News Industry scrap metal 3302 21 March 2024

At the same time, exports of raw materials reached their highest level since January 2022

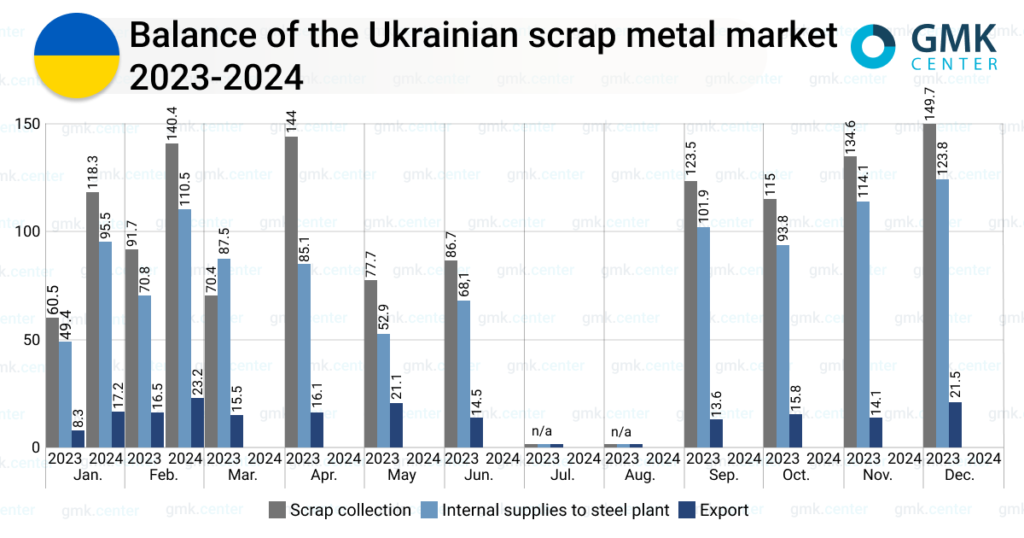

Scrap collection volumes in Ukraine in February 2024 increased by 18.7% compared to the previous month – to 140.4 thousand tons. The figure increased by 53.1% compared to February 2023. This is according to the Ukrainian Association of Secondary Metals (UAVtormet).

The supply of raw materials to Ukrainian steel plants amounted to 110.5 thousand tons for the month, which is 15.7% more than in February and 56.1% more than in February. The significant year-on-year growth is explained by the low comparison base, as in winter 2023 the domestic steel industry significantly limited production due to the shelling of critical energy infrastructure by Russian troops.

Exports of scrap in February reached their highest level since January 2022, at 23.2 thousand tons, up 34.9% compared to January this year and 40.6% y/y. There were no imports.

In January-February 2024, scrap collection in Ukraine amounted to 258.7 thousand tons, up 70% compared to the same period in 2023. The supply of raw materials to domestic steelmakers increased by 71.4% y/y – to 206 thousand tons. Exports increased by 62.9% y/y – to 40.4 thousand tons. Imports amounted to 0.02 thousand tons (-60% y/y).

Thus, more than 15% of Ukraine’s scrap is exported, and monthly shipments are gradually increasing, approaching pre-war levels. Exports are increasing in the face of difficulties in collecting raw materials due to the hostilities, as most scrap procurement enterprises were located in the temporarily occupied territories or in the war zone before the full-scale war.

Such conditions pose a threat to the operations of domestic steelmakers, as partial unblocking of sea exports helps to increase the capacity of the plants. In particular, ArcelorMittal Kryvyi Rih plans to increase its utilization to 50% in April by launching a second blast furnace. Other Ukrainian companies have similar plans. The improved prospects for the industry are also evidenced by the steel production data for January-February, which increased by 52% y/y – to 1.08 million tons. For a significant increase in capacity, sufficient scrap supply is critical, and exports are impractical. At the same time, UAVtormet forecasts that 250-300 thousand tons of scrap will be exported from Ukraine in 2024, with collection rates of 1.5-1.7 million tons, which is more than 17% of the total procurement volume.

«Ukrainian steelmakers are gradually resuming production, which requires scrap, among other things. The growth rate of scrap exports is outpacing the growth rate of steel production. This situation could potentially become a threat to Ukrainian producers, as scrap collection and sales to the domestic market cannot be considered predictable under current conditions, while exports are quite attractive,» comments GMK Center analyst Andriy Glushchenko.

Scrap is a strategic raw material for the global steel industry to achieve its carbon neutrality goals. Most developed countries are now in favor of a ban on scrap exports to preserve critical raw materials in the context of green steel development. The European Union may turn from an exporter to an importer of steel scrap in less than 5 years as global steelmakers switch to electric arc furnaces, so the competition for this raw material will only intensify.

As GMK Center reported earlier, in 2023, ferrous scrap сollection in Ukraine increased by 28.1% – to 1.27 million tons compared to 2022. Over the same period, scrap supplies to steelmakers amounted to 1.034 million tons (+15.4% y/y). Exports increased by 3.4 times compared to 2022 – to 182.48 thousand tons.