Production of iron ore concentrate fell by 23% y/y, and coal production increased by 17% y/y

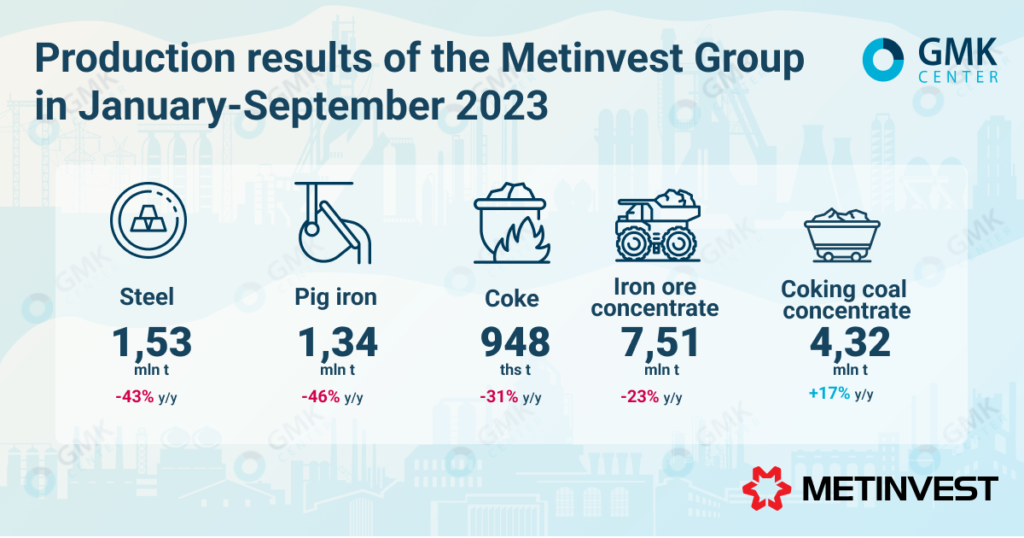

In January-September 2023, Metinvest Group reduced steel production by 43% compared to the same period in 2022 – to 1.53 million tons. This is evidenced by the company’s data published on its official website.

The production of iron ore concentrate for 9 months decreased by 23% y/y – to 7.51 million tons, and coal concentrate increased by 17% y/y – to 4.32 million tons. Pig iron production for the period amounted to 1.34 million tons, down 46% compared to January-September 2022.

In the third quarter, Metinvest reduced steel production by 8% q/q – to 499 thousand tons. Pig iron production fell by 10% q/q – to 425 thousand tons. Iron ore concentrate output amounted to 2.77 million tons and coal concentrate to 1.27 million tons, up 13% q/q and 19% q/q respectively.

«In the third quarter, pig iron production decreased by 10% q/q mainly due to the shutdown of blast furnace No.1 at Kametstal for scheduled overhaul. As a result, steel production decreased by 8% q/q» the report says.

