Key volumes of raw materials were sent to China, Slovakia and Poland

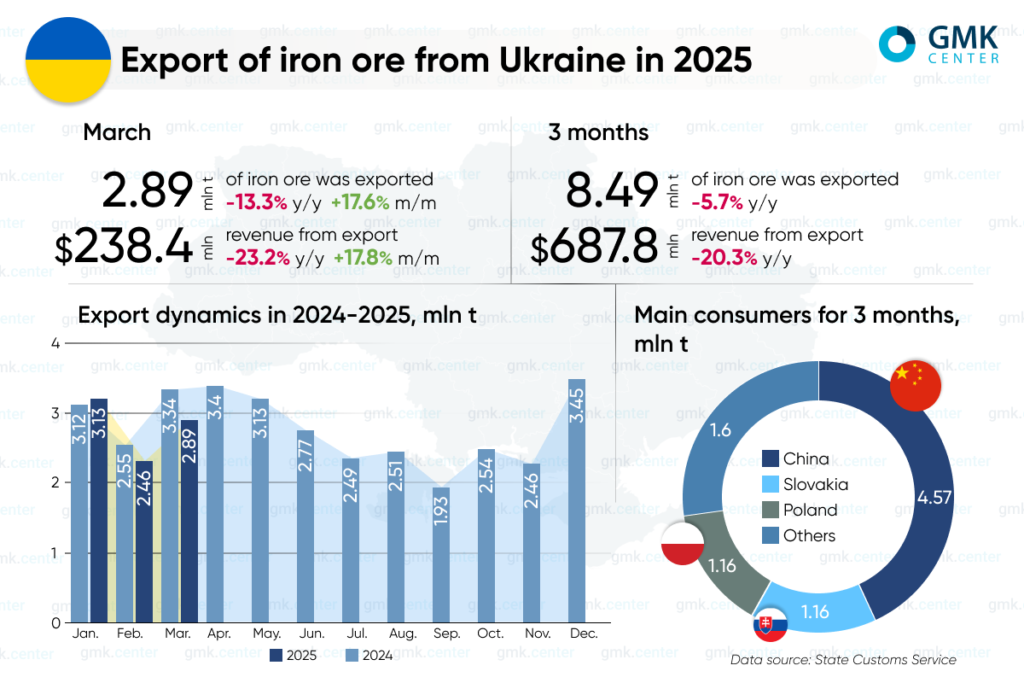

In January-March 2025, Ukraine’s mining industry reduced iron ore exports by 5.7% compared to the same period in 2024, but increased by 0.5% quarter-on-quarter to 8.49 million tons. This is according to GMK Center’s calculations based on data from the State Customs Service.

China is traditionally the largest consumer of Ukrainian iron ore. In Q1, shipments of raw materials to this country amounted to 4.57 million tons. Slovakia received 1.162 million tons and Poland 1.156 million tons.

In March, Ukraine exported 2.896 million tons of iron ore, up 17.6% month-on-month and 13.3% less by March 2024. During the month, 1.55 million tons (+19.2% m/m) of raw materials were exported to China, 492.26 thousand tons (+86% m/m) to Slovakia, and 340.25 thousand tons (-18.3% m/m) to Poland.

Revenues from iron ore exports in March amounted to $238.4 million (+17.8% m/m; -23.2% y/y), and in January-March – $687.79 million (-20.3% y/y).

Chinese quotations for low-grade Fe 58 ore rose to $91/t CFR Qingdao by April 2, compared to $89/t as of March 21. This was driven by strong demand due to the refusal of Chinese steel mills to carry out scheduled maintenance. At the same time, prices for high-grade ore remained stable at $117.04/t CFR for Fe 65 and $104/t CFR for Fe 62.

As GMK Center reported earlier, in 2024, Ukraine increased iron ore exports by 89.9% compared to 2023 – to 33.699 million tons. Shipments increased mainly due to the opening of the sea corridor in August 2023. Revenues from iron ore exports from Ukraine in 2024 amounted to $2.8 billion (+58.7% y/y).

The main producers of iron ore in Ukraine are Ingulets Mining, Kryvyi Rih Iron Ore Enrichment Plant, Poltava Mining, Yeristovo Mining, Northern Mining, Central Mining, Southern Mining, ArcelorMittal Kryvyi Rih, Sukha Balka, and Rudomine.