News Infrastructure sea transportation 907 23 December 2023

The cargo on board was intended for Turkish buyers

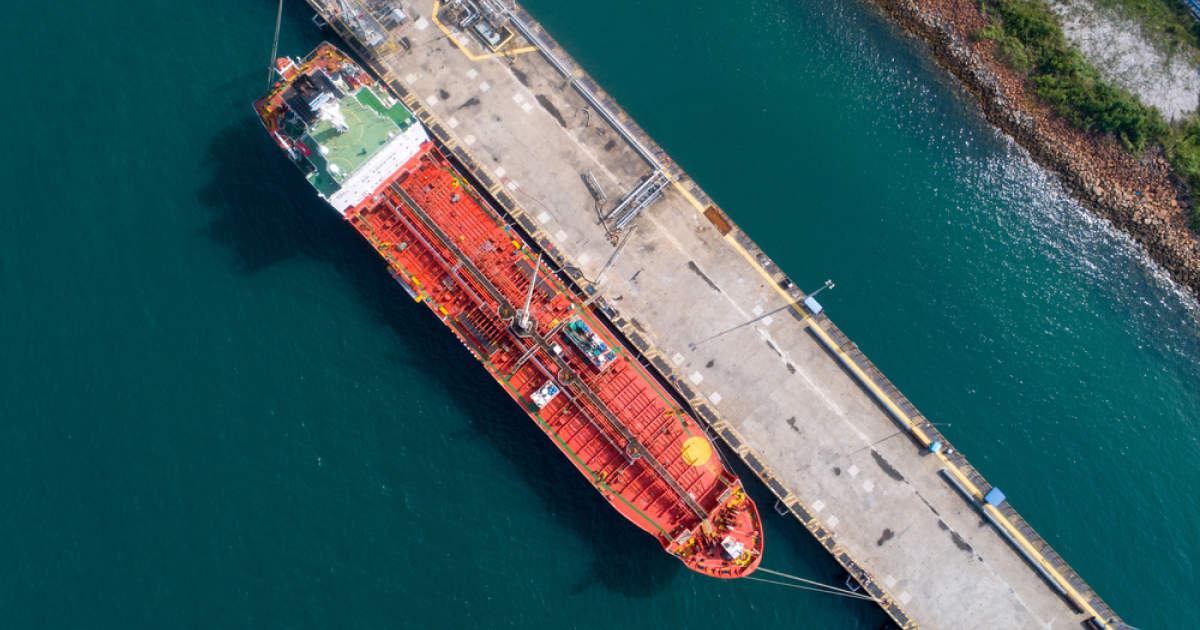

A vessel carrying steel coils from Korean steelmaker POSCO (the business is carried out through the Samsung trading company) was hijacked by pirates off the coast of Somalia. This was reported by Argus.Media.

The products on board the Maltese-flagged Ruen vessel (41,607 dwt) were intended for a number of Turkish buyers. According to market sources, it is carrying about 40,000 tons of steel coils. The company is negotiating with pirates to free the bulk carrier.

According to Argus, as of December 13, the Ruen was on its way to the port of Gömlik in Turkiye. It entered the risk zone in the Gulf of Aden/Southern Red Sea on December 15. The bulk carrier has been off the central coast of Somalia since December 18 (according to ship tracking programs).

A representative of West of England Insurance Services said that they are working closely with the relevant authorities and cannot comment further at this time.

Sources at Turkish steel mills believe that the incident could disrupt supplies from Asia to the region, which would support coil prices. Traders and Turkish buyers speculate that shipowners and charterers may try to avoid the Red Sea/Suez Canal route, opting for a longer and more expensive route around the Cape of Good Hope and along the east coast of Africa. This will also affect the cost of sailing in the Mediterranean region.

Shipping through the Red Sea and the Suez Canal has already been hampered by recent attacks on container ships. Some carriers have announced that they will also bypass the Cape of Good Hope, which will increase costs and transit time. One trader noted that some steel mills will stop selling steel on CFR (Cost and Freight) terms, putting the risk on buyers. In addition, there is a possibility that European buyers who have materials at sea and plan to receive a quota by January 1, 2024, may face a delay in shipments.

As GMK Center reported earlier, global prices for hot-rolled coils continued to rise in early December. In the European market, the upward trend in hot-rolled steel prices has been observed since mid-October. This was driven by a decrease in the supply of local products and the exhaustion of HRC import quotas.