News Global Market scrap metal 5961 04 April 2024

Major global markets faced pressure from uncertainty in the steel market and falling prices for other raw materials

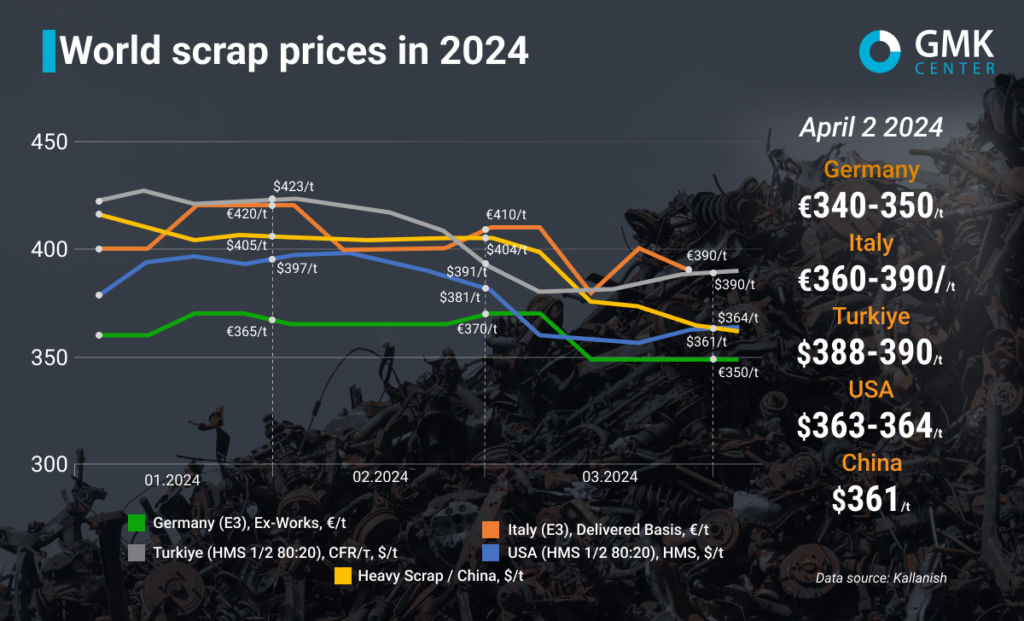

Global scrap prices fell significantly in most global markets in March 2024, with European, North American and Chinese markets experiencing the greatest pressure. At the same time, the decline in Turkey was minimal, as the market suffered major losses in January and February.

Prices for HMS 1&2 80:20 scrap in Turkey for the period March 26-April 2, 2024, decreased by $2/t, or 0.5% compared to the previous week, to $388-390/t CFR. In March, the price of raw materials dropped by $5/t, or 1.3%, with quotations falling to $376/t during the month and reaching a maximum of $392/t.

Activity in the Turkish scrap market recovered slightly in March, as evidenced by the adjustment of price levels. Overall, the negative trend has been in place since early February after positive January trading.

In the second decade of March, steel mills began to show interest in purchases after a long break. Orders were limited, as steelmakers were in no hurry to replenish stocks due to negative sentiment in China and low sales of steel products. In addition, Turkey’s macroeconomic situation also put pressure on consumers’ willingness to resume purchasing raw materials in April.

The lowest monthly price level was reached on March 6 at $376/tonne CFR, although steelmakers considered these levels unworkable and insisted on further reductions. Later, prices began to rise gradually as activity in the Chinese market, along with raw material prices, began to increase. Weak scrap supply also contributed to the price increase.

By the end of March, prices had recovered to the same level as at the beginning of the month. Most market participants returned to purchases, but growth was limited by insufficient demand for finished products. Most steelmakers are skeptical that steel sales will improve in the short term.

In early April, scrap prices stabilized as demand for raw materials slowed again following the local elections. Due to the long Eid al-Adha holiday next week, Turkish mills are expected to suspend purchases, which will have a negative impact on prices. At the same time, consumers will have to return after the holidays, as May purchases have not yet been completed.

The overall outlook for scrap prices in the Turkish market is ambiguous, as the prospects depend on the state of the Chinese steel market and the competitive supply of billets from Asia. Most market participants expect prices to stabilize.

The EU market saw a decline in scrap prices in March. In particular, in Germany, E3 scrap lost €20/t over the month, stabilizing at €340-350/t Ex-Works as of early April, and in Italy (E8) – €20/t, €340-350/t Ex-Works.

Scrap quotations showed a negative trend due to weak demand from domestic steel mills and a decline in exports, particularly to Turkey.

Most market participants expect activity to resume after the Easter holidays in the first two weeks of April. However, it is likely to depend again on demand from Turkey and Asia. Low harvest volumes will continue to provide some support to prices.

The situation is similar in North America. In March, scrap prices on the US East Coast fell by $19/t, or 5%, to $358-362/t FOB. At the same time, in late March and early April, quotations began to rise, recovering to $363-364/t as of April 2.

In March, the North American scrap market was also affected by negative sentiment on the global commodities market and weak demand for steel, but the situation improved at the end of the month and prices bottomed out. Trade was boosted by higher prices for rolled steel and pig iron, but weak Turkish demand still weighed on prices.

As we approach April trading, US scrap market participants have positive expectations for raw material prices after a sharp drop in March. Although some mills are still expecting prices to soften due to production shutdowns, most market participants believe that prices will either stabilize or rise.

In China, domestic prices for heavy scrap in March decreased by $39.5/t, or 9.8%, to $364.82/t. In April, quotations continue to fall. As of April 2, Chinese scrap is estimated at $358.2/t, down 4.5% from the previous week.

Prices for raw materials in China collapsed in March amid unfavorable steel market conditions. As a result of the decline in steel prices and, consequently, lower margins, most steel mills are limiting production and reducing capacity utilization by going into early maintenance or shutting down completely. This, in turn, affects the demand for scrap. At the same time, the decline in iron ore prices is also further weakening the competitiveness of scrap.

Scrap prices in China are expected to remain low in the short term, as most steel companies are still operating at a loss and have accumulated inventories. At the end of this week, China will enter the Qing Ming holiday. The supply of scrap may be limited, so some local mills will increase purchases to reserve stocks for the holiday.

«Although it is believed that China does not directly affect the scrap market, as Turkey is the largest importer, such an impact can be seen now. China affects the global steel market, and depending on it, steelmakers place orders for scrap supplies. We are currently waiting to see how much steel production and consumption in the Chinese economy will stabilize, which will affect the price of scrap in the near future,» said Andriy Glushchenko, GMK Center analyst.