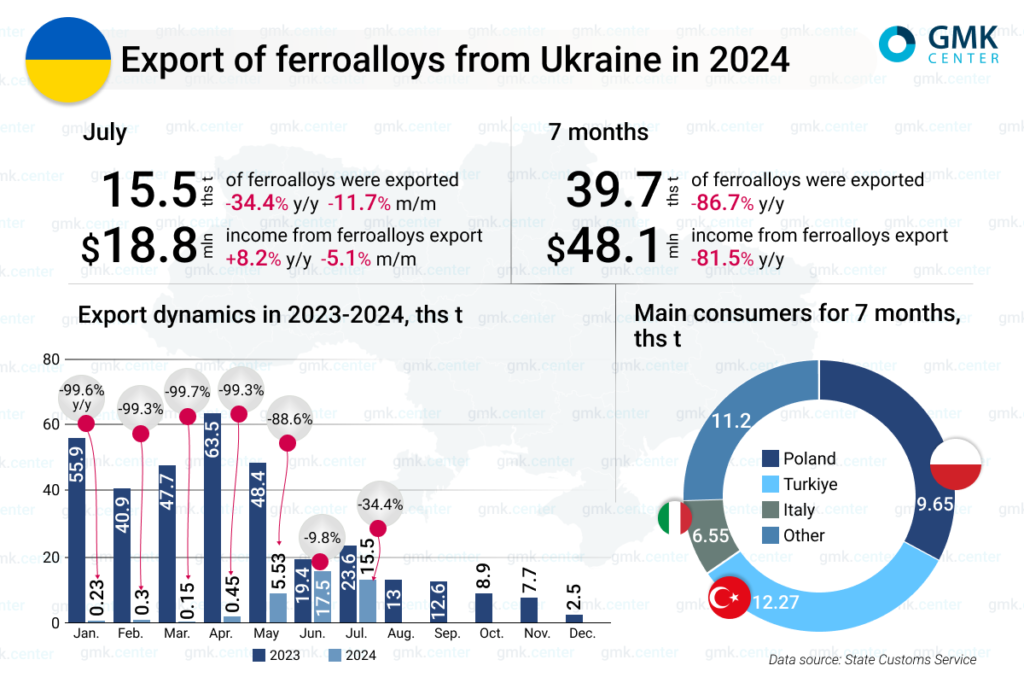

Shipments of ferroalloys are gradually recovering after the restart of some capacities, but are still down 86.7% y/y

In January-July 2024, the Ukrainian ferroalloy industry reduced exports by 86.7% compared to the same period in 2023, to 39.69 thousand tons (299.46 thousand tons in January-July 2023). This is evidenced by the data of the State Customs Service of Ukraine.

In July, Ukrainian producers exported 15.48 thousand tons of ferroalloys, down 11.7% month-on-month and 34.4% y/y. Export volumes declined month-on-month for the first time in 4 months.

In May-July, export shipments of ferroalloys from Ukraine began to approach last year’s figures, while in January-April, exports were on the verge of stopping, not exceeding 0.1-0.3 thousand tons.

The main consumers of the products are Poland – 9.65 thousand tons for 7 months, and 3.14 thousand tons (-30.2% m/m), Turkey – 12.27 thousand tons and 6.61 thousand tons (+16.8% m/m), respectively, as well as Italy – 6.55 thousand tons and 3.55 thousand tons (+18.2% m/m), respectively.

Ferroalloy shipments have resumed due to the partial reopening of Zaporizhzhia Ferroalloy Plant (ZFP) in May. As previously reported, the company is operating two furnaces, which is only 7% of its total capacity, and has no visible plans to increase its utilization. Since the end of June, the NPF has also been operating at a minimum level. Currently, the enterprises are working with the stocks of raw materials left over from last November and the electricity they can receive. Pokrovsk Mining, Marhanets Mining, and Pobuzhsky Ferronickel Plant (PFP) are idle.

At the same time, Ukraine’s heavy industry is facing many challenges, including a decline in demand for products, problems with energy supply, a shortage of personnel due to mobilization, etc. The ferroalloy industry is under particular pressure from high electricity tariffs and energy shortages, as the production of ferroalloys is an energy-intensive process.

In particular, on June 1, 2024, CMU Resolution No. 661 amended the Regulation on the Peculiarities of Electricity Imports under the Legal Regime of Martial Law in Ukraine, which obliges Ukrainian producers to buy at least 80% of electricity from the EU at the European price to avoid forced electricity supply restrictions. Previously, the mandatory share of imports was 30%.

This decision by the Ukrainian government could lead to numerous negative consequences for domestic energy-dependent industrial companies, especially iron ore producers and steelmakers. For example, the share of electricity in iron ore concentrate production is 60%, pellets – 32%, EAF steel products – 24%, BF-BOF – 3.5%.

The rise in electricity costs is leading to a sharp rise in production costs, making it uneconomic to continue production, and some mining and metals companies warn that this could lead to a complete shutdown. In general, the restriction of electricity supplies will inevitably lead to a significant decline in production and exports.

Revenue from ferroalloy exports in 7M2024 decreased by 81.5% y/y – to $48.13 million, and in July it fell by 8.2% y/y and 5.1% m/m – to $18.79 million.

As GMK Center reported earlier, in 2023, Ukraine’s production of ferroalloys decreased by 57.4% compared to 2022. Exports fell by 4.9% y/y – to 344.2 thousand tons. Compared to pre-war 2021, shipments of ferroalloys abroad decreased by 48.5%, or 324.4 thousand tons. Poland was the largest consumer of Ukrainian-made ferroalloys in 2023, accounting for 52.8% in monetary terms. Turkey accounted for 14.1% of export shipments and the Netherlands for 8.5%.

In 2024, according to Serhiy Kudryavtsev, executive director of the Ukrainian Ferroalloy Producers Association (UkrFA), the state of Ukraine’s ferroalloy industry will depend on three factors: shelling, logistics, and affordable electricity.