News Global Market Türkiye 792 30 June 2023

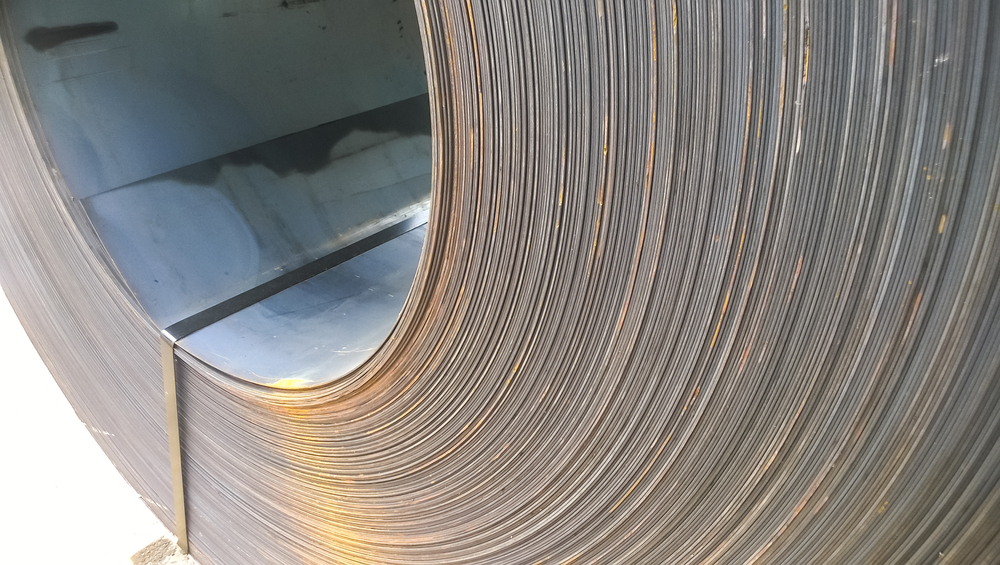

In May, China exported a total of 1.77 million tons of HRC

Turkiye became the largest buyer of Chinese hot-rolled coil (HRC) in May 2023, despite the increase in import duties in the country. Fastmarkets informs about it.

In May, China exported a total of 1.77 million tons of HRC, which is more than 10% more than in April 2023, but almost 9% less y/y. Exports to Turkiye amounted to 335.8 thousand tons and accounted for almost 19% of the total volume.

Demand from Turkiye was strong a few months ago, especially after the devastating earthquake in February, one trader said. The Turkish government’s increase in import duties, which took effect on May 1 after two delays, had a limited impact on demand for Chinese materials. Buyers from Turkiye could absorb the additional costs, and most of them avoided the duty by re-exporting final products made using imported steel.

According to traders, demand from Turkiye for HRC decreased in the run-up to the presidential election in May, but has shown signs of growth in recent weeks due to the emergence of inquiries and small transactions.

The volume of deliveries to Vietnam, the second largest buyer of Chinese rolled steel in May, in this period amounted to 256.2 thousand tons. The reduction of deliveries to this country was caused by a drop in prices and weak demand in Europe for Vietnamese galvanized coil products In the third place is South Korea, which in May 2023 imported 147.6 thousand tons of HRC from China.

In May, China imported almost 91.2 thousand tons of hot-rolled coil, which is 65% more m/m and 28% less compared to May 2022.

As GMK Center reported earlier, world HRC prices fell in June 2023. Such a trend, in particular, is observed on the European market, which was caused by a sharp influx of imports. Steelmakers in China were waiting for the government’s next steps, while Indian companies had to pay attention to global trends and supply timings.