News Global Market scrap prices 1769 11 December 2023

China stands out from the general trend, where a high supply of raw materials hinders price growth

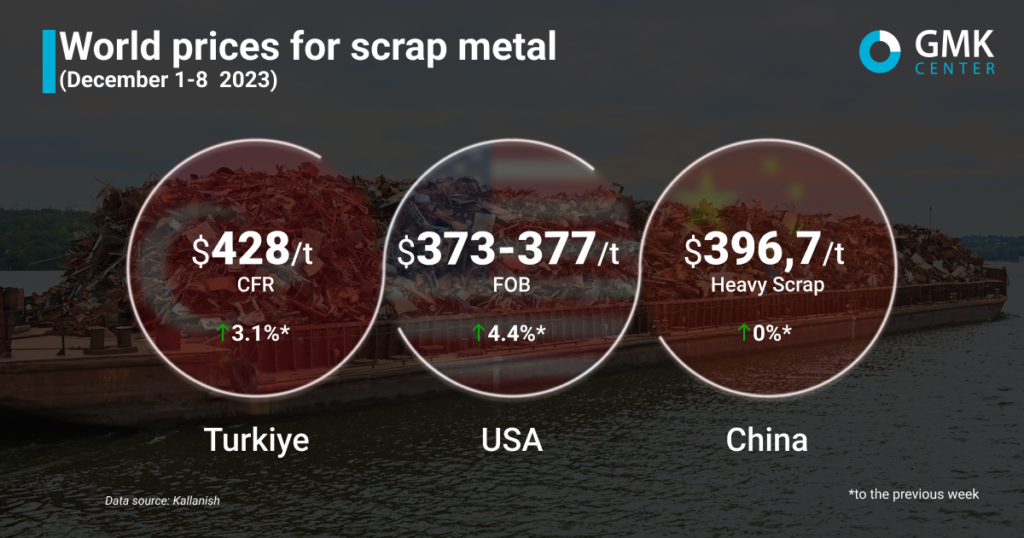

Last week, global scrap prices continued upward trend since the end of October. The Turkish market is supported by a number of factors that force local steelmakers to buy raw materials despite the weak steel market. In the US, prices are supported by demand from Turkish consumers. China, in turn, bucks the trend due to high supply, although the market forecasts growth in the short term.

Scrap prices in Turkiye for the period December 1-8, 2023, increased by $13/t or 3.1% compared to the previous week – up to $428/t CFR. In general, scrap quotations in the Turkish market have been growing since the end of October, and during this period increased by $70/t. In November, the growth amounted to $49/t.

High and stable activity in the Turkish scrap market over the past month has contributed to a significant increase in raw material prices. Currently, the supply level has exceeded $400/t, the highest level in the region since early May this year.

The rise in scrap prices is driven by numerous factors, including higher freight and dockage rates, the strengthening of the euro against the dollar and the projected increase in domestic raw material prices in the US and EU, which are the main suppliers of scrap to Turkey. The scrap market is also supported by the growth in domestic demand for rebar in the country, but this factor is too volatile amid current financial problems.

At the same time, Turkish plants believe that current price levels are high and unattainable in the current state of the steel market. However, scrap prices are unlikely to decline in the near future due to limited supply, the upcoming winter holidays, rapidly rising freight rates and the needs of steel producers. In such circumstances, we still have to purchase cargoes to avoid facing even higher raw material costs in the future.

In the short term, scrap prices in Turkiye are likely to stabilize as purchasing intensity slowed slightly in early December. The mills have almost fulfilled their cargo booking requirements for January, and expensive scrap is cutting into their margins.

In addition, some steelmakers may gradually switch to billets instead of scrap, as this type of raw material is already more competitive. Russian suppliers offer billets for $520-525 per tonne CFR, but despite favorable offers from Russia, Turkish steelmakers are wary of making steel from raw materials from the aggressor country.

In the US, scrap prices also followed an upward trend. As of December 1-8 this year, scrap prices on the East Coast increased by $16/t (+4.4%) compared to the previous week to $373-377/t FOB. In November, prices increased by $31/t. Thus, prices have now reached their highest level since May 2023.

Sentiment in the American scrap market has improved significantly following a sharp rise in prices in Turkiye, the largest export destination. Market participants believe that raw material prices will inevitably rise in December trading amid support for exports and a gradual recovery in US hot rolled coil prices since early November. In addition, the increase in freight due to restrictions on transit through the Panama Canal also supports the market.

In the Chinese market, scrap prices remained stable at $396.69/t (Heavy Scrap) during the period of December 1-8. At the end of November, raw material quotations increased by $14.6/t (+3.8%) to $396.69/t.

Scrap prices in China remained stable last week as supply and demand were balanced. Scrap supply remains high, which does not contribute to positive changes. In addition, imported raw materials have become competitive, which is very rare.

At the same time, amid a rebound in steel prices and rising profits for steelmakers, some plants have significantly increased their electric arc furnace utilization, which will increase demand for scrap in the short term and is likely to drive up prices.

As GMK Center reported earlier, Ukraine increased its scrap exports by 3.7 times y/y in January-September 2023 to 131.1 thousand tons. Imports fell by 50% y/y – to 0.8 kt during this period.