Posts Global Market steel import 1519 03 June 2025

By the end of 2025 the share of Turkish steel may exceed 60% of imports in Ukraine

Since the start of the full-scale invasion, steel imports into Ukraine have increased significantly. Initially, this surge was driven by the need to compensate for shortages caused by the loss of 40% of domestic steelmaking capacity and a number of essential steel products. However, in 2024, these imports began to show signs of market dominance. For example, the share of steel products imported from Turkey rose from 17.8% of total Ukrainian steel imports in pre-war 2021 to 51.5% in 2024. If the current trend continues, this figure could exceed 60% by the end of this year.

Turkish wave

In 2022, due to the consequences of the war in Ukraine, there was a shortage of certain types of steel products, which allowed Turkish rolled steel to partially fill the supply gaps. This was facilitated by convenient logistics and the need for Turkish producers to look for new markets in the face of stagnant domestic consumption. Since February 2022, Ukraine has turned from a net exporter to a net importer of steel products from Turkey.

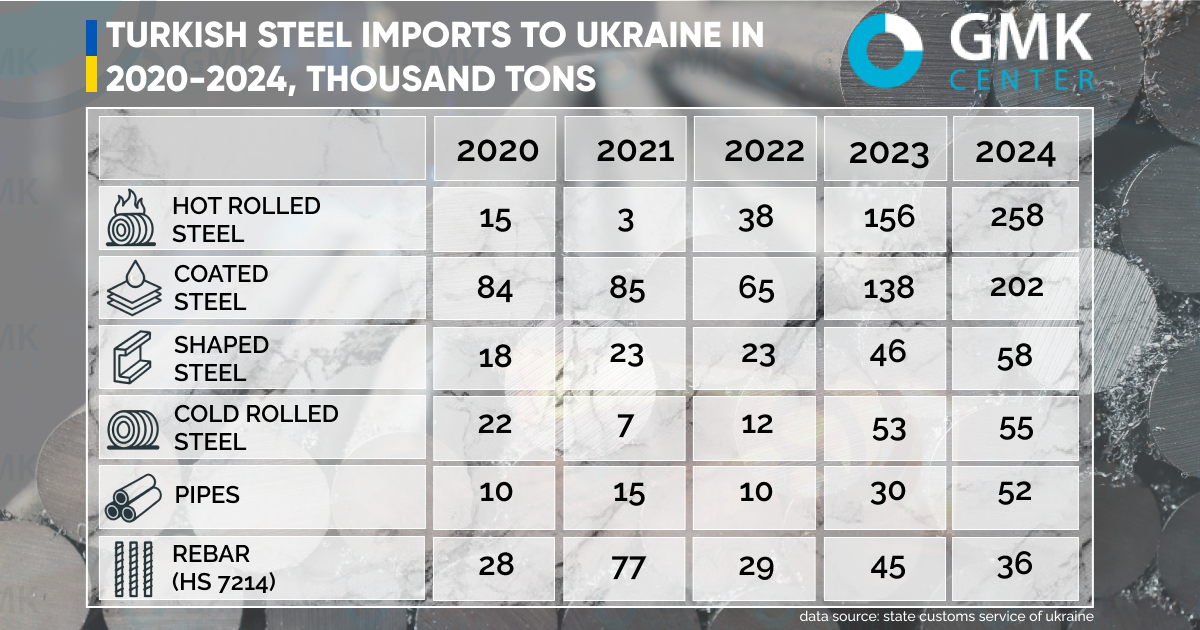

In 2024 compared to pre-war 2021, Turkey sharply increased supplies to the Ukrainian market of such steel products:

- hot-rolled coils – 80 times, from 3 thousand tons in 2021 to 258 thousand tons in 2024;

- cold-rolled coils – 8 times, from 7 thousand tons to 55 thousand tons;

- pipes – 3.5 times, from 15 thousand tons to 52 thousand tons;

- shaped rolled products – 2.5 times, from 23 thousand tons to 58 thousand tons;

- coated sheets – 2.4 times, from 85 thousand tons to 202 thousand tons.

“We work with rolled steel products of construction grade. After 2022, imports of hot-rolled sheet products in thicknesses of 10-30 mm increased sharply, and now this segment is 90% filled with cheap Turkish products, which are directed to the construction sector, production of steel structures, etc. Also actively, but in smaller volumes than steel sheets, profile pipes, beams, angles, etc. are imported to Ukraine from Turkey”, says Vitaliy Pritula, CEO of the company Evrometal, which specializes in the import of rolled steel products.

The trend of increasing Turkish imports continued in 2025. In January-April of this year compared to the same period of 2024, the growth in certain types of steel products amounted to:

- pipes – by 92%, up to 16 thousand tons;

- rebar (code 7214) – by 87%, up to 11 thousand tons;

- hot-rolled coils – by 82%, up to 112 thousand tons;

- shaped rolled products – by 81%, up to 25 thousand tons;

- coated sheets – by 65%, to 79 thousand tons.

