Infographics iron ore mining 1936 20 May 2025

Administrative pressure from the state has a negative impact on the performance of enterprises in the sector

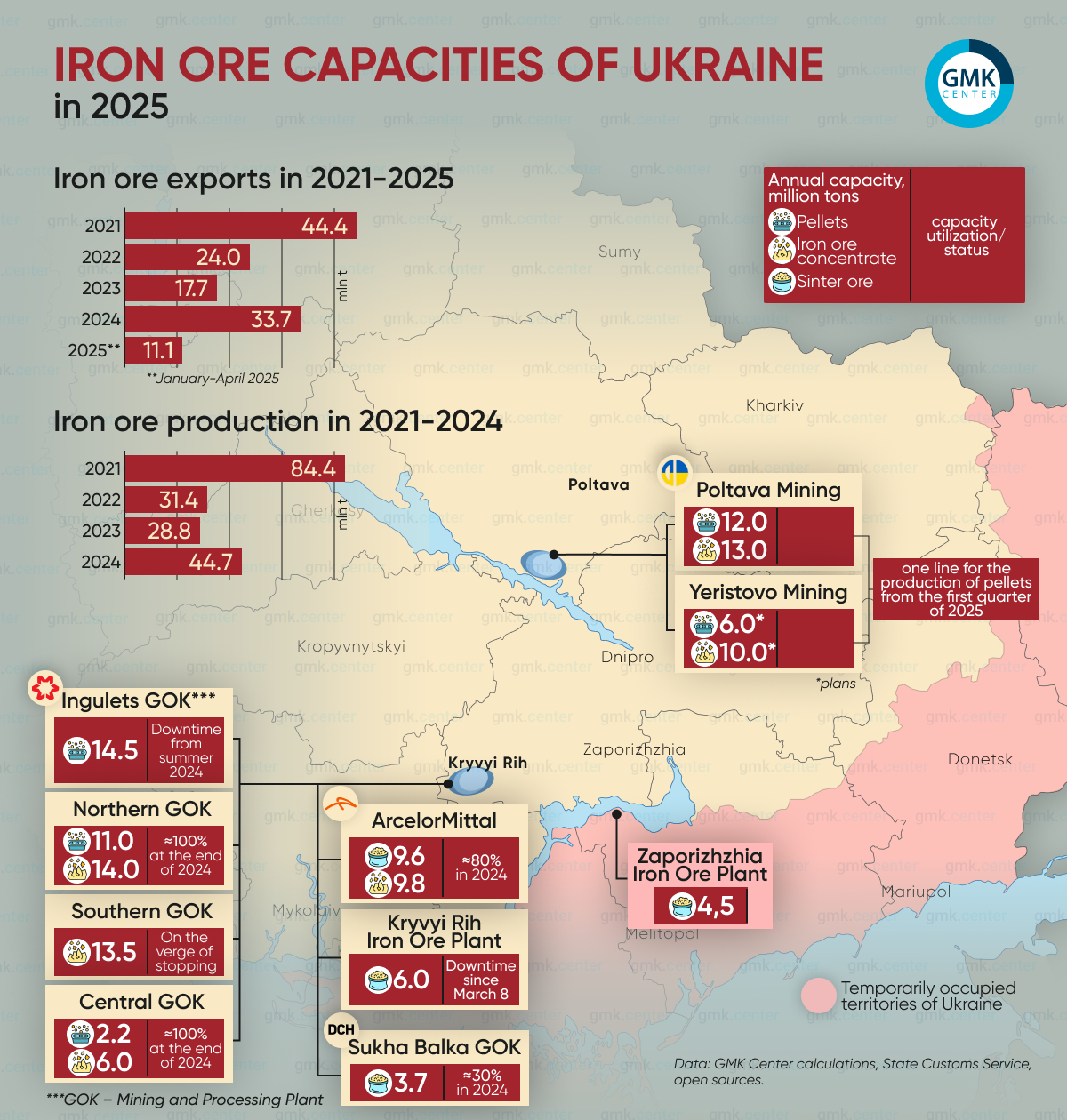

The iron ore industry remains one of the key sectors of the Ukrainian economy, providing foreign exchange earnings, exports, employment and investment even during a full-scale war. In 2024, iron ore exports reached $2.8 billion. At the same time, in 2025, most mining and processing plants reduce or completely stop production, and exports decline. The reasons for the crisis are not only market-related. Representatives of the industry are increasingly pointing to the actions of government institutions as a key destabilizing factor.

