News Global Market rebar 3209 23 July 2024

There is a seasonal lull in the market amid of a decrease in buyer activity

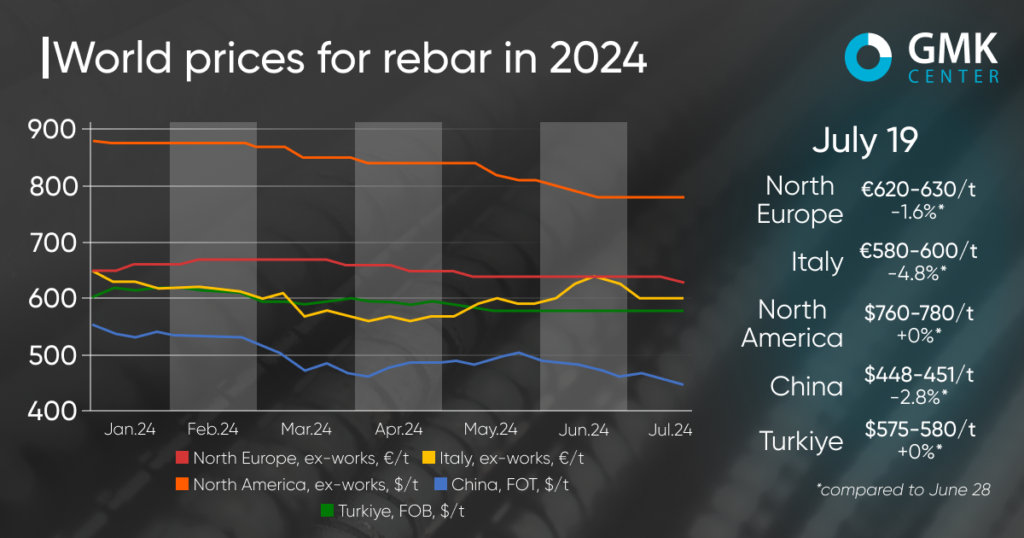

Global rebar prices have remained stable in most major regions since the beginning of July. The market stagnation is a result of a slowdown in steel demand. At the same time, the Chinese market is experiencing negative price dynamics amid changes in national standards.

Rebar prices in Turkey, according to Kallanish, remained stable at $575-580/t FOB during July 1-19. In general, the market has been stagnant since mid-May, with quotations not exceeding $580/t and not falling below $570/t.

Turkish rebar prices have remained stable for a long time amid weak domestic and export demand. At the same time, the price of scrap is maintained at levels that do not allow rebar prices to be reduced despite the lack of demand. On the other hand, this position restrains buyers who could become more active if rebar prices were to fall. Although the market is pressing for discounts on long products, producers cannot afford to do so, as high scrap costs would lead to unprofitability.

Demand from European consumers continues to slow down amid the holiday season. However, Romania and Bulgaria are showing some interest in Turkish long products. In addition, Egyptian and Algerian producers have entered the European market with more favorable offers, which has led to increased competition. US buyers may resume their activity only in August.

“The current sales volumes are negligible, given Turkey’s capacity. I do not expect sales to recover in the near future. However, the expected US Federal Reserve interest rate cut in September and the end of the holidays are likely to bring some activity in the second half of August,” the trader said.

Rebar prices have fallen slightly on the European market since the beginning of July. In Northern Europe, quotations for the period June 28-July 19 fell by €10/t – to €620-630/t Ex-Works. At the same time, the upper limit of prices has been stable since the beginning of May, while the lower limit fluctuated by no more than €10/t during this period. In Italy, the drop in quotations was more significant – by €30/t, to €580-600/t Ex-Works.

European rebar producers are also facing weak demand for their products and pressure on prices amid low construction activity. Some producers tried to increase their offer prices but faced market resistance and weak demand. As the summer vacation season approaches, activity will continue to slow down, so European rebar prices will stabilize or decline slightly in the short term.

In the US, rebar prices have been stable over the past 4 weeks at $760-780/t Ex-Works. Supply remains at a sufficient level, but buyer activity is slowing. The negative situation on other steel markets, in particular on the hot-rolled plate market, is putting additional pressure. The steel markets are expected to be supported by a rise in scrap prices in July, and a possible further rise in raw material prices. A rebound in prices is expected in late August and early September.

As of July 19, rebar prices in China were at $448-451 per tonne FOT Warehouse compared to $461-464 per tonne on June 28 (-2.8%). Quotes reached their lowest level since 2017 amid the introduction of new national standards by the State Administration for the Regulation of the Chinese Steel Market. The transition to the new standard means that rebar that meets only the old standard will no longer be sold. Last week, this prompted traders to unload their existing stocks, which led to a drop in prices.

However, several traders pointed out that although some steel mills are starting or planning to produce products to the new standard, the current high inventories and low off-season demand will likely result in some stocks remaining unsold until the end of September. Consequently, product prices are expected to remain low in the coming weeks.