News Global Market iron ore prices 2313 06 September 2024

Weak macroeconomic data from China and no signs of a recovery in steel demand are weighing on iron ore prices

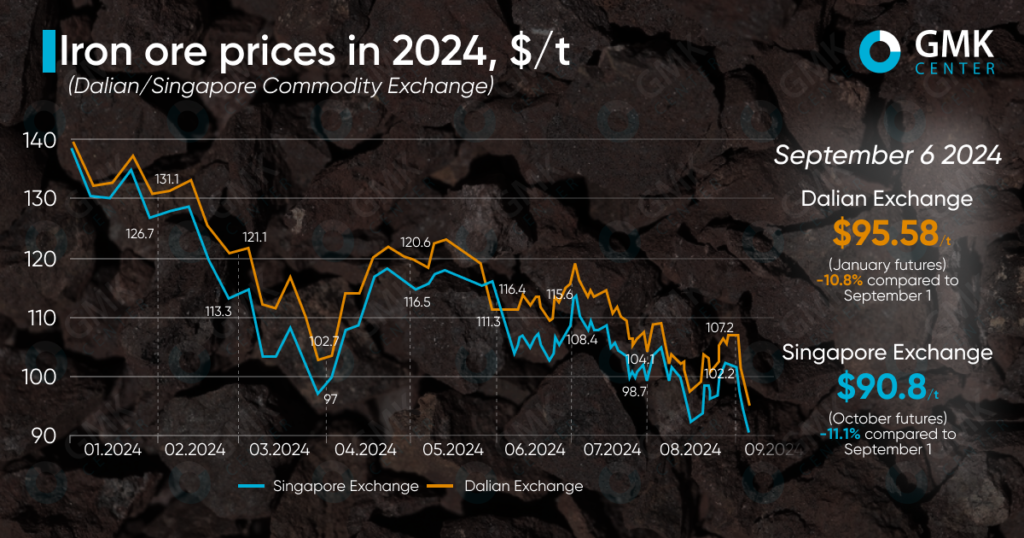

January iron ore futures, the most traded on the Dalian Commodity Exchange since the beginning of September 2024, fell by 10.8% – to 678.5 yuan/t ($95.6/t). On the Singapore Exchange, quotations for the main October futures as of 6 September 2024 decreased by 11.1% compared to the price on 1 September – to $90.8/t.

In early September, iron ore prices hit a one-year low. At the same time, iron ore prices fluctuated throughout August, with a rise at the end of the month. The maximum price level reached $108/t and the minimum was $97.2/t (Dalian Exchange). Improved sentiment in the second half of August was driven by renewed hopes for improved steel demand in the near term, but concerns about high port stocks of raw materials kept iron ore prices from rising. In addition, the downtime of some facilities due to maintenance restrained production and supply.

In early September, the iron ore market experienced its sharpest price decline in two years amid a series of unfavorable macroeconomic results in China. Manufacturing activity in the country fell to a 6-month low in August. The real estate sector also continued to struggle despite a number of support measures.

An additional factor putting pressure on the Chinese steel market and expected iron ore consumption is the growing tension in major export markets. A growing number of countries are protecting their domestic markets by taking various measures to restrict such imports. In the long term, the loss of export flows could spell disaster for the Chinese steel industry if domestic demand does not recover.

In addition, between 26 August and 1 September, more than 29 million tonnes of iron ore from Australia and Brazil were shipped to Chinese ports, up 10.9% week-on-week. Shipments from Brazil rose to their highest level since 2019. The steady flow of raw materials to the Chinese market amid current uncertainty and weak demand will inevitably lead to further pressure on prices in the short term.

‘There are no signs of improvement in demand for steel products, so steelmakers have little room to increase production. The downward trend in iron ore prices is expected to continue,’ said Zhang Shaoda, an analyst at China Futures Co.

Analysts at Donghai Futures predict that iron ore prices are likely to fluctuate between $80-110/t in the short term. However, it will be difficult to maintain prices at the upper end of this range.

ANZ Research expects iron ore prices to be in the range of $90-100/t by the end of 2024 amid weak Chinese fundamentals. According to the worst-case scenario, prices will fall to $60-80/t.

British international commercial bank HSBC Holdings expects iron ore prices to reach $100/t in 2024. Capital Economics predicts that quotations for this raw material will range from $99-100/t. By the end of next year, iron ore prices will fall to $85/t.