Posts Global Market hot-rolled prices 218 03 July 2025

European mills were forced to make concessions in an attempt to fill their order books

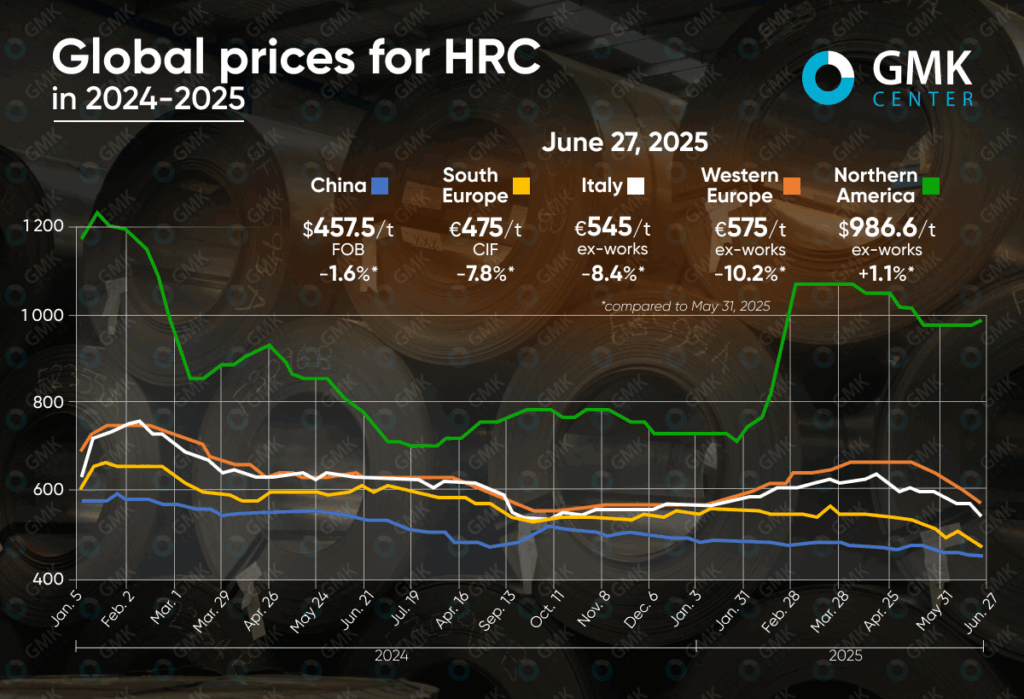

In June 2025, there was an imbalance in the hot-rolled coil market. In the US, domestic producers managed to raise prices thanks to Trump’s tariffs. In China and the European Union, however, the market remained weak: low consumer activity, inventory buildup, and fierce competition forced sellers to lower their prices. Despite slight signs of stabilization at the end of the month, the overall mood in the market remained cautious.

Europe

Prices for hot-rolled coil (HRC) in Europe declined during June. In particular, offers in Western Europe fell by 10.2% to €575/t ex-works, import prices in Southern Europe fell to €475/t CIF (-7.8%), and in Italy to €545/t ex-works.

Throughout June, the hot-rolled coil market in the EU was under pressure from weak demand and aggressive competition from importers. Service centers and re-rollers refrained from purchasing amid high warehouse stocks and low end-user activity. Additional pressure was caused by offers of imported HRC from Turkey, North Africa, and Asia at prices ranging from €460/t to €520/t CFR, which is significantly lower than the level of the intra-European market.

Domestic producers, trying to maintain sales volumes, reduced prices to €570/t and below. Although higher levels were officially announced – up to €640/t – actual deals were concluded with significant discounts. Italian mills showed the greatest flexibility, seeking to compete with imports and maintain capacity utilization.

Despite the overall weakness of the market, there were signs of stabilization at the end of June: some buyers regained interest in purchases, believing that prices had bottomed out. Confidence in further price growth is also growing, given the planned introduction of the Carbon Border Adjustment Mechanism (CBAM) from 2026. CBAM is expected to make Asian imports less attractive and strengthen the position of European suppliers in the second half of the year.

USA

Prices for hot-rolled coil in the US rose in June. As of June 27, 2025, prices for products in North America increased by 1.1% compared to the end of May, to $986.6/t ex-works.

The basis for the growth of domestic prices in the US was a political initiative – the doubling of import duties on steel under Section 232 to 50%, announced by the Donald Trump administration. This step significantly changed the market sentiment: despite weak demand, domestic producers began to gradually raise prices. In particular, Nucor raised its spot base price three times in June, bringing it to $910 per short ton.

Market participants reported growing interest in purchases, but there was no rush. Most customers remain cautious: consumption in key sectors remains weak. At the same time, short delivery times and high capacity utilization indicate that there is no structural shortage.

The price increase was accompanied by the gradual disappearance of discount deals on the spot market, indicating a strengthening of producers’ positions. Some mills, such as Cleveland-Cliffs, announced even higher price levels in an attempt to establish a new price range. However, most market players agree that significant price increases are only possible after demand stabilizes, which is expected after the US Independence Day celebrations on July 4.

China

Hot-rolled coil prices in China fell by 1.6% in June to $475.5/t FOB.

In June, the Chinese hot-rolled coil market was under pressure from weak domestic demand, excess inventories, and low export activity. Despite minor fluctuations in the futures market and brief periods of stabilization, the overall price trend remained negative, especially in the export segment, where traders were forced to lower prices to maintain sales volumes.

The fundamental reasons for the decline were weak macroeconomic indicators: the PMI index for May pointed to a further decline in manufacturing activity, especially among medium-sized enterprises. In response, steel mills, including Baosteel, kept their domestic prices unchanged for the fourth month in a row, reflecting their caution in an unstable market.

In the export market, competition intensified not only due to oversupply, but also due to the emergence of aggressive new traders offering unprecedentedly flexible terms, including 90-120-day payment deferrals. This practice caused concern among more traditional exporters and pushed the market toward even deeper discounts. At the same time, demand in key regions, particularly the Middle East, declined due to geopolitical tensions.

In the second half of June, the situation stabilized somewhat, and domestic prices even rose slightly, but the overall market remained oversaturated. Participants do not expect a significant improvement in the situation in July, as this is traditionally a dead season in China.