- cold-rolled coils – by 25%, up to 24 thousand tons.

Ukraine also imports wire rod (8 thousand tons in 2024), corrosion-resistant rolled products (5 thousand tons) and wire (4 thousand tons) from Turkey. These imports have increased several times since the beginning of the war.

Since the beginning of the full-scale war, the share of Turkish rolled steel in the Ukrainian market has grown 3 times. In 2024 Turkish steel imports amounted to about 52% of total imports. This year this figure may exceed 60%, as for January-April the share already amounted to 57%.

Additionally, in 2024, Turkish steel products accounted for 23% of Ukraine’s total steel consumption. These figures allow us to talk about the high dependence of our market on imports of Turkish steel.

According to the last year results, Turkish steel products in certain positions occupied the following market shares in the total consumption in Ukraine:

- galvanized steel sheets – 46% (according to Metipol);

- shaped rolled products – 36.5%;

- hot-rolled coils – 28.9.3%;

- cold-rolled coils – 22.5%;

- rebar – 5.4%.

“The main advantage of Turkish rolled steel is the price. The price difference with European rolled steel can be up to 20%. At the same time, the qualitative characteristics of Turkish steel products are quite high, and in the absolute majority of cases they are almost as good as their European counterparts,” says Vitaliy Pritula.

New format of trade

Further economic cooperation between Ukraine and Turkey is expected to develop within the framework of the Free Trade Zone (FTZ), which has been under negotiation for the past 15 years. The agreement was signed on February 3, 2022. Turkey completed ratification on August 1, 2024, but the Verkhovna Rada of Ukraine has not yet considered the relevant draft law.

The agreement stipulates that Turkey will eliminate tariffs on 93.4% of industrial goods and 7.6% of agricultural products, with an additional 1.5% of industrial goods and 28.5% of agricultural products to become duty-free after transitional periods of 3 to 7 years.

Ukraine, for its part, will cancel import duties for about 56% of industrial and 11.5% of agricultural products. After the end of the transitional periods (2-10 years) Ukraine will cancel duties for another 43.2% of industrial goods and 53.7% of agricultural products.

The key achievement is that no additional increased duties above the maximum level set under the terms of Turkey’s WTO membership will be applied to Ukrainian goods. However, there is an exception – steel products, for 167 items of which quotas are set (not less than 411 thousand tons).

It is expected that the agreement will increase trade turnover to $10 bln and will contribute to the GDP growth of Ukraine by 2.2%. It should be noted that in 2021, Ukraine’s trade turnover with Turkey amounted to more than $7.4bn, but last year it fell to $6.4bn. At the same time, Ukrainian business is less optimistic about the terms of the FTZ. The light industry, cement production, mechanical engineering and other sectors are among those potentially affected.

The Ukrainian market will become more open for Turkish products. The total nominal export duty rate in Turkey for Ukrainian goods under the FTZ will be 10%, while the Ukrainian rate will be only 0.5%.

The agreement includes special protection mechanism that allows Ukraine to apply protective duties in case of a sharp increase in Turkish imports if it harms national producers.

“The most realistic and effective tool remains the application of anti-dumping measures. A national manufacturer will be able to appeal to the Ministry of Economy with a complaint on a specific product. As part of the investigation, if there is enough evidence, the Ministry will determine the anti-dumping margin and the margin of harm, and propose to the Interdepartmental Commission on International Trade (ITCM) to apply the lowest of these indicators, after which anti-dumping duties can be applied,” Alyona Omelchenko, head of international trade practice at Ilyashev & Partners law firm, told GMK Center in a commentary.

In addition, the agreement includes the possibility of introducing bilateral protective measures in case of increased imports from Turkey. However, their level cannot exceed the level that existed before the agreement came into force.

It is logical to assume that the observed growth of imports from Turkey cannot remain unnoticed by Ukrainian state authorities. Turkish producers operate in completely different conditions than Ukrainian ones. Turkey has not imposed any restrictions against Russia, so Turkish companies can easily import Russian raw materials and semi-finished products, thus reducing their own production costs.

The production costs of Ukrainian companies, on the contrary, have increased. This is also due to the shutdown of Pokrovskvugillia at the beginning of the year. Ukrainian steel producers have to import coking coal, which additionally complicates competition with steel imports.

The current market situation is a direct consequence of the Russian military aggression, which destroyed Ukrainian steel facilities. At the same time, Russia continues to supply to the market the products that Ukraine could supply before the war. Russian producers, continuing to supply international markets, benefit economically from the consequences of the war and allow other companies to strengthen their competitiveness.

Russian footprint

A possible scenario is the tightening of sanctions following the example of the European Union, which imposed restrictions on imports of products from third countries manufactured using materials from Russia. As part of the eighth sanctions package, which took effect on September 30, 2023, the EU expanded existing restrictions on steel imports by extending the ban to include products manufactured in third countries using Russian steel.

