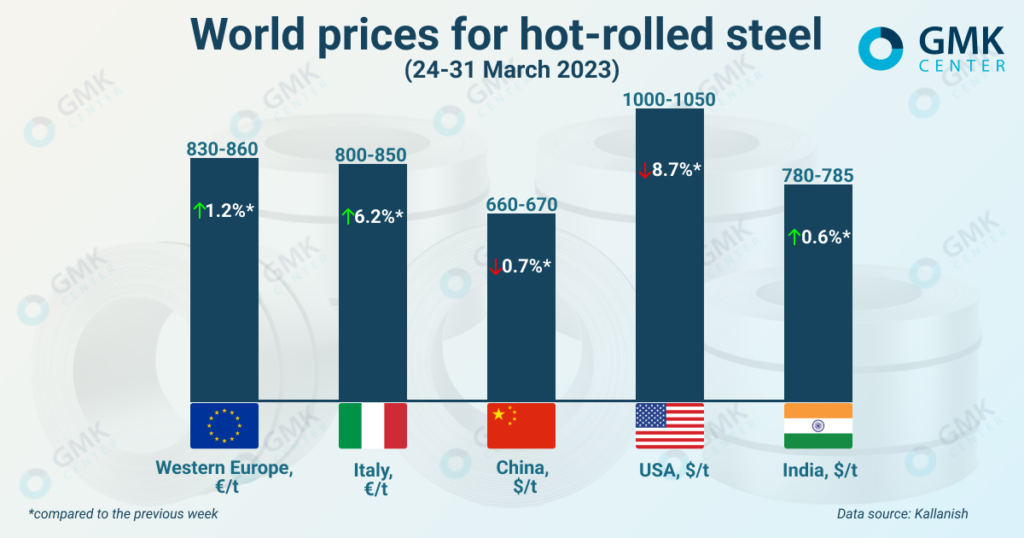

News Global Market hot-rolled prices 1369 03 April 2023

The European market is breaking out of the general trend due to limited supply

Prices for hot-rolled products in most countries of the world have started to decline or are approaching this trend, as the market is under pressure from weak demand and uncertainty about the future outlook for steel consumption.

Quotation of hot-rolled rolled steel in Europe for the week of March 24-31, 2023, slightly increased, as the supply of products still remains at an insufficient level, and the nearest order fulfillment dates are June-July 2023. At the same time, the demand is limited.

As of March 31, according to Kallanish, the prices for hot-rolled steel in Western Europe were €830-860/t, which is €10/t (+1.2%) more compared to March 24. On the Italian market, product quotations reached €800-850/t, exceeding the previous week’s levels by €50/t (+6.2%).

Quotations of hot-rolled steel on the European market manage to be maintained at a high level due to low competition from imported products, which is unprofitable due to a sufficiently high cost. But small batches of products are still ordered, as delivery times are shorter than local ones.

The limited rolled steel offer is caused by insufficient capacities. Recently, a fire engulfed two ArcelorMittal plants. In particular, due to a fire at the Spanish plant in Gijón, one of the blast furnaces was stopped for at least 2 months. France’s ArcelorMittal Dunkirk is also assessing damage from the fire at blast furnace №4, continuing to work at one of the three BFs. Rolled steel consumers in the automotive and home appliance sectors are already experiencing delivery delays due to recent incidents.

Some market participants indicate that demand has begun to recover. Buyers start purchasing products for the third quarter. This may indicate that, in the current situation, a seasonal drop in prices may not occur in the summer.

In the near future, quotations for rolled steel on the European market will be stable, since the low demand for products will not contribute to the increase in prices. At the same time, a drop in prices is also not expected, because the supply is also limited.

In the longer term, quotations could be boosted by supply chain disruptions due to incidents at ArcelorMittal plants, Tata Steel’s force majeure in Eimeiden, as well as a significant reduction in coil production at Acciaierie d’Italia, and falling imports from Asia.

The Chinese market saw a slight drop in prices for hot-rolled coils during March 24-31, 2023. Product quotations fell by $5/t compared to the previous week – to $660-670/t. This is facilitated by the low volume of demand for steel, as well as the banking crisis in the country.

The market outlook now depends on the recovery of steel demand in April and iron ore prices. During the current month, the market plans to verify the availability of state support for the real estate sector and the recovery of the pace of construction. These factors will depend on the further trend of Chinese prices for rolled steel.

Despite the unstable market, Chinese steelmakers have been increasing the production of hot-rolled products for the third week in a row. According to Mysteel, during March 23-29, 2023, China’s steel mills produced 3.2 million tons of such products, which is 3.5% more compared to the previous week. The increase in production is due to the restoration of capacities after technical maintenance. Oversaturation of the market with products in conditions of insufficient demand may harm the prices for hot-rolled steel in the short term.

Prices for hot-rolled steel in USA also declined due to weak orders as buyers are wary of purchasing steel at high prices in a volatile market. Product quotations in North America for the week of March 24-31, 2023, fell by $100/t, or by 8.7% compared to the previous week – to $1,000-1,050/t.

On the market of India quotations for rolled steel saw a slight increase in the week of March 24-31, 2023, by $5/t, or by 0.6% – up to $780-785/t. Prices for Indian products are supported by stable small batches of supplies to the EU. However, further market prospects do not look positive due to a slowdown in purchases in the European market, a slowdown in the global steel market and weak sentiment in China.

Prices for hot-rolled steel

As GMK Center reported earlier, Ukraine exported 64.46 thousand tons of flat rolled in January-February 2023 for $43.03 million, and 52.89 thousand tons of long rolled steel for $48.18 million. The largest consumers of Ukrainian steel are Romania, Poland and Bulgaria.