Posts Global Market Russia 426 21 May 2025

Russia was able to partially reorient steel supplies to Asia and MENA countries, but this reduced export margins

Western sanctions have failed to fully affect Russia’s resource exports. Russia has organized, with the help of other countries, large-scale schemes to circumvent trade restrictions. Against this background, the Russian authorities like to say that Western sanctions do not work, but the figures show that the Russian steel industry has largely felt the negative effect of Western pressure. Global steel market conditions were weak after 2022, and under sanctions, production and exports of steel products in Russia began to decline sharply.

Overall market conditions

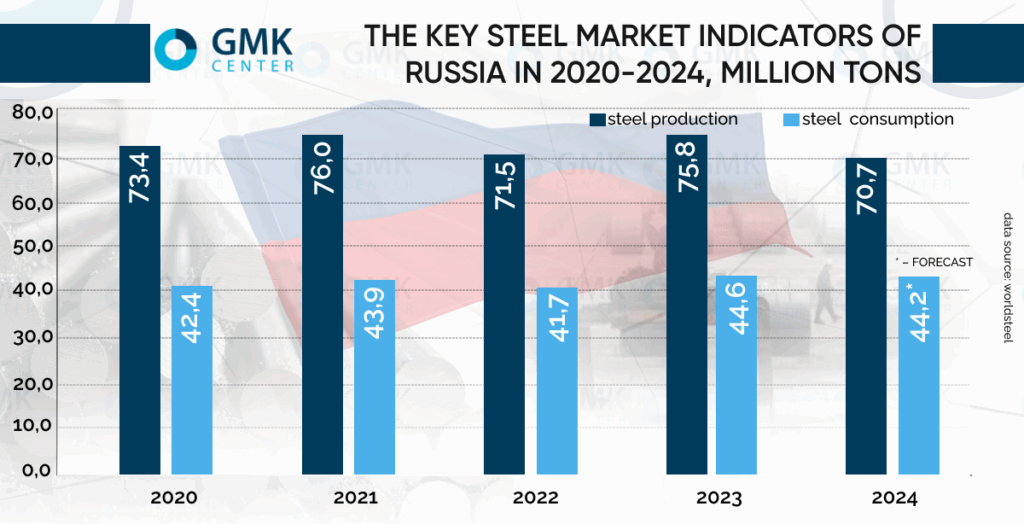

According to Worldsteel, steelmaking in Russia last year declined by 7% y/y – to 70.7 million tons. The largest steel companies reduced their steelmaking by 8-14%. The drop in indicators has become a stable trend, as the Russian steel industry did not show positive dynamics in annual terms in any of the months of last year.

We can say that the economic situation due to sanctions “caught up” with the Russian metallurgy for the second time: last year and in 2022, when steelmaking fell by 7.2% y/y to 71.5 mln tons – to 71.5 million tons. At the end of 2023, there was an increase of 5.6% y/y due to the redirection of exports of steel products.

According to various Russian sources, the main production indicators last year predictably went into “minus”:

- rolled steel products – by 7.2% y/y, to 59.9 mln tons;

- pipe products – by 6.3% y/y, to 12.8 mln tons;

- pig iron – by 5.5% YoY, to 51.2 mln tons.

The negative trend continued into 2025. According to Worldsteel, steelmaking in Russia in January-March decreased by 3.8% y/y – to 17.7 million tons. According to Russian sources, other industry indicators in Q1 also showed a decline:

- iron ore – by 6.6% y/y, to 26.9 mln tons;

- pig iron – by 4.5% y/y, to 12.9 mln tons;

- rolled steel – by 3% y/y, to 14.8 mln tons.

At the same time, steel pipe production rose to 2.8 million tons, 2.7% higher than in the same period in 2024.

A key problem in studying the Russian steel market and, in particular, exports is the closed nature of customs statistics. Therefore, quantitative estimates are based on various analytical studies and assessments, as well as on export statistics of Russia’s trading partners. At the same time, the data in different sources may not coincide with each other to a certain extent.

If we summarize the reasons for the drop in production volumes, the list of the main problems of the Russian metallurgy will look like this:

- Loss of part of external high-margin markets and forced dumping in exports. Sanctions of Western countries significantly limited exports of Russian steel products. This led to a reorientation towards the domestic market and the markets of “friendly” countries. At the same time, the practice of offering price discounts of 15-30% was used to expand presence.

- High key rate of the Central Bank (21%). This has an extremely negative impact on the dynamics of bank lending and investment and, as a consequence, restrains demand for steel products.

