Posts Companies Liberty Ostrava 1437 16 June 2025

The company has now restarted the blast furnace in Galati and is making a last-ditch effort to save its UK assets

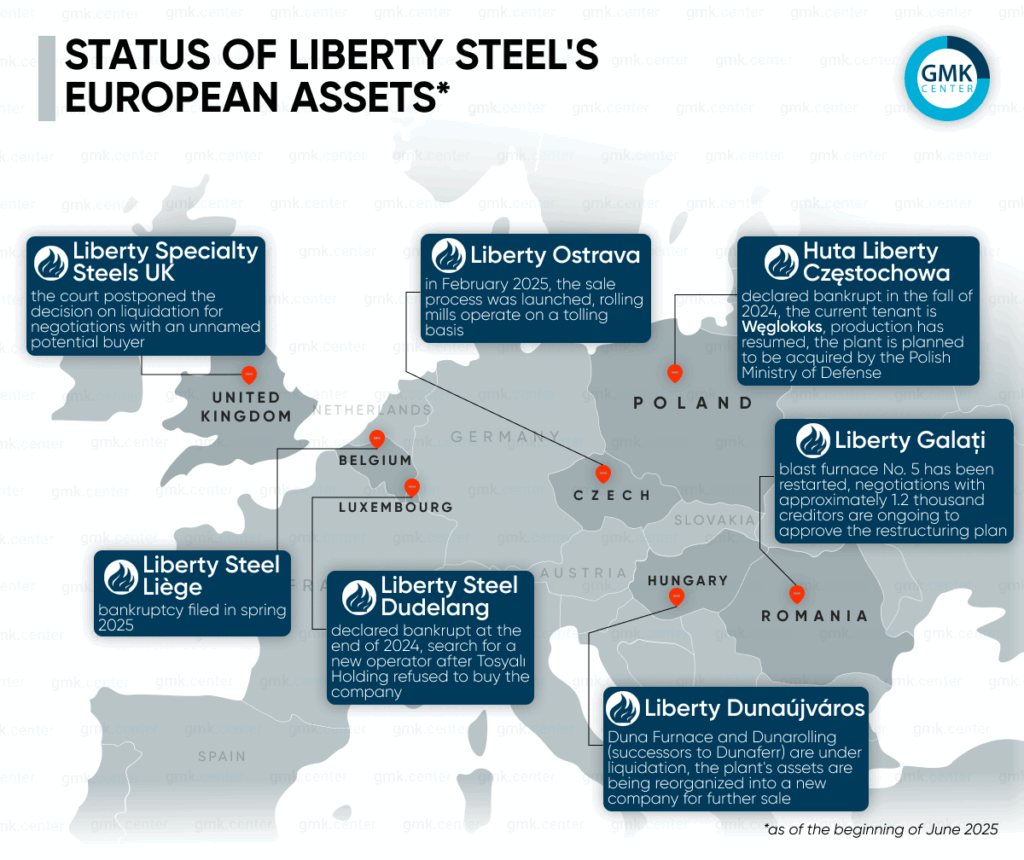

In 2018 to 2023, Liberty Steel, a member of the GFG Alliance, was actively expanding its “empire” by acquiring European assets, including distressed ones. However, after the bankruptcy of its main creditor, Greensill Capital, in 2021, the company faced significant financial difficulties. Despite attempts to restructure its debt and attract investors in recent years, the situation for the group remains critical, as do its assets in Europe, a number of which have been declared bankrupt or are in liquidation. Governments are forced to intervene because these are steel mills with a long history, which have investment potential and are major employers in the regions where they operate.

Hungary.

In July 2023, Liberty Steel won a tender for the acquisition of Hungary’s Dunaferr, offering €55 million for the company. Then an agreement was signed to acquire 100% of the shares in Dunarolling Vasmű and Duna Furnace Vasmű, two new target companies formed from the viable divisions of the liquidated one. The transaction, which was formalized in the agreement, took place in October, following the approval of the European Commission.

Liberty committed to take urgent measures to protect the environment, retain the workforce, continue steel production, and transform Dunaferr from BF-BOF to EAF-based production. However, the company quickly ran into problems with labor costs and sustaining production operations.

In August 2023, Liberty shut down the plant’s only blast furnace due to high production costs, and since then, the plant’s rolling mills have been operating only intermittently. According to the annual report, most of the revenue in 2023 came from the sale of carbon allowances.

In the summer of 2024, the process of closing two coke oven batteries began, and in August, it was announced that China would provide a €1.3 billion financial guarantee to modernize the Hungarian plant, including its conversion to EAF.

In the fall of 2024, relations between Liberty Steel and the Hungarian government deteriorated amid prolonged downtime at the Dunaujvaros plant and financial difficulties. Hungarian officials have cautioned that Liberty Dunaújváros could face bankruptcy and potential liquidation unless urgent steps are taken to resume operations and ensure salary payments. It should be noted that at the beginning of the year, the parties were still looking for a common solution to keep the company operating.

The situation escalated after ISD Power, the energy supplier, filed a petition to liquidate Dunarolling Dunai Vasmű, the rolling division, in early October due to energy supply arrears.

