246% y/y and 16.6% m/m.

The significant increase in August compared to August 2023 is the result of a low comparison base. Last year, when the sea corridor was not yet operational for mining and metals cargo, the EU was the main market for the products. Starting in August, EU steelmakers faced a significant weakening in steel demand, which led to massive maintenance shutdowns and capacity cuts, which in turn negatively affected demand for pig iron, including Ukrainian-made pig iron.

As GMK Center reported earlier, in 2023, Ukraine reduced pig iron exports by 5.8% compared to 2022, to 1.25 million tonnes. Compared to the pre-war year of 2021, pig iron shipments abroad decreased by 61.4%, or 1.99 million tonnes. Export revenues of domestic enterprises decreased by 26.2% y/y – to $471.5 million.

Poland was the largest consumer of Ukrainian pig iron in 2023, accounting for 51.9% in monetary terms. Spain accounted for 21.4% of export shipments and the US for 13.1%.