Decline in production and exports due to government pressure on business

In January-April 2025, iron ore exports decreased by 20.9% in value terms (to $892.99 million) and by 10.2% in physical volumes – to 11.15 million tons. This means a loss of more than $235 million in foreign currency revenue in just four months. GMK Center forecasts that by the end of 2025, Ukraine’s iron ore exports will decline by about 20% y/y – to 27 million tons from 33.6 million tons in 2024.

Production figures also show negative dynamics. In particular, Ferrexpo, one of the three largest iron ore companies in Ukraine, cut production by 26% in the first quarter to 1.35 million tons. In May, the company announced that it had shut down two pelletizing lines due to non-refund of VAT on exported products. The total expected underproduction in 2025 is estimated at 4 million tons.

“Ferrexpo has become one of the most high-profile victims of predatory government policies. The London-listed company was denied a VAT refund of $12.5 million just because its minority shareholder is a sanctioned person. This is a gross violation of the rule of law and a signal to investors that corporate rights in Ukraine can be devalued by bureaucratic arbitrariness,” Alan Riley, visiting lecturer at the College of Europe (Natolin), wrote in a column for thepage.ua.

Metinvest Group’s Ingulets Mining has been idle since the summer of 2024, and Southern Mining is on the verge of shutting down due to disputes with the State Tax Service. The agency wants to sell the company’s property and compensate for UAH 3.7 billion in taxes that the plant allegedly underpaid when paying dividends to owners in 2017-2019.

Kryvyi Rih Iron Ore Plant (KZHRK) stopped production in March 2025 and put most of its employees on idle time. The reason is the inability to pay for electricity and stopped VAT refunds from the state. Employees of the company recently announced plans to partially resume work, but there is no official order yet.

Fiscal pressure and the VAT issue

One of the key problems pointed out by the industry’s companies is the systemic non-refund of VAT. In January 2025, Ferrexpo did not receive a refund of UAH 513 million, and KZHRK did not receive a refund of more than UAH 330 million. The explanations of the tax authorities include sanctions against individual beneficiaries that are not legally applicable to the companies themselves. This leads to severe financial strain, as limited access to working capital prevents companies from paying wages, covering energy expenses, and restarting production.

The consequences are lower production, reduced exports, lower tax revenues, and loss of foreign currency earnings. Ferrexpo alone has paid over $300 million in taxes and rents to the budget over the two years of the full-scale war.

At the same time, the total volume of VAT refunds in the country in the first quarter of 2025 increased by 30% – to UAH 42.4 billion, which indicates the availability of resources. The problem lies in the selective approach to refunds, which undermines business confidence in government tax policy.

Tariff policy: a factor of unprofitability

The tariff policy of state-owned monopolies has a significant negative impact on the profitability of mining and processing companies. Over the past year, the cost of electricity for the industry has doubled, which has a critical impact on concentrate producers, where electricity share in production costs reaches 60%. Railroad freight tariffs are growing by an average of 35-40% annually and are 1.5 times higher in dollar terms than in 2019-2021.

Ingulets Mining ceased operations due to the combined pressure of energy, transportation and port tariffs. According to the company’s estimates, port costs in Ukraine are twice as high as in European ports. In addition, a significant excise tax on diesel fuel (25% of the cost) is applied even to fuel used by mining dump trucks that do not use road infrastructure.

Of particular note is the change in the cargo transportation route for ArcelorMittal Kryvyi Rih in April 2025. Ukrainian Railways increased the tariff distance by 257 km, which further increased the company’s logistics costs. Without proper justification, such decisions may be perceived as examples of inefficient or discriminatory tariff regulation.

Staff shortage

In addition to financial and logistical challenges, the industry is facing an acute shortage of personnel. It is estimated that 15% to 20% of the iron and steel sector’s workforce is mobilized. This creates difficulties in maintaining production processes, even if orders and production capacity are available. The instability of mobilization legislation and the lack of a systematic approach to booking specialists only exacerbate the problem.

Conclusions

In 2024, the iron and steel sector accounted for about 7% of GDP and 15% of Ukraine’s exports. However, in 2025, the sector is already facing a number of systemic problems, some of which are of administrative origin. Without revising approaches to tariff regulation, fiscal policy, and support for export-oriented producers, the country risks losing one of the key pillars of the economy in times of war.

The mining industry does not require direct budgetary funding. For stable operation, it needs a predictable regulatory environment, timely tax credit refunds and an economically sound tariff policy. In the current environment, each ton of iron ore products means foreign currency earnings, tax revenues and jobs. Failing to recognize the industry’s strategic importance undermines the country’s ability to recover economically and poses long-term risks to financial stability.