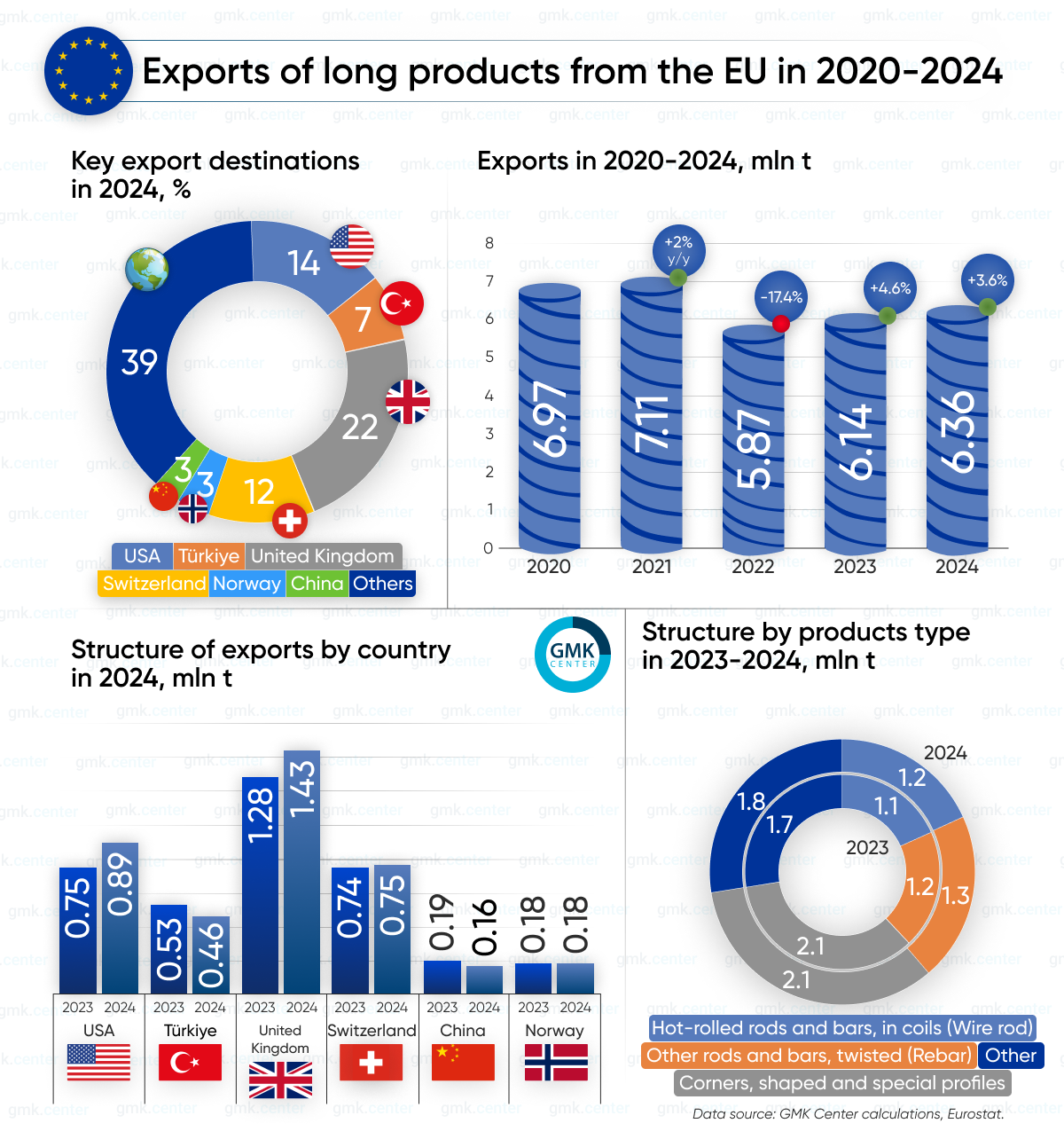

Infographics long products 1202 20 March 2025

Product shipments grow for the second year in a row after a significant drop in 2022

In 2024, steel companies in the European Union (EU) increased exports of long products to third countries by 3.6% compared to 2023, to 6.36 million tons. Shipments have been growing for the second year in a row after falling by 17.4% y/y in 2022. This is according to GMK Center’s calculations based on Eurostat data.

The largest export volumes for the year were angles, shapes and special sections made of unalloyed steel (HS-7216) – 2.14 million tons, up 0.7% y/y. Another 1.29 million tons (+8.9% y/y) of exports were made up of other rods and bars of carbon steel, not further processed, twisted (HS – 7214), and 1.17 million tons (+3.7% y/y) of hot-rolled rods and bars of carbon steel, in coils (HS – 7213).

More than 60% of exports went to the US, Turkey, the UK, Switzerland, China, and Norway.

The largest volumes were supplied to the UK – 1.43 million tons (+11.6% y/y). Of these, 608.79 thousand tons (+33.5% y/y) were angles, shapes and special sections.

Another 890.5 thousand tons were shipped to the United States (+19.1% y/y), 752.2 thousand tons (+1.9% y/y) – to Switzerland, and 461 thousand tons (-12.3% y/y) – to Turkey. The company exported 176.31 thousand tons (-2.3% y/y) to Norway, 161.3 thousand tons (-13.8% y/y) – to China, 39.15 thousand tons (-27.8% y/y) – to Ukraine, and 36.7 thousand tons (-2.2% y/y) – to Egypt.

The key exporters of long products among the EU countries are:

- Germany – 1.5 million tons;

- Spain – 1.41 million tons;

- Italy – 1.05 million tons;

- Portugal – 485.56 thousand tons.

Thus, the European long products market is showing a gradual recovery, which indicates that production has stabilized and demand in key foreign markets, including the UK, the US and Switzerland, remains strong.

However, a number of factors continue to weigh on the export sector. First, high energy prices and production costs in the EU reduce the competitiveness of European steelmakers compared to producers from Turkey or China. Secondly, geopolitical instability, including trade restrictions, affects supply chains.

Despite these challenges, the outlook for 2025 remains moderately positive. Exports are expected to continue to grow due to the recovery in economic activity in the US and the UK, as well as a potential improvement in the EU’s terms of trade. At the same time, possible fluctuations in commodity markets and regulatory changes may create additional risks for exporters.