- Reduced demand for steel in the fuel and energy complex and construction sector, as well as the postponement of a number of infrastructure projects. The most sensitive reduction in consumption was recorded in construction (over 60% of demand for steel products), in particular due to the termination of the preferential mortgage program as of 01.07.2024. Transport infrastructure facilities remain the only driver.

- High inflation. It affects production costs at all stages of product creation, including growth in energy costs, labor costs, etc.

- Logistical difficulties. Sanctions-induced changes in logistics chains have led to an increase in transportation costs and delivery time.

- Increase in transaction risks and costs. Blocking of import payments leads to slower settlements with counterparties and increased commission expenses.

Overall picture of steel exports

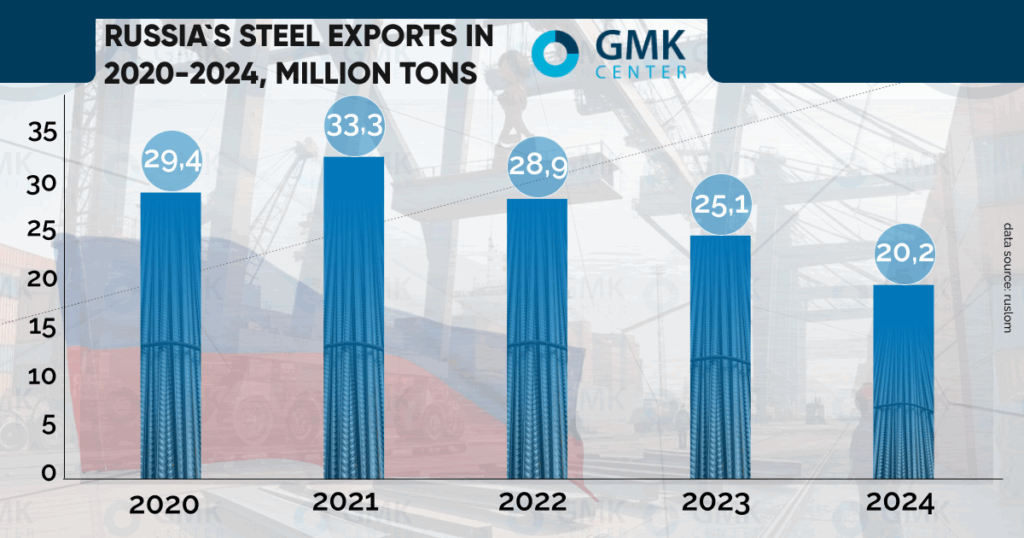

After the start of the full-scale invasion of Ukraine, the EU and the US imposed many different sanctions and restrictions against the Russian steel industry and limited the access of Russian products to their markets. Over the last two years, the volume of Russian steel exports has been expectedly declining.

According to Metaltorg, exports of steel semi-finished products in 2023 reached 13.8 million tons, down 16.6% year-on-year. Slabs retained the leading position in this segment with a share of over 63%. Finished steel exports in 2023 amounted to 8.9 million tons (-16.9%). The main decline was in flat rolled products, supplies of which decreased by 23.9%.

According to the Ministry of Industry and Trade of the Russian Federation, traditionally, about 40-45% of the total volume of steel produced was exported. However, in 2023, this figure dropped to 30-35% due to an increase in domestic demand and a reduction in imports of certain types of steel products. The share of exports is expected to decline further this year.

Full export statistics on the Russian steel market for 2024 are not available in open sources, but scattered analytical estimates clearly indicate a significant decline. According to Metals & Mining Intelligence, steel exports from Russia in the first nine months of 2024 fell by 22% y/y – to 14.1 million tons.

The Ruslom association estimates that Russian steel exports in 2024 will decline by 19.5% y/y – to 20.2 mln. Compared to 2021, the drop amounted to 39.4% or 13.1 mln tons. Last year, Russia’s pig iron exports fell by 19.4% y/y – to 2.9 million tons, and large-diameter pipes – more than four times, from 436,000 tons to less than 100,000 tons.

Deliveries to China and India

In the first year of large-scale sanctions, the Russian Federation partially reoriented its steel supplies to China after the loss of Western markets. For example, Russian shipments of semi-finished steel products to China tripled to 2.3 million tons in 2022.

However, subsequently, the importance of the Chinese market for Russian steelmakers began to decline sharply. Thus, in 2023, supplies of semi-finished products and pig iron decreased by almost 60% y/y – to 921 thousand tons and 157 thousand tons respectively.

