News Global Market rebar prices 2465 14 June 2023

In the Chinese market – the opposite trend, as participants continue to rely on active policies to stimulate the economy

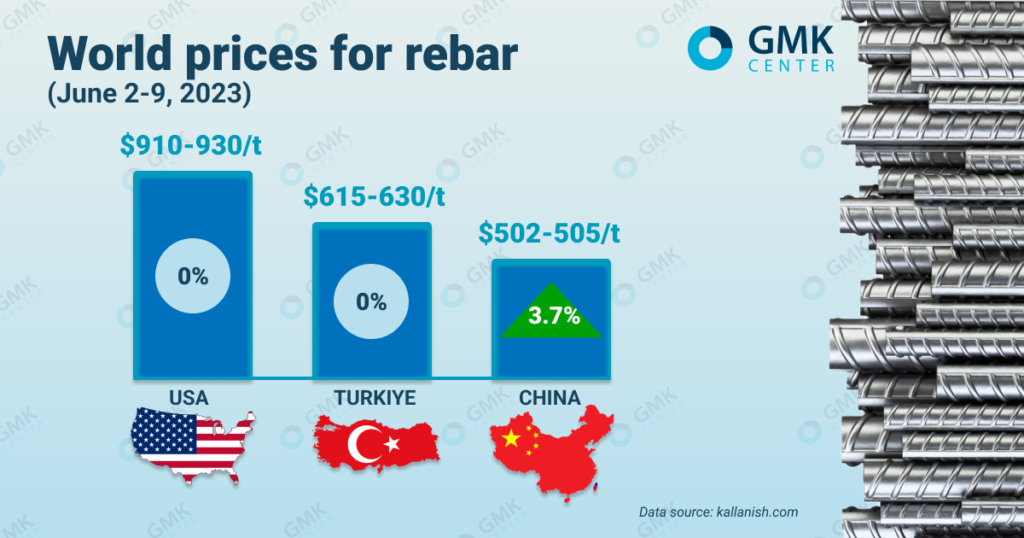

World rebar prices last week were stable in most markets. In Turkiye and the US, product quotations have not changed in the last 2-3 weeks as the markets were supported by domestic demand. At the beginning of this week, price levels in these markets began to decline under the influence of falling prices for scrap and macroeconomic factors. In China, the situation is reversed – product prices have been rising for the last 2 weeks, as the market expects the government to stimulate the economy and the real estate market.

Rebar quotes in Turkiye, according to Kallanish, for the week of June 2-9, 2023, were stable – at the level of $615-630/t. As of June 13, product prices fell to $615-625/t.

Turkish rebar producers have kept product prices unchanged in the past two weeks, despite the fact that they significantly exceeded the offers of competitors in the global market. At the beginning of the current week, rebar quotations began to decline.

This position of local producers was supported by domestic demand for rebar. Export sales were limited as the competitiveness of Turkish products is still low due to higher production costs than export competitors and macroeconomic problems in Turkiye.

Sales of Turkish rebar took place only in traditional export markets, mainly to Yemen and Africa. Israeli buyers offered $615/t, but Turkish mills are refusing such prices, relying on higher domestic levels.

Local steelmakers note that electricity costs are still high, so if tariffs are not revised in the short term, they may lose their traditional foreign buyers – Israel, Yemen. Russia, China and Egypt offer rebar to these markets at lower prices.

In the domestic market, activity is supported by a sharp depreciation of the lira against foreign currencies, which forces stock players to buy steel to limit devaluation losses. At the same time, even end-users purchased rebar. At the beginning of this week, domestic demand weakened, so steelmakers began to cut prices in order to get orders in export markets.

On the USA market rebar prices during June 2-9 were also stable for the second week in a row – at $910-930/t. At the same time, the forecast price of products for June 16 is $910-920/t.

The activity of the construction sector, for the most part, supported the stability of rebar prices since the beginning of the year. However, the general decline in prices in the US scrap markets has begun to put pressure on the plants, which may soon lead to lower price levels for steel products.

At the beginning of this week, a slight decrease in prices has already been recorded, but plants are in no hurry to be subjected to pressure from buyers.

Prices on Chinese rebar, maintaining the trend last week, rose during June 2-9 this year by 3.7% – up to $502-505/t. The construction steel market in China has been rebounding since early June, as traders and consumers raised their expectations of a possible stimulus for the construction sector by the authorities.

Last week, China’s major state-owned banks announced a cut in deposit rates, and experts suggested easing restrictions on property purchases, which also had a positive impact on the steel market. But some market participants believe that the effect of these factors will soon disappear, and therefore, either an increase in demand for rebar or a decrease in its supply is required to maintain the market balance.

As GMK Center reported earlier, Ukrainian steelmakers reduced their export of long products by 17.5% compared to the previous month – to 39.95 thousand tons. In monetary terms, the export of such products fell by 13.5% m/m – to $35.31 million. The main consumers of such products were Poland, Romania, Germany and Moldova.