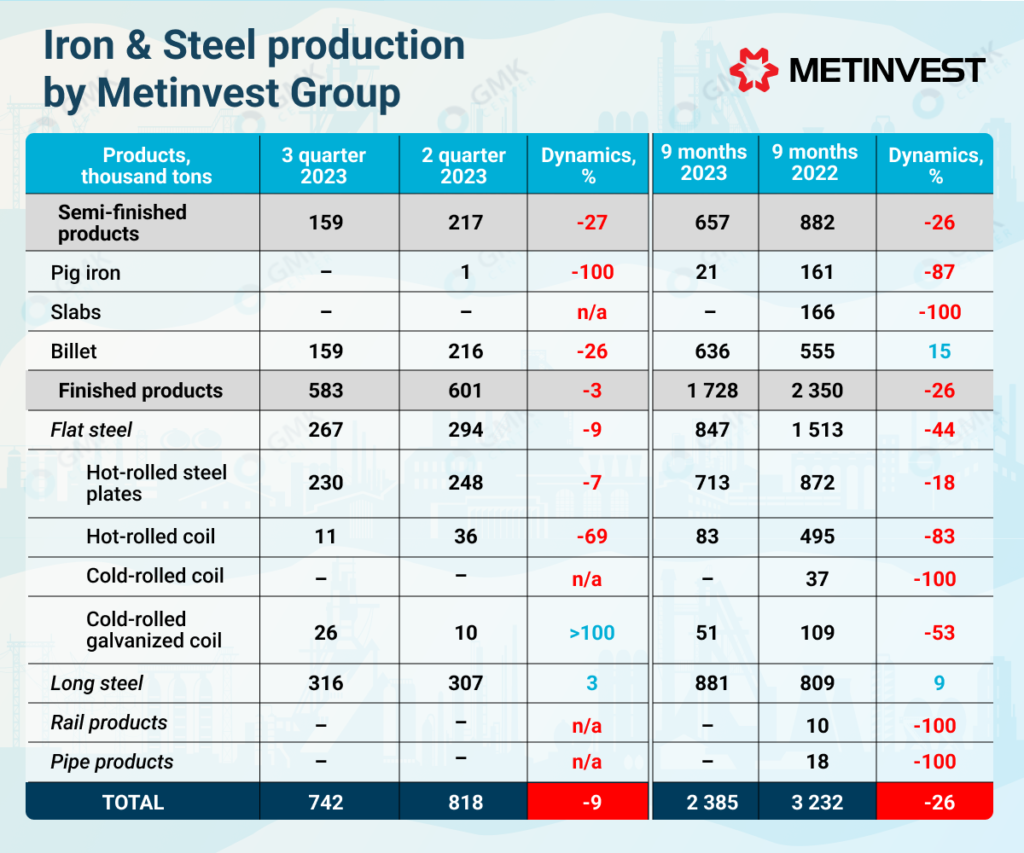

Production of steel products (semi-finished and finished products) in January-September 2023 decreased by 26% year-on-year – to 2.38 million tons. In particular, the production of semi-finished products amounted to 657 thousand tons (-26% y/y), and finished products – 1.73 million tons (-26% y/y).

In the third quarter, steel production fell by 9% quarter-on-quarter – to 742 thousand tons. Output of semi-finished products decreased by 27% q/q – to 159 thousand tons, and finished products by 3% q/q –to 583 thousand tons.

«In the third quarter of 2023, the production of semi-finished products decreased by 27% q/q, mainly due to increased domestic consumption at downstream stages. Production of finished products decreased by 3% q/q, in particular, due to a decrease in the order book of flat products at the rolling mills in Italy and the UK. This was partially offset by an increase in galvanized cold-rolled coil production at Unisteel Ukraine as the fourth inductor was launched after a major overhaul in the second quarter. Long products output grew by 9% q/q mainly due to an increase in the rebar order book at Kametstal», the company added.

Coke production in 9M2023 decreased by 31% y/y – to 948 thousand tons, and in the third quarter by 9% q/q – to 299 thousand tons. The decline was mainly due to lower demand from Kametstal.

Since the start of Russia’s full-scale invasion of Ukraine, the domestic steel sector has suffered significantly from the blockade of seaports and the loss of the largest steel plants in Mariupol. As a result, production and exports of iron and steel products fell significantly, with iron ore exports down 37% y/y – to 14.2 million tons, pig iron down 3.2% y/y – to 1.11 million tons, and semi-finished products down 40.4% y/y – to 1.03 million tons over the first 10 months of the year.

Ukraine’s steelmakers are forced to ship all their products mainly to the EU market by rail, which is 4-5 times more expensive than traditional sea transportation. In addition, the EU market is facing unfavorable conditions, which significantly reduces interest in Ukrainian products. Russia’s withdrawal from the grain deal has given Ukraine an impetus to develop ways to circumvent the Russian blockade, with ports already shipping more than 700,000 tons of iron and steel products, which improves prospects for the industry, but these volumes are still far from pre-war levels. In addition, the shipped products are mostly those that were blocked in ports since the beginning of the great war.

As GMK Center reported earlier, in 2022, Metinvest group reduced production of steel by 69% compared to 2021 – to 2.92 million tons. Pig iron production fell by 72% y/y – to 2.74 million tons. Production of iron ore concentrate amounted to 10.71 million tons (-66% y/y).