Subsequently, the Hungarian government issued an emergency decree enabling a fast-tracked bankruptcy process and the swift appointment of a receiver to guarantee employee wage payments. New, additional rules amending the bankruptcy law were directed against Liberty Dunaújváros.

At the end of November last year, the court ordered the liquidation of Dunaferr’s successor companies, Dunarolling and Duna Furnace, both of which had been declared bankrupt a month earlier.

The plant’s assets are currently being restructured under a new entity, with efforts underway to sell them. Liquidators are conducting tenders in search of buyers for specific parts of Dunaferr. The government continues to be criticized for its extraordinary support of Liberty without proper control.

Romania

In early June 2025, after almost a year of downtime, Romania’s largest steel mill, Liberty Galați, resumed production with the launch of blast furnace No. 5. According to CEO Radu Ionescu, with the launch of the blast furnace and rolling lines, the company will once again supply high-quality domestic steel for defense, infrastructure, construction and shipbuilding.

At the same time, the company is negotiating with approximately 1,200 creditors to secure approval for its restructuring plan, which must receive court confirmation by July 5. The main goal is to achieve positive EBITDA over the next two years, increase the order book in strategic industries and reduce operating costs. According to Remus Borza, President of EuroInsol, the company is also implementing a number of initiatives to maintain the value of its assets in Romania, utilize non-core assets and seek new sources of financing.

Borza noted that the resumption of production was made possible by the coordinated efforts of the team, cost optimization and support from government partners.

EuroInsol and Sierra Quadrant, the two firms that make up the consortium, are serving as administrators for Liberty Galați, which has been under preventive insolvency since March 5. The company had repeatedly announced plans to restart Blast Furnace No. 5, but each time the timeline was pushed back due to technical issues and a lack of raw material inventories.

According to the Romanian service of Radio Free Europe/Radio Liberty, Romania has provided €292 million in financing to the Galați plant over the past 18 months through Exim Banca Românească. The purpose of these funds was to restart the only working blast furnace at the plant. In particular, in December 2023, the company was granted a €142 million working capital loan with subsidized interest. These funds helped the plant maintain the operation of blast furnace No. 5 only in the first half of 2024. In December last year, the government provided Liberty Tubular Products Galați SA with another loan totaling up to €150 million. The company in question owns a welded pipe rolling mill, 99.99% of which is controlled by Liberty Galați, and is also located on the plant’s platform.

Poland

Poland has been quite successful in rescuing Huta Częstochowa, one of the country’s largest producers of heavy plates. Liberty Steel acquired the company in May 2021 for PLN 190 million. The assets were put up for sale three times, with this amount being the minimum starting price of the third tender, and the buyer, Corween Investments (part of Liberty Steel Group), had previously leased the plant.

The plant’s financial difficulties escalated at the end of 2023, when production was halted. In January and February 2024, attempts were made to resume operations, but they proved to be unsuccessful. In April, a “crisis headquarters” was set up to save Huta Częstochowa. However, mounting debts to ZUS (the social security institution) and other creditors forced them to file for bankruptcy.

In October 2024, Huta Liberty Częstochowa was finally declared bankrupt after the court rejected the company’s appeal against the decision to liquidate it.

In November, Poland’s Węglokokoks was selected as the tenant of the Częstochowa steel plant. To fulfill the agreement concluded with the insolvency receiver, Huta Częstochowa sp. z o.o. was established to take over the employer’s obligations to the employees of the bankrupt plant and is responsible for the resumption of its operations.

In January 2025, the company’s electric arc furnace shop was launched, and in February, a rolling mill for heavy plate steel was launched. Huta Czestochowa has produced more than 100 thousand tons of steel since the plant resumed operations at the beginning of the year. In the coming months, production volumes are expected to grow further, and the plant’s products are supplied not only to the domestic market but also for export. The plant is planned to be acquired by the country’s Ministry of Defense, but an appeal against its value is currently pending – after the launch of production, the value of the asset increased from PLN 227 million to PLN 253.8 million.

Belgium and Luxembourg

At the end of April 2025, after a two-year suspension of operations, the court declared the Belgian company Liberty Steel Liège bankrupt. In March, an interim administrator was appointed.

Earlier, an attempt to declare a quiet (closed) bankruptcy (a procedure to find a buyer for assets freed from debt), which was agreed to by the Romanian parent company Liberty Galati, failed. This was due to a lack of funds, in particular, to pay employees and maintain assets, and insufficient guarantees from the region of operation.

The European trade union organization industriAll Europe, in turn, said that the bankruptcy of Liberty Steel Liège was a sad but expected outcome of Liberty Steel’s operations. According to Judith Kirton-Darling, the organization’s general secretary, the company has systematically failed to fulfill its promises regarding investments and industrial activities.

