News Industry flat rolled steel 2383 28 February 2024

During the month, Ukrainian consumers imported 71.44 thousand tons of relevant products

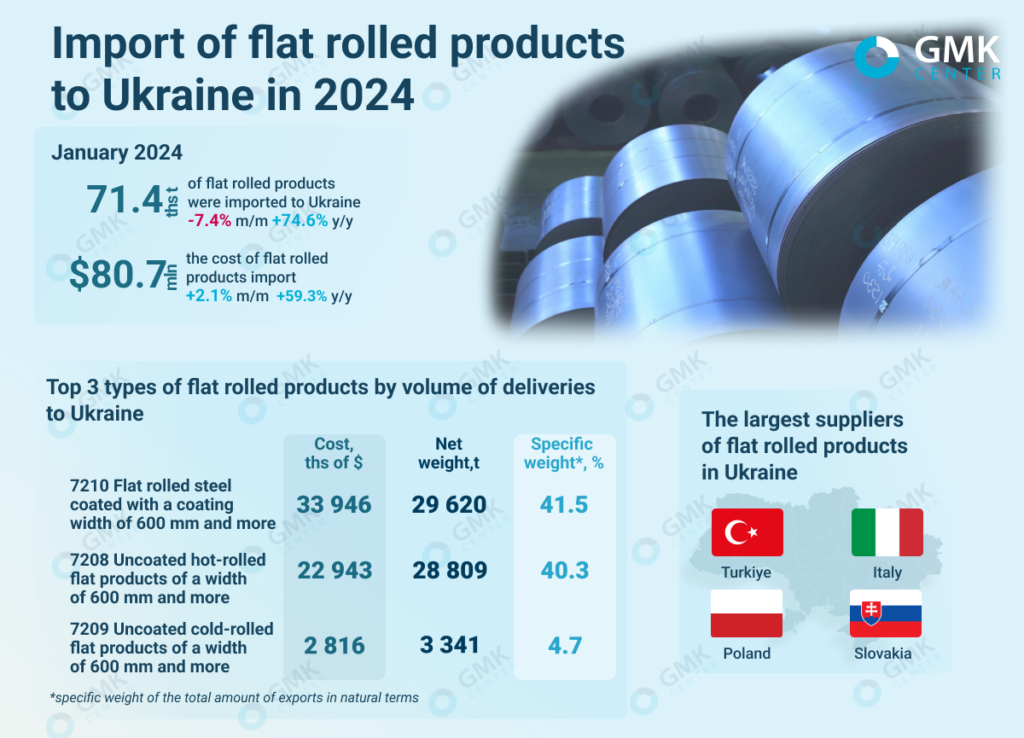

In January 2024, Ukraine reduced imports of flat products by 7.4% compared to the previous month – to 71.44 thousand tonnes. Import costs totalled $80.7 million, up 2.1% m/m. This is evidenced by the data of the State Customs Service.

Compared to January 2023, in January of this year, Ukrainian consumers increased imports of flat products by 74.6%, while spending on the purchase of foreign products increased by 59.3%.

In January, Ukraine imported the largest volume of coated flat products with a width of 600 mm or more (HS 7210) – 29.62 thousand tonnes (-4.6% m/m, +20.4% y/y) for $33.95 million (+2.4% m/m, +13.9% y/y).

The company also imported 28.81 thousand tonnes (-3.7% m/m; +170.7% y/y) of uncoated hot-rolled flat products with a width of 600 mm and more (HS 7208) for $22.94 million (-0.4% m/m; +154.8% y/y).

Cold-rolled flat products made of uncoated carbon steel with a width of 600 mm and more (HS 7209) were among the top three types of flat products imported to Ukraine in January, with 3.34 thousand tonnes (-69.2% m/m, +179% y/y) worth $2.82 million (-66.3% m/m, +131.2% y/y).

Turkiye, Poland and Slovakia were the largest suppliers of coated flat products with a width of 600 mm or more in January, accounting for 26%, 22% and 16.1% in monetary terms, respectively. Turkiye (49.8%), Slovakia (23.8%) and Italy (16.9%) shipped more than 90% of uncoated hot-rolled flat products with a width of 600 mm and more. Turkiye was the main supplier of uncoated cold-rolled flat products (78.3%).

The sharp increase in imports is due to the destruction of Mariupol steel mills that specialised in flat products. In addition, there is the impact of a low comparison base – in the first half of last year, economic activity was low due to the hostilities. Consequently, imports were not at the top of the agenda.

Imports of flat products are expected to grow in the long term, especially during the post-war recovery period. Imports will be the main source of supply to meet domestic demand. In the short term, imports will stabilise at a certain level, given the existing logistical constraints in the war.

As GMK Center reported earlier, in 2023, Ukraine increased imports of flat steel products by 93.2% compared to 2022, up to 908.2 thousand tonnes. Import costs increased by 48.4% y/y – to $1.03 billion. The largest suppliers of products were Turkiye, Romania, Slovakia and China.