Infographics flat rolled steel 968 19 March 2025

Exports increased for the first time since 2019

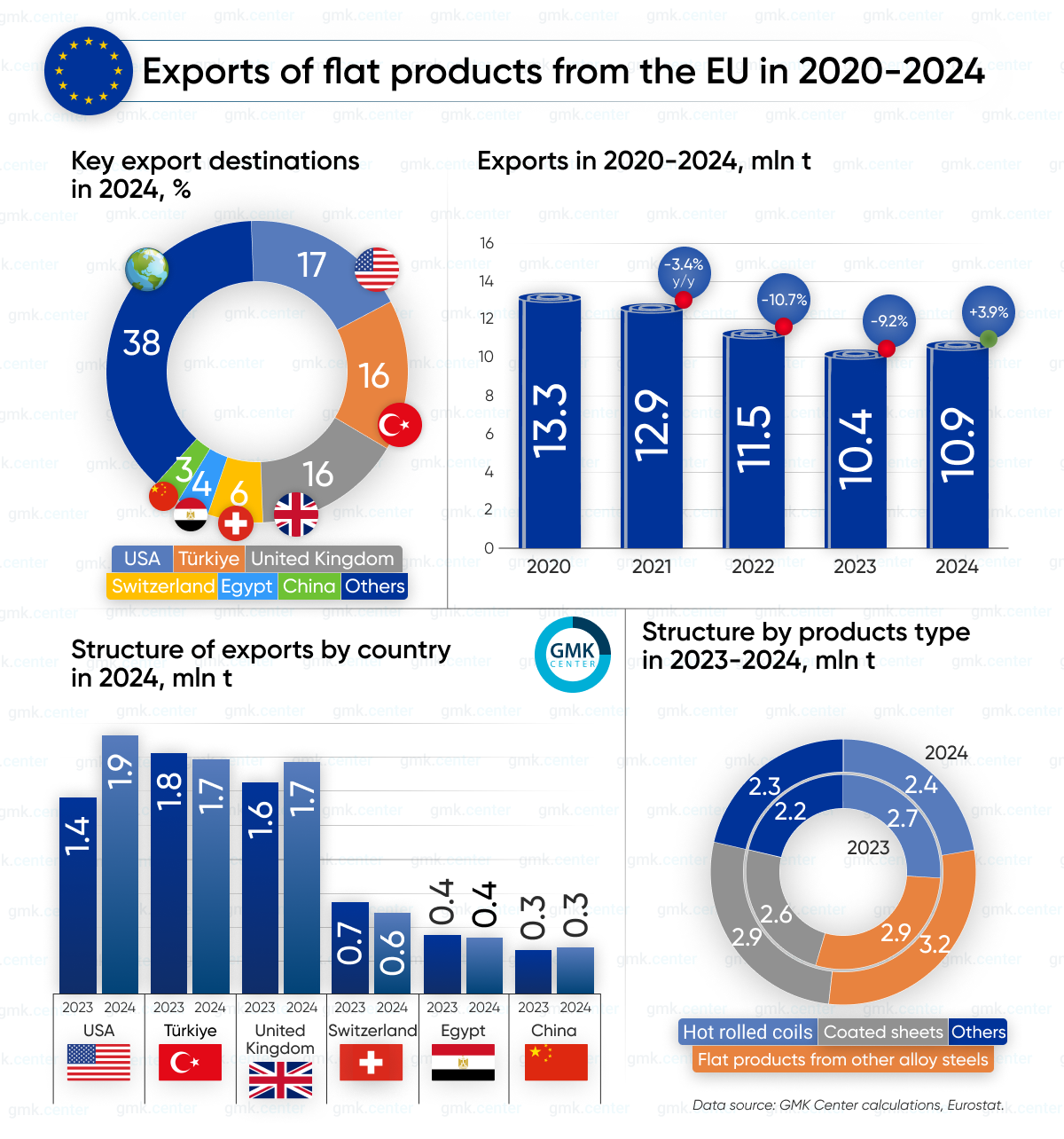

In 2024, the European Union (EU) increased its exports of flat products to third countries by 3.9% compared to 2023, to 10.86 million tons. Product shipments increased for the first time since 2019. This is evidenced by GMK Center’s calculations based on Eurostat data.

The largest export volumes were accounted for by flat products made of other alloy steels (HS-7225) – 3.19 million tonnes, up 8.4% compared to 2023. Another 2.94 million tonnes (+13.5% y/y) of exports were made up of coated flat products (HS 7210), and 2.44 million tonnes (-10.5% y/y) were exported as hot-rolled flat products (HS 7208). The company also exported 808.49 thousand tons of cold-rolled flat products (HS 7209), up 19.6% y/y.

European steelmakers exported more than 60% of flat products to the US, Turkey, the UK, Switzerland, Egypt, China and Norway.

In particular, the United States consumed 1.9 million tons of flat products from the EU last year, up 31.5% compared to 2023. In 2020, these volumes were estimated at 1.24 million tons. Coated flat products accounted for the bulk of supplies – 756.36 thousand tons (+58% y/y), and flat products made of other alloy steels (HS-7225) – 612.97 thousand tons (+27.1% y/y).

A significant volume of products was exported to Turkey – 1.71 million tons (-2.6% y/y). Compared to 2020, the figure fell by 36.5% (2.7 mln tons). The largest export volumes were supplies of flat products made of other alloy steels (HS-7225) – 575.4 thousand tons (-5.5% y/y), and coated flat products – 443.15 thousand tons (+9.6% y/y).

Over the past year, 1.7 million tons of flat products from the EU were shipped to the UK (+9.7% y/y), with the bulk of exports coming from hot-rolled flat products – 641.63 thousand tons (+12.6% y/y) and coated flat products – 389.62 thousand tons (-2.2% y/y).

In 2024, Switzerland imported 607.09 thousand tons of flat products from the EU (-10% y/y), Egypt – 409.48 thousand tons (-4% y/y), China – 345.01 thousand tons (+7.2% y/y), Norway – 174.76 thousand tons (+5.2% y/y). Other countries accounted for 4 million tons of supplies.

In 2024, 262.47 thousand tons of flat products were exported to Ukraine, down 24.7% y/y.

The increase in exports of flat products from the EU indicates the recovery of the European steel sector after several years of decline. The largest increase in shipments was observed in the segment of coated and other alloy steels, indicating a steady demand for high-tech products.

The US market plays a key role in export growth, as shipments to the US increased significantly. This is due to stable demand for European products and favorable trade conditions. High-quality steel remains particularly in demand amid restrictions on Chinese and Russian producers.

However, the prospects for exports to the US depend on customs regulations. Despite some easing, the US government may revise import conditions to protect domestic producers.

“The introduction of import tariffs on EU steel by the United States will be a challenge for European producers, as they will have to find markets for the 4 million tons of steel products currently exported to the US. The possibility of continuing these supplies will depend on market conditions and the terms of future trade agreements,” said Andriy Glushchenko, GMK Center analyst.

Overall, export prospects remain positive, although European producers should be prepared for changes in trade policy and environmental requirements, which will require flexibility in sales strategies.