News Global Market iron ore prices 997 25 August 2023

Political support and expectations of seasonal demand support iron ore prices

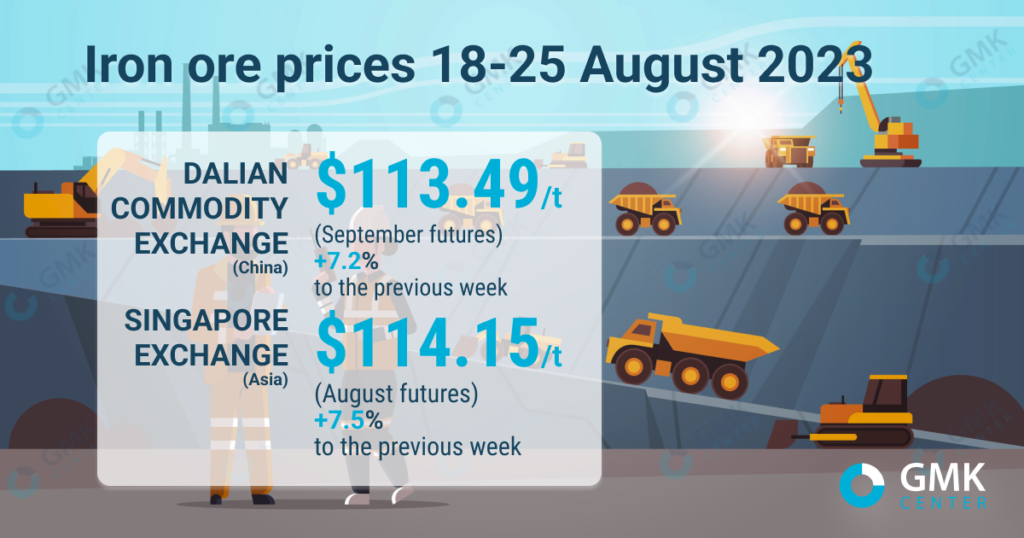

January iron ore futures, the most traded on the Dalian Commodity Exchange, grew by 7.2% week-on-year on August 18-25, 2023, to 827 yuan/t ($113.49/t). This is evidenced data Nasdaq.

On the Singapore Exchange, the quotes of basic September futures as of August 25, 2023 decreased by 7.5% compared to the price a week earlier – to $114.15/t.

Iron ore prices in China rose during the week on the back of ongoing economic stimulus and stable steel production, which has not yet been affected by restrictions. Market sentiment is also supported by the approaching construction season, which may improve domestic demand for steel.

«As the market enters a season of increased steel consumption, we believe that iron ore prices will find support after falling,» Marex analysts said.

The decrease in port ore stocks in the largest ports of China, along with the increase in steel production in anticipation of a seasonal upsurge in construction activity, also strengthens support for iron ore prices.

Currently, demand for iron ore remains stable despite the suspension of sintering processes at some factories in Tangshan for one week, from August 24 this year, in accordance with government requirements to improve air quality.

The market is expected to continue to rise until the Chinese government imposes final restrictions on steel production in 2023. After the announcement of clear plans, the market expects a decline in prices against the backdrop of reduced demand.

As GMK Center reported earlier, the investment bank Goldman Sachs revised its price forecast for iron ore in the second half of 2023 downwards – by 12%, to $90/t. This is due to the projected oversupply of raw materials in the amount of 68 million tons and a decrease in the volume of steel production in China. ING analysts expect the price of iron ore to be $105/t in the third quarter, and $100/t – in the fourth.