News Global Market steel production 1003 11 January 2024

The gloomy outlook for demand creates a worrying outlook for the coming years

Global steel overcapacity is growing again and is expected to be as high as in 2014, at the start of the previous steel crisis. This is stated in the January report of the Organization for Economic Cooperation and Development (OECD).

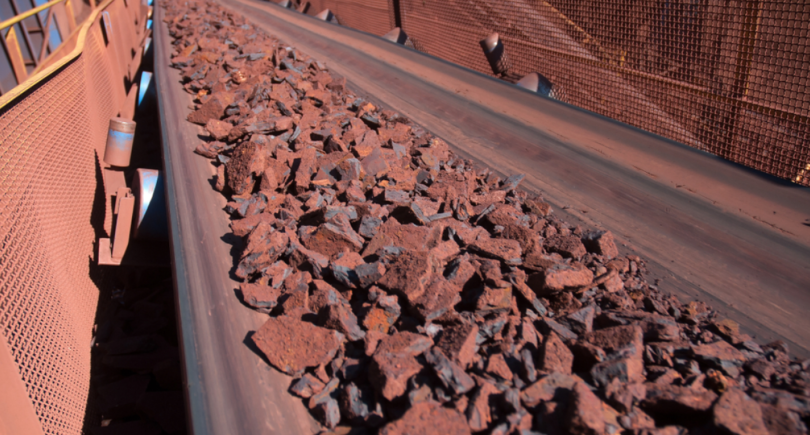

According to the study, by the end of 2023, global steelmaking capacity was expected to increase to almost 2.5 billion tons, marking the fifth consecutive year of growth and outpacing the latest demand forecasts. The 57.1 million tonne increase in global capacity last year is the highest annual growth in the last decade. Asia accounts for 30.5 million tons, or 53.3% of this figure.

The gloomy outlook for steel demand and the upward shift of steel capacity from China to other regions create an alarming outlook for the coming years. This is also a major obstacle to achieving the industry’s decarbonization goals.

In particular, Chinese steel companies are investing heavily overseas in ASEAN, other parts of Asia, and Africa. In addition, outdated induction furnaces that do not meet environmental and product quality standards are often imported into ASEAN countries, which is a concern for local communities.

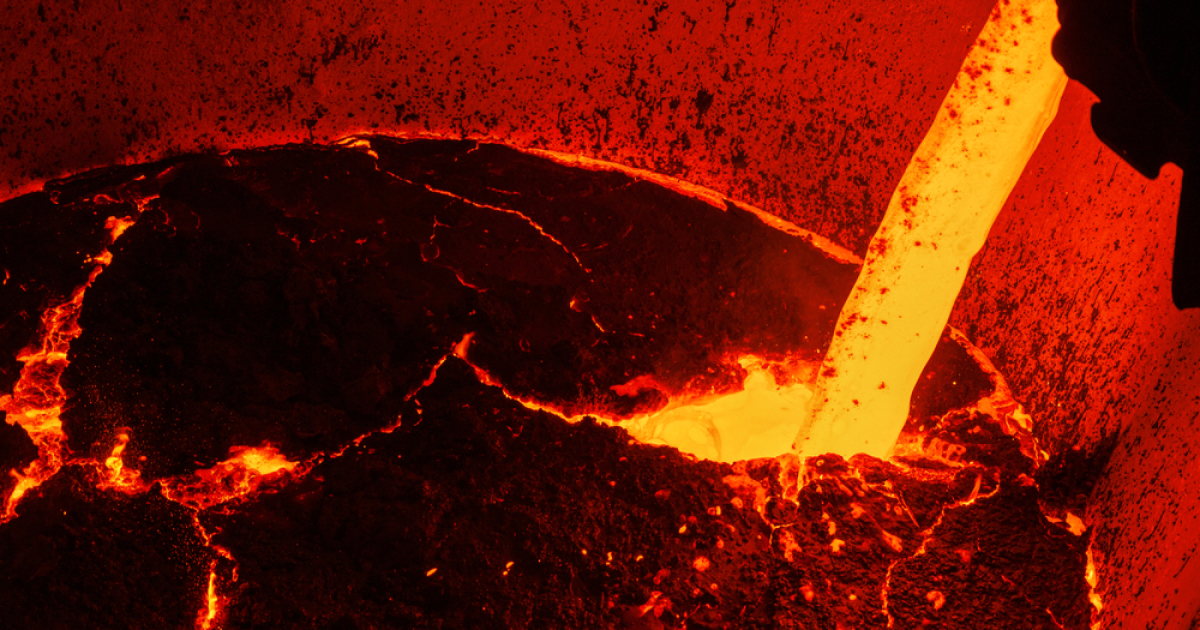

Most of the new investments in Asia are in traditional blast furnaces and oxygen-converter furnaces. Other regions are seeing a more moderate increase in capacity, with a focus on electric arc furnaces. There are also 65 new low-carbon steel projects underway around the world using innovative technologies.

Global steelmaking capacity is also expected to increase significantly over the next three years (2024-2026): 46 million tons will be commissioned, and another 78 million tons are being planned.

At the same time, the prospects for growth in global demand for steel products are overshadowed by the risks of a serious drop in China due to the situation in the real estate sector and its impact on financial markets and the economy.

Global steel capacity utilization has been deteriorating for two years in a row. In 2023, the gap between global capacity and steel production widened, reaching 610 million tons year-on-year.

Overcapacity also contributes significantly to emissions from the steel industry. Closed calculations show that even a partial reduction of overcapacity (by about a third) would reduce emissions in the global steel industry by 2% to 14% and lead to a much healthier business environment in the industry.

As GMK Center reported earlier, last September, the OECD Steel Committee expressed concern about the deteriorating conditions in the global steel market. This situation was caused by a decline in demand, rising overcapacity and government intervention in some economies.