Trade unions have repeatedly criticized Liberty Steel and the GFG Alliance. In February of last year, IndustriAll Europe and IndustriAll Global called for an end to what they described as the group’s “irresponsible management” of its European assets. The unions urged GFG to provide full transparency of its consolidated financials and called on the European Commission to establish a crisis task force. They also emphasized that national governments should attach strict conditions when offering state support to Sanjeev Gupta’s alliance. In response, GFG dismissed the statement as inaccurate and misleading, arguing that Liberty’s operations, like all European steel industry, have been severely impacted by surging energy prices, inflation, and rising import volumes.

The situation surrounding Liberty Steel’s Dudelange plant in Luxembourg has also taken a dramatic turn, with the facility officially declared bankrupt at the end of 2024. In May 2025, it became known that the Turkish Tosyalı Holding, which had planned to buy the plant, had withdrawn from the deal. This steel group had been recognized as the best candidate, with plans to invest, retain staff and develop the plant.Although negotiations had been progressing positively, as it was reflected in public statements from the Turkish side, Turkish group suddenly revised its position following changes in EU regulations on steel imports from third countries. The case has now been handed back to the interim administrator, who will reassess the previously submitted bids or potentially consider new ones. A three-month window has been set for identifying a new operator.

Czech Republic

In February of this year, the process of selling the bankrupt Liberty Ostrava steel mill was launched with the approval of the creditors’ committee. At the end of May, Czech media reported that only SPV Nova Hut, owned by former Interior Minister Martin Pecina, had submitted a binding offer. However, according to bankruptcy administrator Simon Petak, the amount offered was too low. Negotiations with the interested party were immediately initiated to increase it, and the offer was increased by several hundred million kroons.

The Silesian plant, which was put up for sale, produced steel mainly for the construction, mechanical engineering and petrochemical industries. Liberty Ostrava currently operates three rolling mills, including a pipe mill, which work are supported by other companies through tolling schemes. From the beginning of this year to the end of April, they produced almost 180 thousand tons of products.

The trade union hopes that the buyer of the company will want to continue production. Currently, the creditors’ committee is considering whether it is better to sell the entire company to SPV Nova Hut or to close the plant and then sell it in liquidation.

UK

The situation with Liberty’s British assets remains in limbo. In May, the specialty steel producer Liberty Specialty Steels UK (SSUK) avoided a liquidation order through a potential sale to an unnamed buyer. The court postponed its final decision until July 16. According to The Guardian, Liberty Steel has not produced anything at its two key plants in the country – Rotherham (South Yorkshire) and Motherwell (Scotland) – since July 2024 due to a lack of funds to purchase materials.

According to the publication, SSUK operates an electric arc furnace in Rotherham, a related plant in Stokesbridge and two other assets. The business owes £619 million to creditors, including £289 million to related GFG companies and £289 million to Greensill administrators. In April, a hearing was held on the restructuring plan, at which all of Greensill’s creditors and more than three-quarters of the others opposed it.

The government is likely to face pressure to intervene in this case, following the example of British Steel in Scunthorpe. In May, a spokesperson for the Ministry of Business and Trade stated that the authorities were continuing to closely monitor the situation surrounding Liberty Steel, emphasizing that it was ultimately up to the company to make commercial decisions regarding the future of its assets.

| Enterprise | Rated power output | Products |

|---|---|---|

| Liberty Galați | 3 mln tons | Flat products, pipes, and organic-coated products |

| Huta Częstochowa | •700 ths tons – steel production •1.2 mln tons of heavy plates | Heavy plates, structural steel sheets |

| Dunaújváros | 1.6 mln tons - steel production, ≈ 2 mln tons – hot-rolled coil | Hot-rolled, cold-rolled and hot-dip galvanized coiled products |

| Liberty Ostrava | ≈3.6 mln tons | Long and flat products, machine building products, foundry products |

| Liège-Dudelange | 2.1 mln tons | Galvanized hot-dip galvanized coil, sheet, aluzinc |

| Liberty Steel UK | >1 million t – smelting of steel >2 million tonnes – rolling | Long products, flat products, special steels, semi-finished products |

A destructive strategy

Liberty Steel acquired most of its European assets from ArcelorMittal, which had pledged to sell them before buying the Italian Ilva plant. The deal, completed in 2019, formalized the acquisition of seven steel mills and five service centers in seven European countries for €740 million, including plants in Ostrava, Galati, rolling mills in Dudelange, and two plants near Liège. At the time, it was announced that this makes Liberty Steel one of the top ten producers in the world, excluding China.

Later, the Polish Huta Częstochowa and Hungarian Dunaffer were acquired. However, “assembling” the plants eventually became a path to decline.

Liberty Steel’s problems can be partly explained by the protracted crisis in the European steel industry caused by high energy prices, weak steel demand and financial difficulties, etc. On the other hand, the company’s business model was based on the acquisition of distressed assets that required large-scale capital investments for modernization. The strategy probably relied on attracting government funding. However, even government support did not help, as it is impossible to constantly subsidize operating losses.

Liberty Steel’s consolidation strategy has seriously damaged the European steel industry and set back viable businesses for years. In a number of cases, the company has pushed out other potential investors who could have really modernized the plants and given them a boost. Now, as practice shows, it will not be easy to find buyers for Liberty’s assets.