News Global Market iron ore prices 1742 25 November 2022

Iron ore futures on the Dalian Commodity Exchange for the week of November 18-25, 2022, did not change compared to the previous week

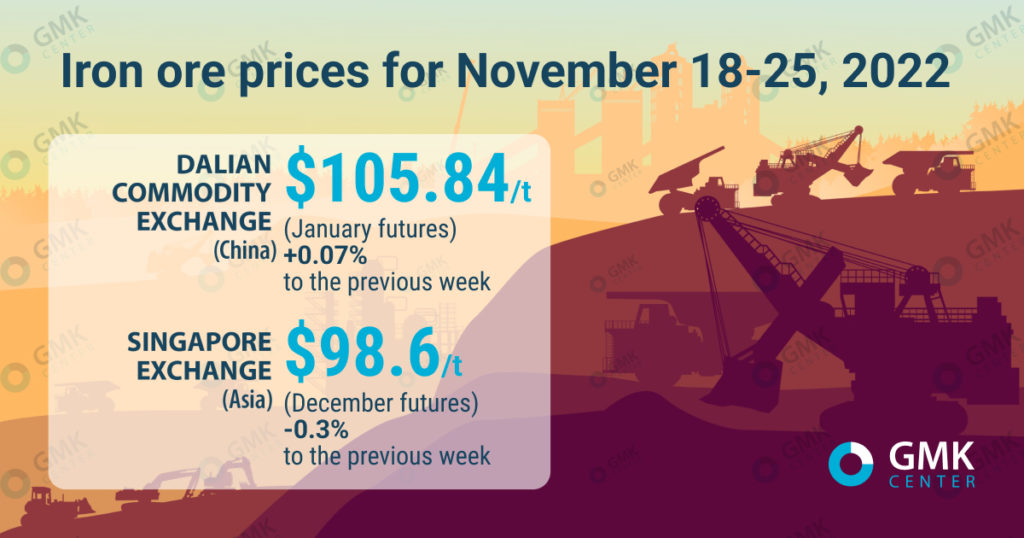

January iron ore futures on the Dalian Commodity Exchange for the week of November 18-25, 2022, remained unchanged from the previous week – at the level of 758/t ($105.84/t). Thus, quotations of iron ore stabilized after a three-week growth. This is evidenced by the Nasdaq data.

December iron ore futures on the Singapore Exchange slightly decreased from $98.95/t as of November 18, 2022, to $98.6/t on November 25.

Iron ore prices in China rose against the background of the government’s support of the country’s industry amid mass quarantines due to the coronavirus epidemic. Beijing has promised to take more policy measures to boost economic growth and eased some restrictions. In addition, new measures designed to support the real estate sector have been announced. All this added to the cheerfulness of the market, due to which the growth of iron ore quotations took place for three weeks.

Already at the beginning of last week, the prices of iron ore began to decrease, as the market worried about the prospects for economic activity due to new outbreaks of infection. On November 21, 2022, the largest area of Beijing was placed under quarantine restrictions, and at least one area of Guangzhou was closed for 5 days. Due to this quote, iron ore fell to $102.4/t.

The market continued to decline until November 24, but the losses were modest against the background of efforts by Chinese banks to support the real estate sector. Regulators have ordered financial institutions to provide more support to developers to stabilize lending, including extending existing loans. Iron ore prices are also supported by low inventories of finished products.

The direction of iron ore price dynamics now depends on the government’s actions to support the demand for finished products, because the number of sick people is increasing every day, and the market’s confidence in government support is fading. China’s largest commercial banks have pledged to provide at least $162 billion in new loans to developers, strengthening regulatory measures. Due to this, the prices of iron ore reached their maximum since the beginning of August 2022 by the end of the week.

The Chinese government promises to maintain the liquidity of the real estate sector despite the disappointing situation in the country. Thanks to this, in the short term, there will be a small increase in quotations. However, in the event of the introduction of mass quarantine restrictions, iron ore quotations will return to decline.

As GMK Center reported earlier, in January-October 2022, steel companies of China reduced imports of iron ore by 1.7% compared to the same period in 2021 – to 97 million tons. In October, China imported 94.97 million tons of iron ore, which is 4.3% less y/y.

China is the largest producer of steel in the world. In 2021, Chinese steelmakers reduced steel production by 3% compared to 2020 – to 1.03 billion tons. In 2022, the country plans to continue reducing production.