News Global Market EU 2701 04 September 2024

The quota for the current year is 1.14 million tons, and its volumes have been exhausted with an expected surplus at the level of 2.2 thousand tons

European steel companies have prematurely exhausted the quota for imports of pig iron originating from the Russian Federation, which is valid until December 31, 2024, and its volumes are 1.14 million tons. This is evidenced by the data of the EU Customs.

As of September 3, 2024, the balance of the Russian quota for the supply of pig iron to the EU amounted to 106.48 thousand tons, while 108.66 thousand tons were already awaiting distribution at customs. Thus, the quota is completely exhausted with an expected surplus of 2.18 thousand tons.

The next quota period will begin on January 1, 2025, which will allow importing from Russia only 700 thousand tons of pig iron. A complete ban on the import of Russian products will be established in 2026. Pig iron arriving in the EU between September and December 2024 is expected to be stored in ports until 1 January, pending a new quota period.

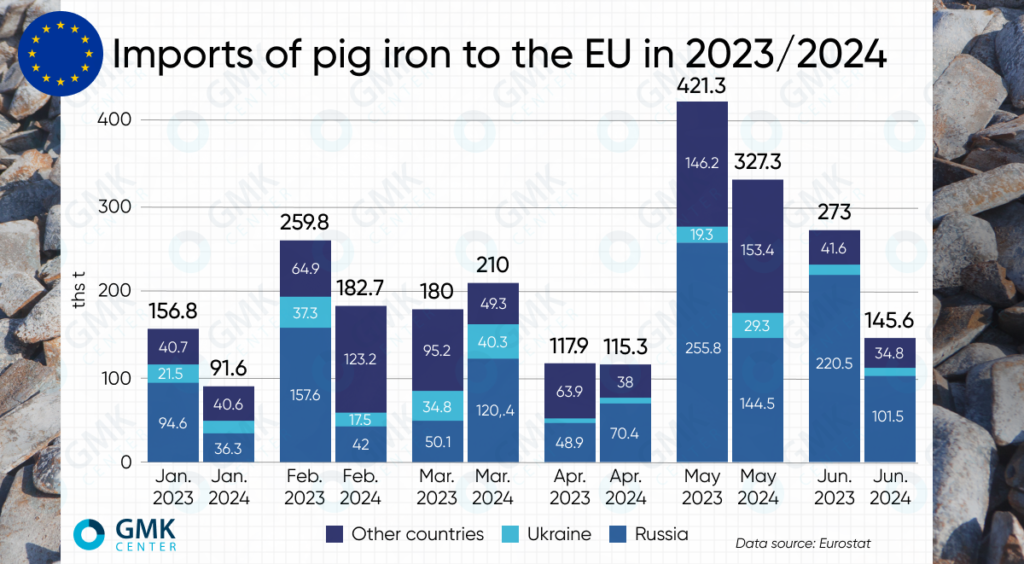

Russian pig iron is an attractive raw material for some European steelmakers, since suppliers from the Russian Federation offer products at significant discounts in order to interest consumers. The bulk of pig iron of Russian origin is sent to Italy – 371.55 thousand tons for 6 months of 2024 (-47.5% y/y), Latvia – 82.7 thousand tons (+ 95.9% y/y) and Poland – 31.26 thousand tons (-16.1% y/y). In total, in January-June 2024, the EU imported 1.07 million tons of pig iron (-23.9% y/y), and about half of the imports fell on the Russian Federation – 515.22 thousand tons (-37.7% y/y).

Some EU steelmakers fear a complete ban on imports of Russian pig iron, citing the lack of an alternative that will allow them to work with the same profits. At the same time, with the outbreak of war, European steelmakers have significantly reduced imports of pig iron from Ukraine, which has the potential to cover the shortage of relevant raw materials in the EU market. Thus, in January-June 2024, imports from Ukraine amounted to 117.93 thousand tons (-8.5% y/y), while, according to the Ministry of Economy of Ukraine, domestic steelmakers are ready to export up to 1.5 million tons of additional pig iron to the EU market instead of Russian suppliers. Before the full-scale war, Zaporizhstal, ArcelorMittal Kryvyi Rih and Kamet-Steel collectively exported about 2 million tons of pig iron. During January-July of this year, the export of pig iron from Ukraine amounted to 669.9 thousand tons, which is 26.1% less than year ago. The bulk is sent to the United States and Turkey.

«The European Union from the very start of the war in 2022 began to increase imports of pig iron from Russia. For a long time, sanctions packages did not include an outright ban on the import of Russian pig iron, since the EU has plants that traditionally depend on the supply of pig iron and steel semi-finished products from Russia. In the case of slabs, we see that the European Commission has decided to ease restrictions and allow imports from Russia to continue. There is a risk that this case will be used to remove restrictions on the import of pig iron from the Russian Federation. The continuation of pig iron imports from the Russian Federation will negatively affect the position of Ukrainian producers who could replace these Russian-made products,» said GMK Center analyst Andriy Glushchenko.

As GMK Center reported earlier, in December 2023, the EU Council adopted the 12th package of economic and individual sanctions in connection with the continuation of Russia’s war against Ukraine. The new package of sanctions, in particular, included a ban on imports of goods such as pig iron, including spiegeleisen, direct reduced iron, copper and aluminum wire, foil, aluminum pipes for a total of €2.2 billion per year.

In 2023, the European Union reduced pig iron imports by 1.3% compared to 2022, to 2.41 million tons. Deliveries from the Russian Federation reached 1.31 million tons, which is 20.1% more year-on-year, mainly to Italy – 1.18 million tons (+22.1% y/y). At the same time, imports from Ukraine fell by 18.8% y/y – to 207.53 thousand tons.