News Global Market iron ore prices 1388 03 February 2023

Iron ore futures on the Dalian Exchange for the week of January 27 – February 3, 2023, fell by 1.2% compared to the previous week

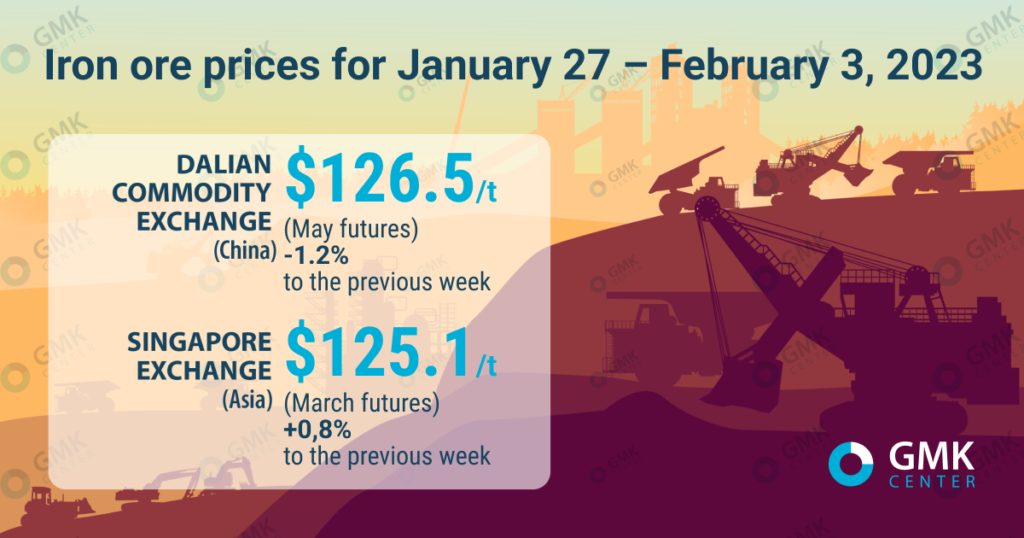

May iron ore futures, the most traded on the Dalian Commodity Exchange, on January 27-February 3, 2023, fell by 1.2% week-on-week – to 853.5 yuan/t ($126.52/t). This is evidenced by the data of Nasdaq.

On the Singapore Exchange, March futures increased slightly compared to the price on January 27 – by 0.8%, up to $125.1 per ton.

Iron ore prices in China

At the beginning of the week, after the Chinese holidays, iron ore prices began to rise – market participants were optimistic about the prospects for demand in the Chinese market. However, the post-holiday enthusiasm lasted only a few days, with overall market sentiment positive amid relaxed lockdown restrictions. In addition, China’s central bank said it plans to increase support for targeted sectors of the economy.

Australian mining company Fortescue Metals Group said China expects a strong economic recovery in the near future, which will have a positive impact on iron ore purchases. But concerns about regulatory intervention, as China has repeatedly warned the market against price speculation, could dampen mining profits.

“China will increasingly insist that iron ore prices are too high if prices continue to rise,” the company said.

Since the beginning of February, iron ore prices in China have slightly decreased, as suppliers have felt a decrease in demand. In addition, in January, iron ore stocks in the country’s ports accumulated significantly, and steel enterprises have not yet fully resumed their work after the New Year holidays. Traders’ concerns about regulatory intervention also contributed to price containment.

In February 2023, iron ore prices in China are likely to be stable as steel mills begin to resume operations after holidays and maintenance. Traders, in turn, will not risk raising prices, as they fear regulatory intervention. However, demand for iron ore could rise sharply in March amid the unveiling of additional stimulus and infrastructure spending at the National Assembly.

As GMK Center reported earlier, Chinese iron ore market will face oversupply in 2023, according to Mysteel, as demand from steelmakers is likely to decline. China’s domestic supply of ferrous metals, including production at local mines and imports, is expected to grow by 23 million tons y/y in 2023 – up to 1.41 billion tons. At the same time, the total demand is projected at the level of 1.39 billion tons, which is 3.6 million tons less than in 2022.