As part of the 11th package of sanctions, the EU further tightened restrictions on imports of steel products. Companies supplying sanctioned steel products to the EU will have to additionally provide evidence that the raw materials used for production were not sourced from Russia.

Large volumes of Turkish steel are made using Russian steel raw materials. According to UN Comtrade, Russian pig iron exports to Turkey increased from 539,000 tons in 2021 to 935,000-945,000 tons in 2022-2024. At the same time, exports of semi-finished steel products from Russia to Turkey also increased, remaining at a stable high level of 2.4-3.4 million tons in 2022-2024. After the imposition of Western sanctions in 2022, Russia exported its steel products at a significant discount, which strengthened the competitiveness of Turkish producers.

Ukraine may consider a mechanism of trade restrictions on goods produced using Russian raw materials, similar to the European one. Moreover, its absence in our country looks illogical, because the Ukrainian authorities insisted the European Union to impose a ban on imports from third countries of products made with Russian materials. However, we do not yet have such a mechanism in Ukraine.

“There is still no effective legal mechanism to restrict such imports. Theoretically, Ukraine could respond to such products, but in practice it is necessary to develop a special legal instrument for this purpose. We are talking, first of all, about the introduction of a clear customs mechanism that allows tracking the origin of raw materials in the composition of finished products. This is a complex task that requires interdepartmental coordination and legislative regulation,” says Alyona Omelchenko.

At the same time, Ukraine needs to do everything possible to ensure that Ukrainian legislation and trade policy correlate with the relevant EU norms. This is especially important in light of the upcoming negotiations on Ukraine’s accession to the EU.

Conclusions

Currently, Ukraine has trade restrictions against such products from Turkey as cement, radiators for heating, fresh cucumbers and tomatoes, fittings for water supply and heating, etc. At the same time, increasing steel imports to Ukraine creates unequal competetive conditions for national producers, who cannot compete with Turkish companies, whose products are made using cheap Russian raw materials and semi-finished products.

Turkish steel products are direct competitors of many Ukrainian producers, among them:

- Zaporizhstal – in terms of hot-rolled and cold-rolled sheets;

- Kametstal – shaped rolled products, rebar;

- ArcelorMittal Kryvyi Rih – rebar, wire rod, shapes;

- Interpipe – electric-welded pipes;

- DMZ – rolled shapes (channel, angle);

- Metipol – galvanized and painted sheets.

According to some reports, certain producers have already begun raising concerns at the official level about the dominance of Turkish steel products in the Ukrainian market and alleged dumping practices by Turkish suppliers

An important question is to what extent Turkish product prices align with market-based pricing principles, especially given the potential use of Russian raw materials and semi-finished products supplied at below-market rates. The answer to this question can be found by conducting a special trade investigation, the rules of which are established by WTO norms and Ukrainian legislation. Based on the results of such an investigation, it will be possible to draw conclusions on whether Turkish imports pose a threat to local producers and whether any response measures are necessary.

“We are not saying that a duty should be imposed on all goods, for example, from China. We have to analyze what exactly goods are produced in Ukraine, whether these goods can completely cover the needs of the market. We are talking about a mechanism that would help Ukrainian producers to survive in this extremely difficult time”, said Alyona Omelchenko during her speech at the conference ‘Trade Wars: The Art of Defense’.

Anti-dumping measures are the most effective, but there is an important nuance. As practice shows, from the moment of filing an application to the direct imposition of anti-dumping duties takes 1.5-2 years, during which time a national producer may go bankrupt or leave the market altogether. To avoid this, it is necessary to shorten the duration of investigations, as the European Union has already done, to organize more frequent meetings of the ITCM, and to introduce a transparent procedure of price commitments.

If necessary, Ukraine can impose bans on any products. According to Article XXI of the GATT (General Agreement on Tariffs and Trade), state may impose trade restrictions for reasons of national security in times of war or other force majeure. However, this option has never been exercised during the three years of war.

For their part, the authorities are ready to continue to protect national producers, but the solution to all existing problems with access of imported products to the Ukrainian market is hardly possible.

“The government is ready to be more proactive in imposing restrictions or self-restrictions necessary for the development of the Ukrainian economy. But these actions will be rather pinpointed – on specific goods”, said Deputy Minister of Economy – Trade Representative of Ukraine Taras Kachka during his speech at the conference ‘Trade Wars: The Art of Defense’.

The introduction of trade restrictions against certain countries can provide significant assistance to the Ukrainian economy and the state budget already at the stage of the country’s post-war economic recovery.

“If at the stage of post-war recovery we do not control localization in construction products and works, there is a great chance that it will not have a significant effect on the Ukrainian economy and state budget. Therefore, the recovery process requires the maximum use of Ukrainian resources,” – emphasized the head of the Ukrcement association Pavlo Kachur during his speech at the conference ‘Trade wars: the art of defense’.