News Global Market EU 1172 23 August 2023

The main share of imports falls on semi-finished products – 62.1% of the total supply

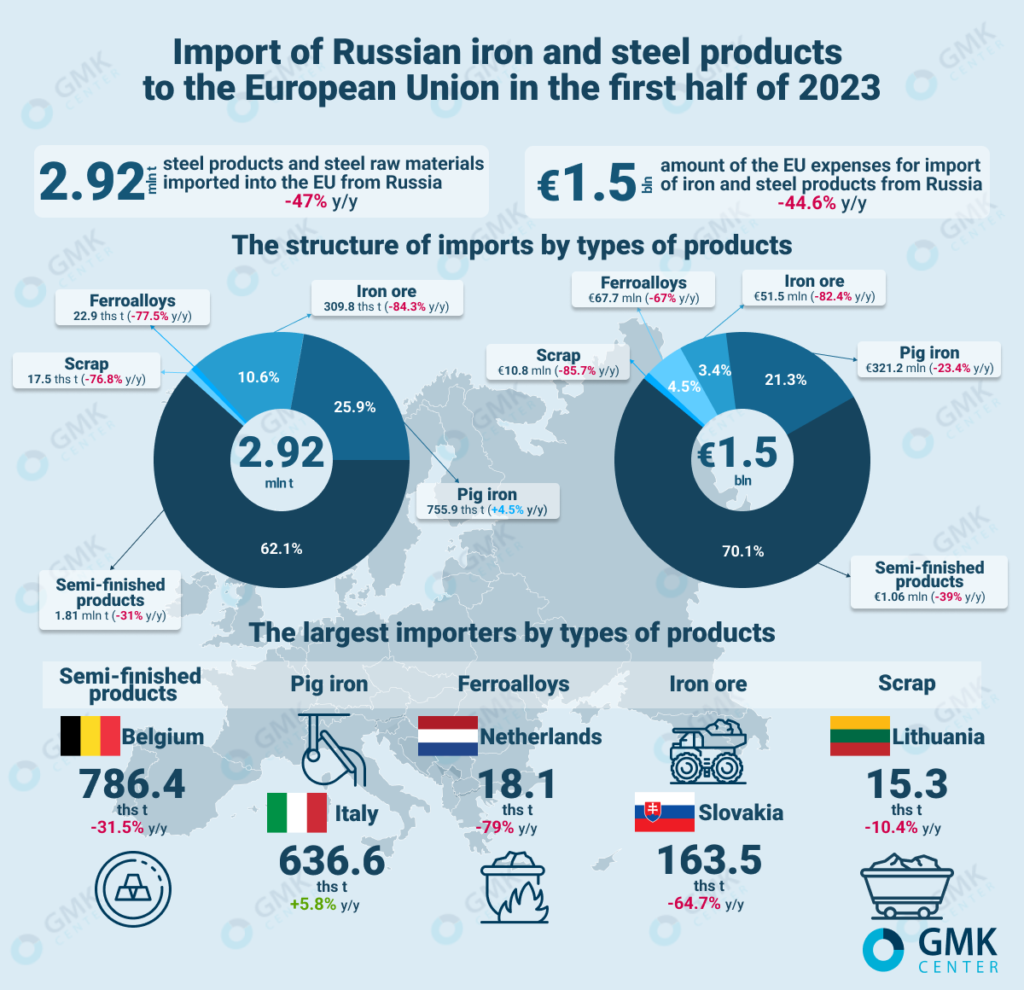

In January-June 2023, the European Union reduced the import of iron and steel products from Russia by 47% compared to the same period in 2022, to 2.92 million tons. The cost of importing Russian products to European consumers amounted to €1,51 billion, down 44.6% y/y. This is evidenced by the data Eurostat.

The main share of imports falls on steel semi-finished products – 62.1% of the total supply of metallurgical raw materials (iron ore, pig iron, ferroalloys, semi-finished products, scrap metal).

Deliveries of such products from Russia to the European Union in January-June decreased by 31% compared to the same period in 2022 – to 1.81 million tons. Most of the Russian-made steel semi-finished products were sent to Belgium – 786.4 thousand tons, and Italy – 429 thousand tons.

Iron ore deliveries from Russia to the EU decreased by 84.3% y/y in January-June – up to 309.8 thousand tons. Imports of pig iron amounted to 755.9 thousand tons, which is 4.5% more y/y, ferroalloys – 22.9 thousand tons (-77.5% y/y), scrap metal – 17.5 thousand tons (-76.8% y/y).

Among the main consumers of this Russian production of the MMC for the first half of 2023 were:

- Iron ore – Slovakia – 163.5 thousand tons (-64.7% y/y);

- pig iron – Italy – 636.6 thousand tons (+5.8% y/y);

- ferroalloys – the Netherlands – 26.2 thousand tons (-74.3 y/y);

- scrap metal – Lithuania – 15.3 thousand tons (-10.4% y/y).

At the end of June 2023, the EU reduced imports of metallurgical raw materials from Russia by 50.7% compared to the same month in 2022 and by 59.5% m/m – to 450.9 thousand tons. Import costs decreased by 68.5% y/y and 65.9% m/m – up to €239.6 million

Imports of semi-finished products decreased by 24.8% y/y and 11.5% m/m – up to 291.4 thousand tons, iron ore – by 94.7% y/y and 77.7% m/m, up to 5.4 thousand tons, pig iron – increased by 91.8% y/y and decreased by 41.8% m/m, to 148.9 thousand tons. Imports of Russian ferroalloys increased by 47.9% y/y, but fell by 50.4% m/m, to 2.6 thousand tons, and scrap metal fell by 50.7% y/y and 59.5% m/m, up to 2.65 thousand tons.

Despite the sanctions imposed against Russia, the mining and steel complex of the Russian Federation continues to receive significant profits from the export of products to the European Union. Although the figures have decreased significantly compared to 2022, in particular, last year exports amounted to 7.92 million tons for €3.87 billion, deliveries still remain at a high level.

Despite the sanctions, Russia still has loopholes that allow it to export steel to the EU countries. This CEO of Metinvest Group Yuriy Ryzhenkov emphasized it in an interview with the Italian edition of Corriere della Sera. On the one hand, the steel industry of the Russian Federation found itself in a difficult situation in terms of market share. In particular, in October 2022, the EU imposed the eighth package of sanctions against Russia, including a ban on the supply of steel products to the EU. However, it provides for a two-year delay for Russian manufacturers to supply semi-finished products to the EU.

Yuri Ryzhenkov also noted that European importers who buy Russian semi-finished products at low prices have an advantage over other producers in the European Union who refuse products from the Russian Federation.

11 months after the start of a full-scale war in Ukraine, according to GMK Center’s research, a number of sanctions have been imposed against the Russian steel industry, complicating its export. However, approaches to restrictions on the part of large economies differ. The US sanctions policy, for example, provides for minimal bans, but American buyers avoid products of Russian origin. The European Union left the possibility of trade in raw materials from the Russian Federation and postponed restrictions on semi-finished products. The UK has taken the path of imposing import duties.

Recently, within 11th package of sanctions against the Russian Federation, the EU have strengthened restrictions on the import of steel goods to the bloc. The new requirements will come into effect on September 30, 2023.