News Global Market EU 704 01 November 2023

In January-August 2023, European consumers reduced steel imports by 19% y/y

In April-June 2023, the European Union reduced imports of steel from third countries (including semi-finished products) by 10% compared to the same period in 2022. The rate of decline in imports slowed down compared to the first quarter, when the figure fell by 27% year-on-year. This is stated in the report of the European Steel Association EUROFER.

Imports of rolled steel in the second quarter fell by 10% year-on-year after a more pronounced reduction in the first quarter – by 29% y/y. In particular, imports of flat products fell by 6% y/y, and long products – by 24% y/y.

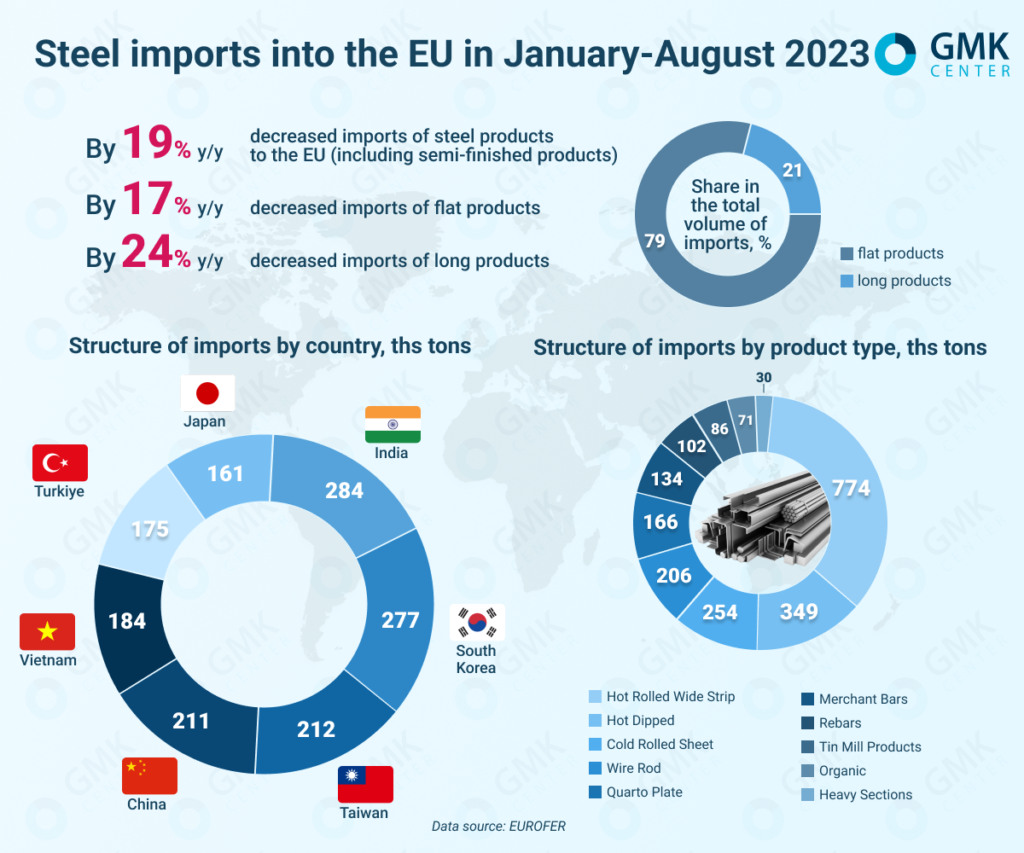

In January-August 2023, European consumers imported 19% less steel products (including semi-finished products) compared to the same period in 2022. Import supplies of finished steel products decreased by 19%, including flat rolled steel – by 17%, and long rolled steel – by 24% year-on-year.

The share of long products in the total imports of finished steel products was 21%, and flat products – 79%.

In the flat segment, imports of cold-rolled sheets (254 thousand tons) and hot-dipped galvanized sheets (349 thousand tons) decreased significantly – by 32% year-on-year each. Supply of coated sheets decreased by 34% year-on-year. The only exception was plates, imports of which increased by 3% y/y (774 thousand tons).

Among long products, only imports of heavy sections showed positive dynamics (+10% y/y). Imports of rebars (102 thousand tons), wire rod (206 thousand tons) and merchant bars (134 thousand tons) decreased by 35%, 25% and 22%, respectively.

“In 2023, imports show stable volatility, reflecting market fluctuations over the previous three years,” the association notes.

In January-August, the main importers of steel to the EU were India (12.6% of total steel imports) – 284 thousand tons, South Korea (12.3%) – 277 thousand tons, Taiwan (9.4%) – 212 thousand tons, China (9.4%) – 211 thousand tons, Vietnam (8.1%) – 184 thousand tons, Turkiye (7.8%) – 175 thousand tons, and Japan – 161 thousand. t. These countries account for 52% of the total imports of steel products into the EU.

During this period, supplies of steel products to the EU market from Turkiye fell by 59% y/y, China – by 11% y/y, and India – by 3% y/y, while Japan increased its shipments by 28% y/y, Vietnam – by 15% y/y, Taiwan – by 9% y/y, and South Korea – by 3% y/y.

As GMK Center reported earlier, the European Union in 2022 reduced imports of finished steel products from third countries by 5% compared to 2021. Supplies of flat products fell by 9% y/y, while long products increased by 11% y/y.