Posts Global Market steel import 5253 18 March 2025

Forecasts for consumption sectors are favorable, but protective measures may worsen supply statistics

The EU steel market has a pronounced dependence on imports. In 2024, approximately every third tonne of rolled products sold here was produced outside the EU. To withstand competition, foreign suppliers have to set a lower price. This complicates life for European steelmakers, but allows sectors that generate demand for steel to develop. Among them, the automotive industry and construction stand out. The European Commission, as a regulator, is forced to find a balance between the directly opposing interests of producers and consumers.

Growth of imports and Brussels’ response

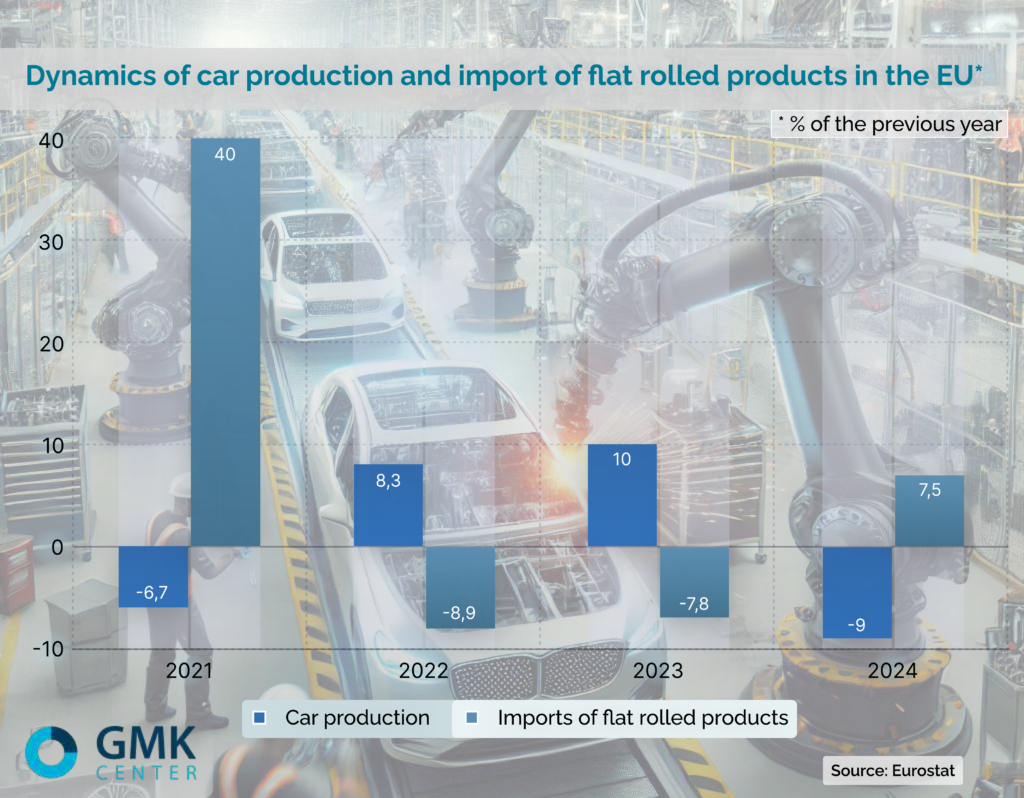

According to the results of 2024, steel imports to the EU increased by 3.7%, to 28.9 million tonnes. The most significant increase, by 7.5%, or 1.5 million tonnes, was noted in the flat rolled products segment. Ukrainian metallurgists also slightly improved their position due to European sales. In terms of volumes of deliveries to the EU, they took 7th place. At the same time, the expansion of imports was not supported by domestic demand. The European auto industry, the main consumer, reduced production by 9% last year, to 13 million units. This means increased pressure from foreign supply on the pricing policy of local rollers. The same situation was observed in 2022.

In January-February of this year, imports of flat rolled products fell by 8%, according to World Steel Dynamics. At the same time, in February there was a real collapse, by 26% in annual comparison.

