Infographics flat rolled steel 2271 18 March 2024

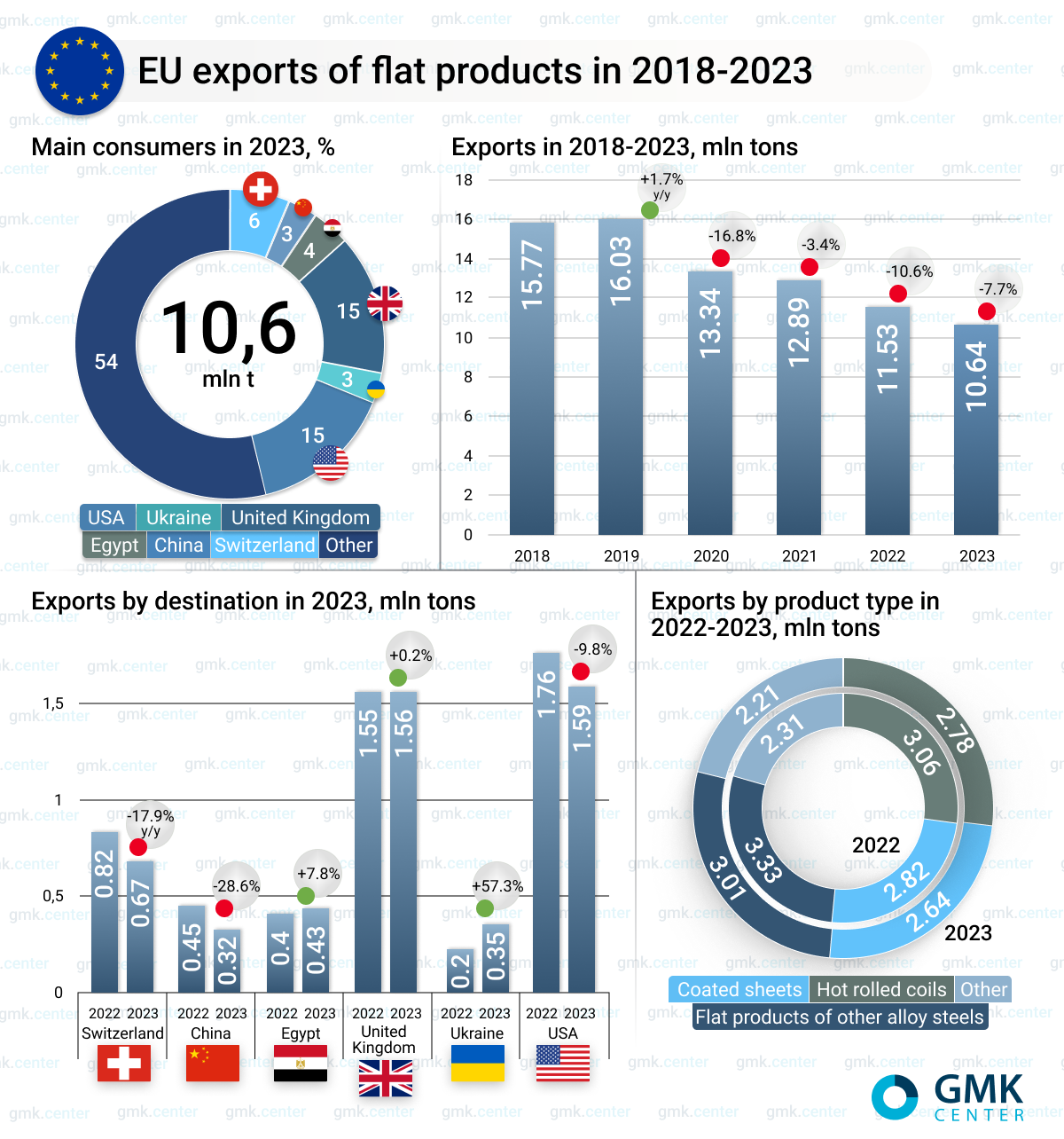

The main consumers of EU flat products last year were the US, UK and Switzerland

In 2023, the European Union reduced exports of flat products to third countries by 7.7% compared to 2022, to 10.64 million tons. Exports have been declining for four years in a row. This is according to GMK Center’s calculations based on Eurostat data.

The dynamics of flat products exports over the past 6 years is as follows:

- 2018 – 15.77 million tons;

- 2019 – 16.03 million tons (+1.7% y/y);

- 2020 – 13.34 million tons (-16.8% y/y);

- 2021 – 12.89 million tons (-3.4% y/y);

- 2022 – 11.53 million tons (-10.6% y/y);

- 2023 – 10.64 million tons (-7.7% y/y).

«The drop in flat products exports is directly related to the decline in steel production in the EU. Due to high production costs, European producers find it difficult to compete with suppliers from other countries. This is true not only in foreign markets but also in the intra-European market. Therefore, the EU is actively introducing trade barriers to imports,» said Andriy Glushchenko, GMK Center analyst.

The main consumers of flat products from the EU are the US – 1.59 million tons (-9.8% y/y), the UK – 1.56 million tons (+0.2% y/y), Switzerland – 774.1 million tons (+0.2% y/y), Switzerland – 674.1 thousand tons (-17.9% y/y), China – 320.33 thousand tons (-28.6% y/y), Egypt – 433.26 thousand tons (+7.8% y/y), Ukraine – 348.69 thousand tons (+57.3% y/y). These countries accounted for about 50% of EU exports of steel products in 2023.

The largest exports were of flat products from other alloy steels – 3.01 million tons (-9.7% y/y), hot-rolled flat products – 2.78 million tons (-9.1% y/y), and coated flat products – 2.64 million tons (-6.3% y/y).

Shipments of European steel to Ukraine saw a sharp increase last year, up 57.3% y/y, driven by a pickup in steel consumption in the country, while some products were in short supply on the domestic market due to the loss of some steelmaking capacity as a result of the war. The EU was one of the largest suppliers of flat products to the Ukrainian market in 2023, and the upward trend in imports will continue as local steelmakers are unable to supply domestic consumers in full. This will be especially noticeable during Ukraine’s post-war recovery.