News Global Market hot-rolled prices 4265 30 March 2023

Rolled steel quotations rose amid demand recovery and positive expectations, but the market condition is ambiguous

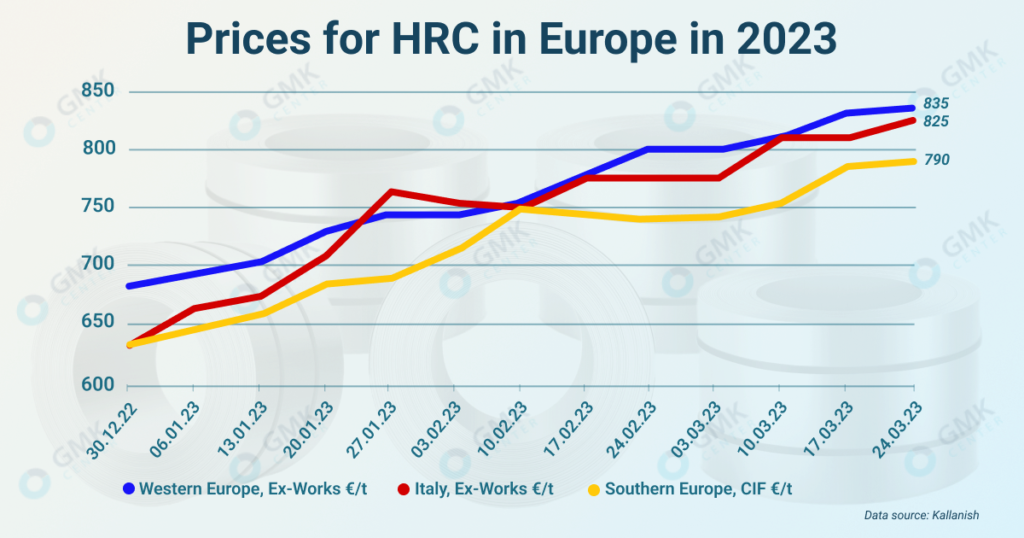

European hot-rolled coil (HRC) prices recovered steadily during March 2023 amid rising demand and positive expectations. On average, product quotations increased by €30-50/t compared to the previous month, depending on the region, according to Kallanish data.

In Western Europe quotations of hot-rolled steel as of March 24, 2023, were €820-850/t, which is €30/t or 3.6% more than the prices on February 24. In Southern Europe a similar trend was observed, but the price level is lower. Over the month, the price of hot-rolled steel in this region increased by €40/t, or by 5.3% m/m – up to €780-800/t. In general, during the month, the growth trend remained stable: the price of products increased by €5-10/t every week.

On Italian market for March the quotations of rolled products increased by €50/t or 6.4% m/m – up to €780-800/t.

In general, since the beginning of the year, the prices for hot-rolled steel in Europe have jumped by €140-180/t, which indicates a gradual recovery of the market after a difficult second half of 2022 for steelmakers. Product prices now correspond to the level of the beginning of June 2022 – the end of the price boom after the start of the war in Ukraine.

Product quotations have started to recover amid rising global steel demand, as well as output shortages as many European producers shut down production capacity at the end of 2022. From the beginning of 2023, EU steelmakers are gradually increasing steel production and decommissioning capacity in line with demand. Since the market is still uncertain, this process is not fast, so orders take longer than usual.

In addition, import deliveries of hot-rolled steel sheets have significantly decreased, which supports local producers. On average, the cost of imports increased by €250/t compared to the end of last year. It is expected that imported products will not be of interest to European consumers until at least the end of the third quarter.

In March, activity on the market decreased after significant purchases in January-February. Service centers have suspended rolled steel orders from producers. At the same time, the order portfolio of European steelmakers is full by July.

It is expected that the upward trend in hot-rolled steel prices will continue during the second quarter. Large producers are already considering further price increases, as the situation with shortages and lack of imports allows producers to take the market under their control. In the near future, quotations of hot-rolled steel sheet may increase to €900/t.

Long-term price growth depends on inflation control, economic growth and demand recovery in the construction and infrastructure sectors. At the same time, the uncertainty of the dynamics of the automobile sector development and fluctuations in the prices of raw materials and electricity continue to worry steelmakers.

Steel production in the EU countries in February 2023 fell by 12.6% compared to February last year – to 10.5 million tons. In January-February 2023, 20.7 million tons of steel were produced in the EU, which 14.3% less y/y.

In 2022, European steelmakers reduced steel production by 10.5% compared to 2021 – to 136.7 million tons. In general, global steel output last year fell by 4.3% y/y – to 1.831 billion tons.

This was facilitated by a massive reduction in production capacity amid rising electricity tariffs and unfavorable market conditions. At the same time, the European market was filled with imported steel products, which attracted consumers at lower prices than local ones. According to Fastmarkets estimates, at the end of 2022, about 14-15 million tons of annual steel capacities were stopped in Europe.

Already at the end of 2022 – beginning of 2023, EU steelmakers began to restart the stopped capacities, as the visible demand for steel and product prices began to grow, and the costs of energy resources – decreased and stabilized. In addition, the industry predicts further growth in demand for steel products.