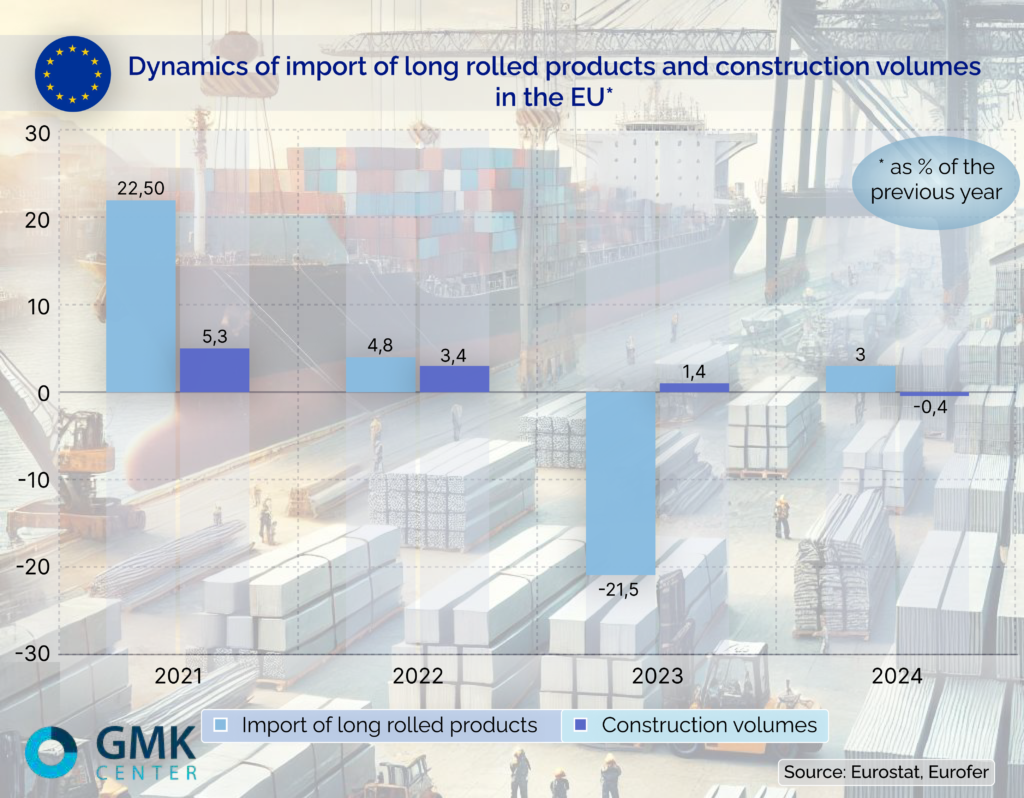

In the segment of long rolled products, the dynamics of imports are closer to market realities. Projects in the civil sector, financed from the European budget as part of counteracting the “covid” crisis, gave a good start to the construction industry in the early 2020s. Manufacturers of long products and rebar outside the EU tried not to miss the favorable moment. But when the growth rate began to fade, they, too, accordingly reduced shipments to the European market.

The past year, however, was marked by a slight increase in foreign supplies of long rolled products, against the backdrop of an ongoing decline in the EU construction industry as a whole. Given the favorable forecasts for steel consumption for the current year, there were no particular reasons for tightening the conditions for steel imports.

But official Brussels nevertheless met the wishes of Eurometallurgists in connection with the introduction of a 25% duty on the import of all types of metal products to the United States. According to the Eurofer association, this measure is capable of redirecting additional export flows to the European market.

In response to this, the European Commission on March 11 announced the results of the revision of protective measures regarding the import of finished steel, which began on December 17, 2024.

What has changed?

– The duty-free import quota limit for hot-rolled coil for all countries in the «other countries» category has been reduced from 15% to 13% of annual imports.

– The option to transfer unused quota volume to the next quarter has disappeared for a number of products. These are hot-rolled and cold-rolled coil, thick sheet and wire rod.

