News Green steel Canada 1805 30 March 2023

The benefits will be attractive to investors in new, developing industries

The Canadian government has unveiled a series of new tax incentives for green investments worth about 35 billion Canadian dollars ($26 billion). Reuters informs about it.

The 2023-2034 federal budget details how the country would create a growth fund or public investment vehicle, that would manage a system of contracts to lock in the future value of carbon or hydrogen and de-risk large projects. Canada has also expanded eligibility for previously announced carbon use and storage (CCUS) tax credits.

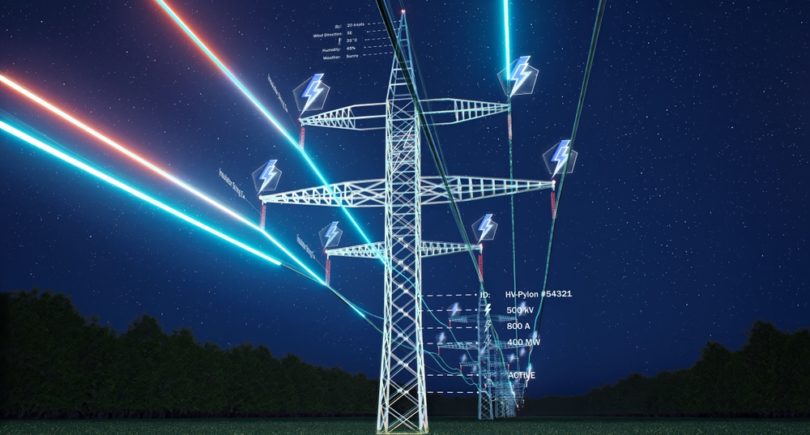

Almost CAD 26 billion of the total amount of tax incentives is provided for the electricity generation and transmission sector. Given the role electricity will play in decarbonizing the Canadian economy, this is probably the most important federal budget to combat climate change, according to Francis Bradley, executive director of the Electricity Canada trade association.

Prime Minister Justin Trudeau’s government has been under pressure since the US passed the Inflationary Reduction Act (IRA), which calls for massive investments in clean technology. Canada had to level the playing field with its largest trading partner.

Although Canadian officials are moving in the direction of a green transition, the funds provided are inferior to the levels of incentives from the United States. According to Michael Bernstein, executive director of the Center for Clean Prosperity, the IRA could offer more than $1 trillion to cleantech investors. Investment tax credits in Canada help companies make one-time capital investments. At the same time, the States offer permanent production tax credits that cover operating costs.

Canada’s new tax breaks will be attractive to investors in emerging industries ranging from clean hydrogen to zero-emission vehicles.

But analysts say Canada still needs to do more to develop contracts for difference that would encourage large-scale carbon capture or hydrogen production projects. Such contracts guarantee investors a fixed price for carbon or hydrogen during their term.

As GMK Center reported earlier, in February 2023, the leaders of the EU agreed that they must allow targeted, temporary and proportionate support to secure Europe’s future as a producing base for clean technologies and counter competition from the US and China. The European Commission has proposed easing state aid rules for investments in renewable energy, decarbonization of industry or zero-emission vehicles.