Posts Global Market hot-rolled prices 1528 05 June 2025

The negative dynamics is due to seasonal factors, trade uncertainty and weakened demand

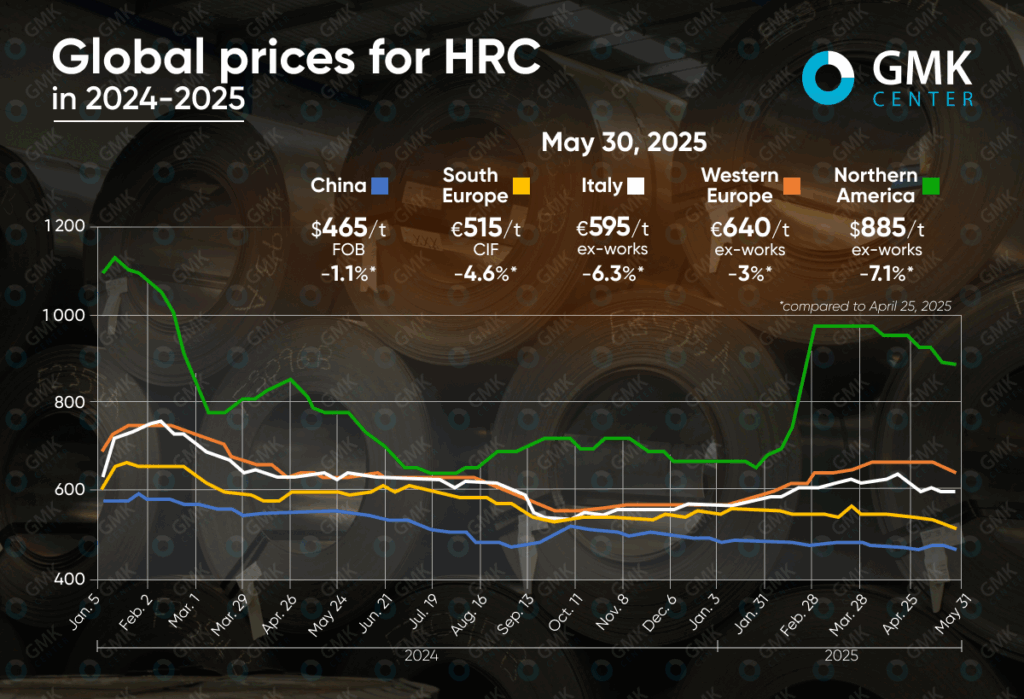

In May 2025, the hot-rolled coil market in Europe, the US and China showed a general downward trend in prices. In Europe, the decline was driven by weak demand and pressure from cheaper imports, especially in the Southern region. The US saw a sharp decline in prices amid falling demand and negative dynamics in scrap prices. The Chinese market was also under pressure due to conflicting factors, ending the month at the lowest price levels since 2020.

Europe

In May 2025, the European hot rolled coil (HRC) market continued to experience a downward price trend amid weak demand, increased price pressure from imports and cautious purchasing activity. In Western Europe, the average price decreased by 3% m/m – to €640/t ex-works, while in Italy the decline was the deepest – by 6.3% to €595/t ex-works. Import offers in Southern Europe fell by 4.6% m/m – to €515/t CIF, the lowest level since November 2020.

The downward trend was formed despite the efforts of producers to stabilize prices, especially against the backdrop of contract negotiations with large OEMs (equipment manufacturers). Mills, particularly in Germany and France, tried to keep spot prices at €650-670/t, but actual deals were increasingly made with concessions. Pressure from imports was particularly noticeable: offers from Turkey and India amounted to €520-560/t CIF with customs clearance, which is significantly cheaper than European quotations. In Italy, where the market was particularly sensitive to price changes, service centers chose a wait-and-see attitude, considering purchases at current prices premature.

European demand remained sluggish. In Spain and Portugal, price cuts did not stimulate real sales growth. In Italy, buyers were working with inventories, and the market was virtually stagnant. Lower rental prices also reduced the margins of service centers, forcing them to focus on cheaper imports.

Import activity, although picking up, was accompanied by concerns about the quality of products from some Asian countries, as well as uncertainty around quotas and the upcoming review of safeguard measures. Despite a significant gap between import prices and European offers (up to €160/t), not all market participants were ready to switch to new sources of supply.

In June, the market is expected to remain weak due to a seasonal slowdown, high inventories, and limited demand. Prices may continue to decline mildly, especially in Southern Europe. The focus is on preparations for the implementation of the CBAM in 2026, which is likely to stimulate additional import purchases in August-September, before the new rules come into effect.

USA

In the US market, supply of hot-rolled coils in May showed a sharp decline: the average price decreased by 7.1% m/m – to $885/t ex-works. The key factor was a combination of weak final demand, lower scrap prices and sluggish business activity after the panic buying period in March-April. Nucor has cut its official price for five consecutive weeks to $870/t, reflecting the general market trend.

Producers offered discounts to large consumers, which contributed to the formation of a wide range of prices – from $840 to $920/t. At the same time, traders observed a decline in the volume of real transactions: purchases were minimal, mostly only to cover current needs.

Additional pressure on prices was exerted by imports at prices below $800/t, although their volume decreased significantly compared to 2024. Fast delivery times (3-4 weeks for HRC) indicate excess production capacity and consumer reluctance to make speculative purchases. Despite some signals of a possible pickup in purchases in June, most market participants expect a further gradual decline in prices in the summer.

China

The hot-rolled coil market in China was under pressure from numerous conflicting factors, which led to a slight but still steady decline in prices – by 1.1% m/m, to $465/t FOB. This is the lowest level since July 2020.

The beginning of the month was marked by a drop in futures and a modest decline in spot prices, despite some support from local demand in Shanghai and Lekun. The export segment, on the other hand, showed weakness, with prices falling to $440-445/mt FOB, and some traders being forced to resort to aggressive pricing strategies.

Mid-May brought a short-term improvement amid a 90-day “trade thaw” between the US and China. This lifted domestic prices, but attempts to transfer this growth to exports failed as buyers abroad reacted with restraint.

Despite stable consumption volumes, by the end of the month market sentiment deteriorated on fears of a summer slowdown in demand. Prices went down again, reaching $442-445/mt FOB, which was a local low.

It is expected that in June the market will remain under pressure from the seasonal decline in demand, although a moderate decline in inventories and stable production may partially restrain further decline.