News Industry semi-finished products 2296 22 March 2024

Export volumes decreased by 36.1% compared to the previous month

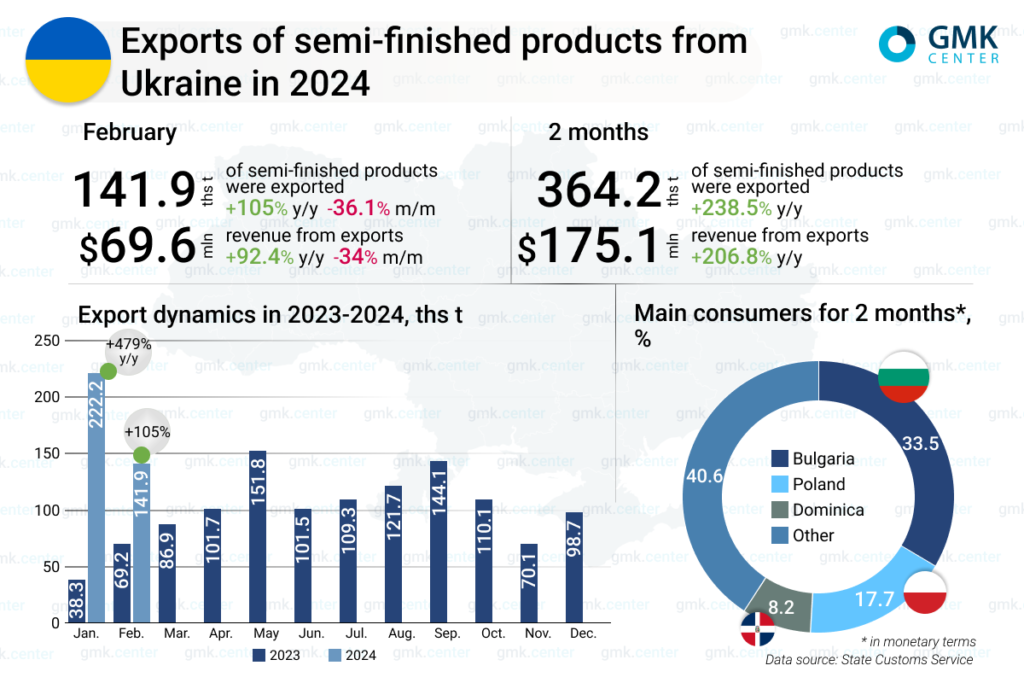

In February 2024, Ukrainian steelmaking companies reduced exports of semi-finished products by 36.1% compared to the previous month, to 141.96 thousand tons. Compared to February 2023, the figure increased by 2 times. This is evidenced by the data of the State Customs Service.

Revenue of domestic enterprises from the export of semi-finished products last month decreased by 34% compared to January – to $69.6 million. Compared to the same month last year, the figure increased by 92.4%.

In January-February 2024, exports of semi-finished products from Ukraine increased 3.4 times compared to the same period in 2023, to 364.16 thousand tons. Export revenue increased 3.1 times y/y – to $175.09 thousand tons.

In January-February, Bulgaria was the largest consumer of Ukrainian semi-finished products, accounting for 33.5% of total exports in monetary terms. Another 17.7% of products were exported to Poland and 8.2% to the Dominican Republic. Exports to the Caribbean were probably made possible by the opening of the maritime export corridor.

In 2023, Ukraine reduced exports of semi-finished products by 36.7% compared to 2022, to 1.203 million tons. Compared to the pre-war year 2021, shipments of semi-finished products abroad decreased by 82.2%, or 5.57 million tons. Revenues of domestic enterprises from the export of semi-finished products last year decreased by 48.9% compared to 2022, to $608.52 million.

The largest consumers of Ukrainian-made semi-finished products in 2023 were Bulgaria – 36.7%, Poland – 23%, and Italy – 9.6%.

In 2023, Ukrainian steelmaking companies continued to operate in the face of limited logistics capabilities and unfavorable global market conditions. Ukraine’s major steel companies, Metinvest Group’s Kametstal and Zaporizhstal, and ArcelorMittal Kryvyi Rih, operated last year at capacity utilization rates of 65-75% and 20-30%, respectively. This year, the industry plans to increase production due to the partial reopening of sea exports.

In the 12th package of sanctions adopted at the end of 2023, the EU introduced new and expanded existing restrictions on mining and metals products from Russia. In particular, the ban on imports of pig iron, mirror iron, and direct reduced iron (DRI) from Russia was extended.

At the same time, the EU extended the quotas on Russian slabs for another four years. In particular, the total quota for imports of Russian slabs from October 2024 to September 2028 is set at 8.5 million tons with a more detailed breakdown by period.

The previous sanctions on slab imports were imposed in October last year (as part of the 8th sanctions package), when it was decided that slab imports could continue until the end of September 2024. Thus, the 12th sanctions package actually eased the previously imposed restrictions.