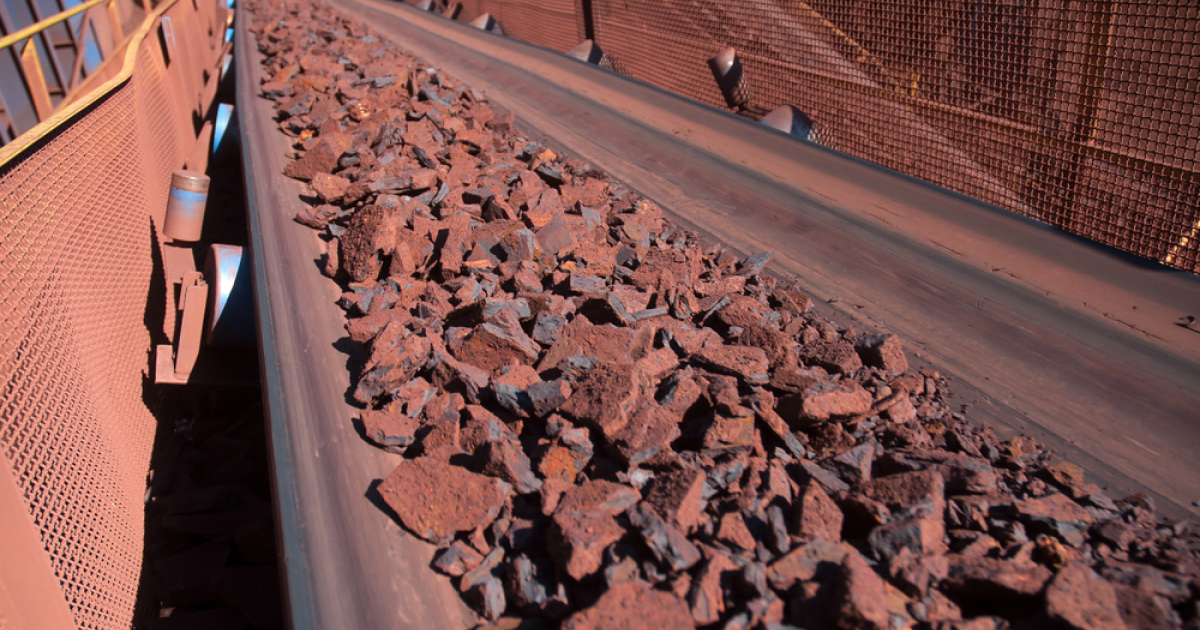

News Global Market iron ore prices 4546 30 November 2023

Estimates were raised amid expectations of increased demand in China

The price of marine iron ore may rise to $150/t in the first half of 2024, analysts believe. Reuters informs about it.

They raised their estimates amid expectations of increased demand in China following recent stimulus measures.

These estimates are up significantly from the previous $130/t. At the beginning of this week, the price of iron ore reached $135 per tonne, but according to Steelhome, it is still well below the record $232.5 per tonne reached in May 2021.

In recent weeks, ore prices have risen after the Chinese government unveiled a series of measures aimed at reviving the country’s economy, including the troubled real estate market, which is a key steel consumer. China buys more than two-thirds of the world’s iron ore, and its demand dictates prices and production plans of leading mining companies.

In 2023, prices have already exceeded expectations due to stronger-than-expected steel exports from China and growing demand for steel products from the infrastructure and manufacturing sectors.

According to some analysts, China’s iron ore imports could reach a record level in 2023. Others believe that it will not surpass the level of 2020, when steel production in China peaked at 1.065 billion tons.

Next year, prices will also be supported by relatively limited supply. According to a research note by the Chinese financial company CICC, global maritime ore supplies could grow by 3.8% in 2024. But analysts add that demand outside of China is also growing, leading to competition.

«Outside of China, iron ore demand is expected to improve in 2024 thanks to robust demand in India and some recovery of ground lost over the past two years in Europe,» he noted. David Casho, director of research at Wood Mackenzie.

In addition, according to Pei Hao, an analyst at FIS, an international brokerage company, China is likely to see only a slight increase in scrap supply next year.

Experts predict that ore prices will decline in the second half of 2024, when supplies are expected to increase. Another factor may be the restriction of steel production by Beijing.

BMI has raised its forecast for the average iron ore price for the next year to $120/t, Goldman Sachs – to $110/t, Wood Mackenzie – to $108/t.

The average for 2023 was $119/t. For 2024, analysts predict a wider range of $90-150 per tonne, partly due to uncertainty about restrictions on steel production in China and potential government intervention.

As GMK Center reported earlier, in 2024 growth is expected of global iron ore supply, but experts are cautious about future prospects, given the potential challenges. The supply of this raw material is expected to increase next year thanks to investments in new projects and efforts to improve mining operations.