According to the results of 2024, the situation deteriorated even more. Shipments of ferrous metals from Russia to China halved to 0.69 mln tons (-49%), or $754 mln (-21%). The share of Russia in the Chinese market in this segment almost halved to 3% (-2.5 pp).

Moreover, Russian steel exports in 2024 were constrained by the influx of cheap Chinese steel products to many regional markets, exports of which reached a local maximum of 111 million tons. The strengthening of Chinese exports puts pressure on prices, and given the high transaction costs and logistical difficulties, reduces the margins of Russian steel exports. The same factor will significantly limit Russian steel exports in 2025.

At the same time, iron ore supplies to the Chinese market remain quite significant without significant fluctuations – in 2021-2023 they were in the range of 8.5-9.7 million tons.

At the same time, one could expect Russian steelmakers to try to tap another major Asian market – India, which did not support Western sanctions and actively purchased oil from Russia. Although the supply of pig iron and semi-finished products from Russia to India in 2023 compared to 2022 increased by 5.3 and 2.3 times, but their total size – 318,000 tons and 127,000 tons – is not of key importance for Russia. Expensive logistics, export discounts and the fact that the Indian steel industry is quite self-sufficient will not make steel exports to India very important for Russia.

Exports to Turkey and MENA countries

Turkey became another market where Russian steel products supplies were partially reoriented. A short logistical shoulder and price dumping allowed Russia to increase exports of semi-finished products and pig iron to Turkey in 2022 by 2.1 and 1.7 times – to 3.4 million tons and 936 thousand tons, respectively.

However, in 2024, due to increased competition with Chinese steel and more complicated settlements, supplies of Russian semi-finished products to Turkey fell by 20% to 2.4 million tons, and hot-rolled products by 6% to 581 thousand tons. Russian pig iron exports to Turkey at the end of last year (936 thousand tons) remained virtually unchanged.

MENA countries (Middle East and North Africa) under sanctions pressure and redirection of exports failed to become significant steel consumers for Russia. Russia was able to increase only the supply of semi-finished steel products, which in 2022 increased 3-fold to 694 thousand tons, but at the end of 2023 exports decreased by 19% YoY to 562 thousand tons – to 562 thousand tons. At the same time, in 2022-2023, compared to 2021, export volumes of hot-rolled steel and iron ore decreased, while supplies of pig iron were already very insignificant.

Among the MENA countries, the largest consumers of steel products in 2023 were:

- pig iron – UAE (48 thousand tons) and Saudi Arabia (20 thousand tons);

- semi-finished steel products – Egypt (198 thousand tons);

- hot-rolled products – Egypt (163 thousand tons);

- iron ore – UAE (44 thousand tons).

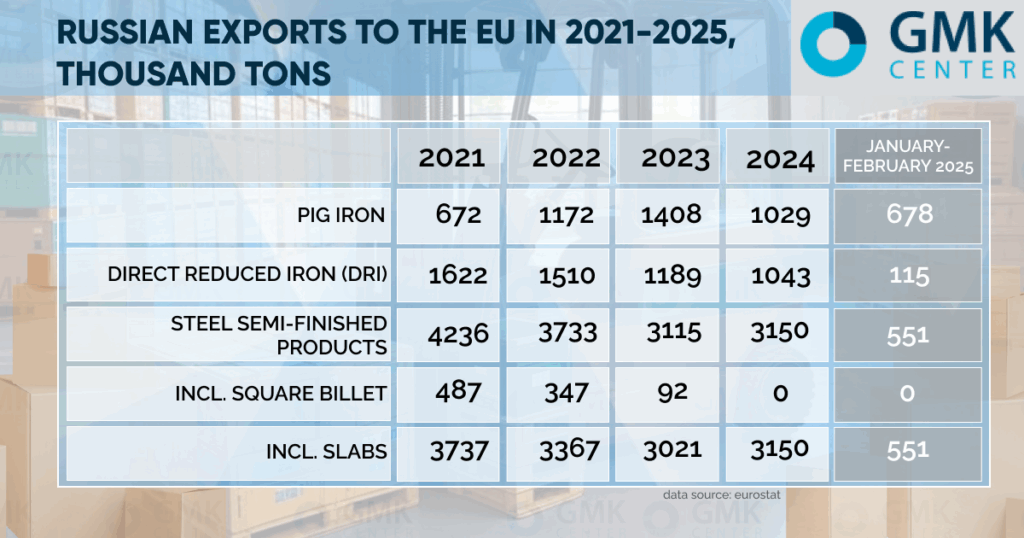

The EU is not giving up on Russian steel

Before the full-scale aggression against Ukraine, the EU was the key market for Russian iron and steel products. At the same time, the EU was one of the first to impose restrictions on imports of rolled steel products from Russia, as well as rebar, welded and seamless pipes. However, supplies of Russian semi-finished products and pig iron to the EU continued, although a quota regime is in place for them.

