News Global Market iron ore 1181 27 November 2023

Probably, the prices of raw materials have reached a peak value

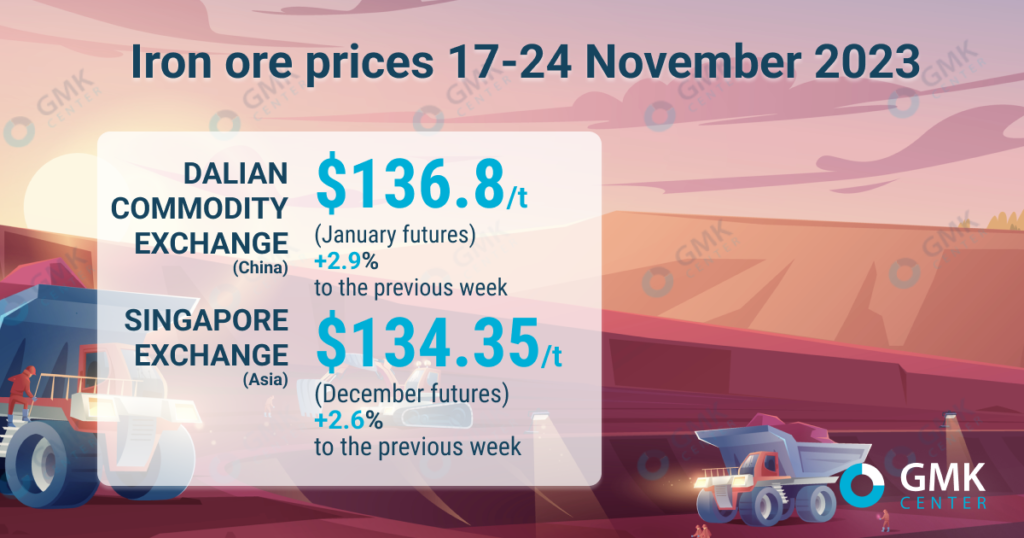

January futures for iron ore, the most traded on the Dalian Commodity Exchange, for the period November 17-24, 2023 increased by 2.9% compared to the previous week – up to 986.5 yuan/t ($136.8/t). This is evidenced by the data of Hellenic Shipping News.

On the Singapore Exchange, quotations for December futures as of November 24, 2023 increased by 2.6% compared to the price a week earlier – up to $134.35/t.

Iron ore prices rose for the fifth week in a row last week despite market volatility. Futures continue to be supported by low raw material inventories, rising steelmaking margins and concerns about future ore supply, particularly due to a possible strike at BHP in Australia.

Falling stocks of raw materials in ports, together with the resumption of operations of some steel mills after maintenance, provide significant support to ore demand. Due to these factors, raw material prices rose to more than an 8-month high.

In addition, last week Beijing provided another support to the real estate sector. Chinese regulators are planning to provide credit assistance to 50 large developers to save them from bankruptcy and fill the shortage of construction financing.

At the same time, the sharp rise in iron ore prices may be curbed by the intervention of the Chinese authorities, who believe that current price levels do not correspond to the market conditions. At the end of last week, China’s State Planner said it would closely monitor changes in the iron ore market and strengthen supervision of spot and futures trading.

«This does not necessarily mean the beginning of a downward trend, but at least prices will stagnate after such movements,» said Pei Hao, an analyst at Shanghai-based brokerage FIS.

Price losses following the announcement were limited due to robust demand. Growth in steelmakers’ margins helped to replenish raw material stocks for the winter period.

In the short term, Everbright Futures analysts expect prices to consolidate amid a combination of favorable and unfavorable factors. Commodity prices are likely to have peaked, as Chinese government intervention in pricing and the winter period will restrain further growth.

As GMK Center reported earlier, Chinese steel companies in September 2023 reduced the import of iron ore by 4.9% compared to the previous month – to 101.2 million tons. In January-September, the country’s steelmakers increased the import of iron ore by 6.7% compared to the same period last year – up to 876 .65 million tons. The average import price in this period was $111.9/ton.