– Only 35% of the quota previously allocated to Russia will be redistributed among other countries.

This decision may affect the market in terms of redistribution of shares between suppliers and even the formation of a supply deficit for certain types of products, believes GMK Center analyst Andrey Glushchenko.

«This will especially affect galvanized sheet metal, where Vietnam’s share in the «other countries» quota reached 80% (under the new rules, the share of one supplier will be limited to 20-25% depending on the type of product). Therefore, galvanized imports may decrease significantly,» the expert predicts.

Earlier, GMK Center chief analyst Andrey Tarasenko noted that the current 15% limit on the share of one country within the quota of other countries in the hot-rolled coil segment did not produce the effect that the European Commission expected. Nevertheless, flat-rolled steel imports to the EU in 2025 may decrease by 15% as a result of the innovations.

WSD predicts that for this reason, already in the second quarter, foreign supplies of sheet and coil will decrease by 1.4 million tons, or 25% in annual comparison. In relation to the previous quarter, the decline will not be so deep: by 10%, or 0.5 million tons.

Problems in the main consumption sectors

The situation in the European auto industry can hardly be called favorable. In the third quarter of 2024, car production decreased by 12.1%. But at the same time, new car sales increased by 0.8%, to 10.6 million units. This means an expansion of the share of auto imports. The European Commission itself created favorable conditions for foreign competitors with its decisions within the framework of climate policy.

In order to sell more electric vehicles, European concerns are forced to raise prices for cars with internal combustion engines. And this is exactly what foreign importers need, especially Chinese ones – not bound by “green” liabilities.

As a result, a decrease in production volumes and the closure of entire auto plants in the European Union. At the end of October last year, Volkswagen announced the closure of three plants in Germany, Audi stopped production at a plant in Belgium. In January 2025, car production in the EU fell by 5.5% y/y.

The construction industry is another “headache” of the European economy. For the last three years, construction in the EU has been on a downward trend. It is being pulled down by the housing sector. Last year, volumes here were the lowest since 2015.

Among the reasons are the high rates of the European Central Bank. This narrows the ability of the banking system to finance housing affordability programs. Plus the rising cost of building materials caused by the rise in electricity prices. At the beginning of 2025, it cost about 20% more in the EU than a year earlier.

The decline in European mechanical engineering in 2024 was 6.8%. In Germany, the engineering center of the EU, new orders fell by 8%.

What’s next?

The Eurofer Association expects visible steel consumption to grow by 2.2% in 2025. In particular, due to an increase in auto production by 2.1%. «A step in the right direction» was the postponement of the entry into force of new requirements for auto emissions: from January 1, 2025 to January 1, 2028.

The Battery Booster program will be an additional incentive for electric cars in the EU. Within its framework, €1.8 billion from the European budget will be allocated to support the production of car batteries. This aid package was announced on March 3. The decisions themselves are planned to be officially published before the end of the month.

The German IFO Institute predicts a further decline in the EU housing construction sector this year by 5.5%, to 1.5 million units. But in the construction industry as a whole, the volume of work will grow by 1.1%, according to Eurofer estimates.

The energy sector may become one of the drivers. According to WindEurope, 30 GW of new wind power plants need to be commissioned annually in the EU to meet its climate targets by 2030.

In Germany, 63% of mechanical engineering companies do not expect a significant recovery in production volumes over the next 3-6 months due to weak new orders, according to a survey by the German association VDMA.

The ECB’s decision of March 6 will help support demand for new cars and housing in 2025. The regulator reduced the base rate for marginal loans by 25 bp to 2.9%. However, this is a very cautious reduction. Further monetary policy measures are needed for real stimulation.

At the same time, the weakening of the exchange rate from €1.04 to €1.09 against the US dollar has actually reduced the cost of raw materials and energy in the EU by 5%, according to WSD calculations. This makes the products of local manufacturers, including metallurgists, more competitive. Both in foreign markets and domestically, complicating sales to importers.