At the end of last year, Russian pig iron exports to the EU fell by 27% to 1.03 million tons, while supplies of slabs grew by 4.3% to 3.15 million tons. Last year the quota for Russian pig iron (1.14 million tons) was fully used by September. In 2025 it is 700 thousand tons.

In January-February 2025, the European Union has sharply increased imports of Russian metallurgical raw materials. The main volume falls on pig iron, import of which for two months amounted to 678.4 thousand tons (+8.7 times y/y). The annual quota for pig iron is close to exhaustion. The largest consumers of pig iron from Russia are Italy – 506.2 thousand tons, Latvia – 87.2 thousand tons and Belgium – 31.1 thousand tons.

Semifinished products also account for significant import volumes – 551.4 thousand tons (+16.2% y/y). The main volumes of these imports in January-February were directed to Belgium – 246.9 thousand tons (+74.4% y/y), Italy – 152.69 thousand tons (+18% y/y), and Denmark – 81.1 thousand tons (-14.8% y/y).

There is a separate situation with another initiator of sanctions – the USA. Until 2022 Russia supplied to the American market mainly pig iron and semi-finished products -2.1 mln tons and 1.2 mln tons by the end of 2021 respectively. Taking into account sanctions and high transportation costs, the current value of supplies of iron and steel products from Russia to the US market is minimal. From January to November 2024, imports of ferrous metals from Russia to the U.S. decreased 16 times to $12.6 million compared to the same period in 2023, aluminum – 19 times to $2.3 million. Supplies of metal ores for the same period amounted to only $872 thousand.

Export conclusions

The dynamics of Russian steel exports to major regional markets is multidirectional. The reorientation of exports to new markets in Asia, the Middle East and Africa did not compensate for the losses in volumes and margins. Moreover, due to the lengthening of export routes, logistics costs increased, while attracting buyers in 2022-2023 was accompanied by discounts of 15-30%. According to Russian estimates, by the end of 2022 sanctions affected exports of 3.9 million tons of finished steel products, 700 thousand tons of semi-finished products and 200 thousand tons of pipes.

In addition, if in 2022-2023 the reorientation to Asian and Middle Eastern markets together with price discounts gave certain results, in 2024 the competition with cheap Chinese steel sharply intensified.

However, despite the sanctions restrictions, Russian steel exports remain significant, mainly due to demand in countries that did not impose them and the absence of a complete ban on imports of Russian semi-finished products in the EU. An additional supporting factor for exports was the dumping of steel products, which made them more attractive to buyers.

On the other hand, due to the prolonged decline in demand and prices for steel products globally, the domestic market of the Russian Federation is becoming even more marginal for steelmakers, especially given the current strengthening of the ruble. Currently, domestic steel prices in Russia exceed global prices by about 15% compared to the average of 4%.

Steel expectations

It is most likely that the negative trend of steel production decline will continue in 2025. In the first three months of 2025, steel consumption in Russia declined by 13% y/y. The Russian domestic market now shows no growth potential in the near term.

The most optimistic scenario is that steel production in Russia will reach the level of 2024, while the worst scenario is that the decline will continue. The Russian Steel Association predicts for 2025 a decline in visible steel consumption by another 6% y/y (2024 – 5.6% y/y) and a decline in exports by 2.5% y/y.

In its turn, the Ministry of Economic Development of the Russian Federation envisioned in the baseline scenario the growth of steel production in 2025 by 1.3% y/y and metal ore mining by 2.3% y/y. However, these are very relative forecasts, as by the end of 2024 the Ministry expected growth in metallurgy by 0.4% y/y, while in reality everything was much worse (-7% y/y).

The state of the industry will be largely determined by the trajectory of the CBR key rate. It is expected that the rate will remain at a high level throughout the entire period, and even at the beginning of the downward cycle, the situation in metallurgy may not improve significantly with a lag of a quarter or more.

However, the situation in the Russian steel industry depends largely on geopolitics – namely, on the speed and nature of agreements with Ukraine, the EU and separately between Russia and the US. In any case, the return of Russian rolled steel to European markets in the near future looks unlikely.