News Global Market iron ore prices 3499 12 January 2024

Quotations of raw materials on the Dalian Commodity Exchange fell to $136.4/t, and on the Singapore Exchange – to $134.1/t

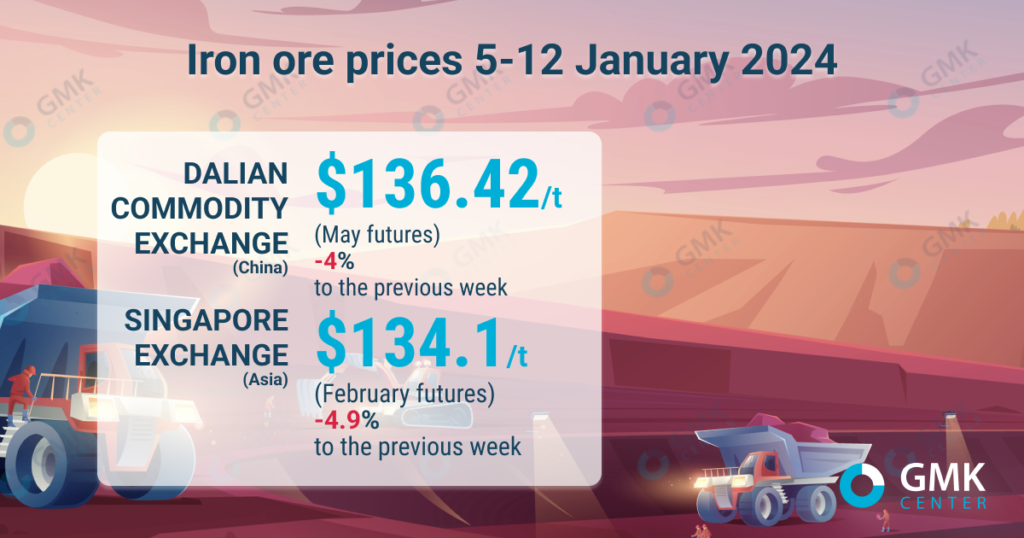

May futures for iron ore, the most traded on the Dalian Commodity Exchange, for the period January 5-12, 2024, decreased by 4% compared to the previous week – to 976.5 yuan/t ($136.42/t). This is evidenced by the data of Hellenic Shipping News.

On the Singapore Exchange, quotations for February benchmark futures as of January 12, 2024, decreased by 4.9% compared to the price a week earlier – to $134.1/t.

Iron ore prices declined slightly in the second decade of January 2024 after peaking in late December and early January at over $141 per tonne. At the time, the rapid growth of the market was supported by hopes for further stimulation of the Chinese economy and the recovery of steel companies’ demand for raw materials. At the same time, falling profitability of steel companies limited growth.

Starting from January 6, 2024, iron ore prices began to decline as lower demand for raw materials and higher-than-expected stocks in Chinese ports undermined consumer sentiment and reduced interest in replenishing stocks as soon as possible.

“This is a normal downward correction after sentiment cooled as the market recovered from the news of the additional lending program (PSL). Prices are also being affected by lower demand for iron ore, as evidenced by the continued decline in pig iron production, which is now lower than last year,» Chu Xinli, a Shanghai-based analyst at China Futures, said.

In addition, relatively high iron ore prices have forced some steel mills to limit purchases in the hope that prices will fall in the second half of January and February.

Some market participants expect China’s pig iron production to hover at a relatively low level as many mills are still suffering losses. This will weigh on the demand outlook. On the other hand, the losses will be limited as some mills are forced to return to purchasing, meeting demand before the week-long New Year break.

In the short term, iron ore prices will remain volatile as the market continues to react to any policy changes from Beijing, and further recovery will depend on economic stimulus. In addition, some steelmakers are planning to cut production in the near term or postpone the restart of blast furnaces that have been under maintenance since December to limit losses.

«The fundamentals of China’s steel industry are weak. Although iron ore supply is moderately declining, seasonal slowdown in demand and higher steel production costs are reducing the profitability of steelmakers, which negatively affects commodity trading. We expect the weakening of the steel market is likely to continue until the Lunar New Year holidays,» Kevin Bai, a Beijing-based analyst at CRU Group, a consultancy, said.

In the longer term, iron ore prices are expected to consolidate at relatively high levels as iron ore stocks in Chinese ports are expected to decline in the first half of 2024 amid seasonal supply constraints.

Fitch Ratings recently raised its iron ore price forecast for 2023-2026. The company expects the price of ore to reach $95 per tonne in 2024, $80 per tonne in 2025 and $75 per tonne in 2026.

Analysts polled by Reuters expect iron ore prices to rise to $150/t in the first half of 2024. BMI raised its forecast for the average iron ore price in 2024 to $120/t, Goldman Sachs – to $110/t, and Wood Mackenzie to $108/t.

JP Morgan predicted that in 2024, ore prices would reach $110/t, and in 2025 – $105/t.