News Global Market hot-rolled prices 2708 29 December 2023

The trend is expected to continue through the first quarter of 2024

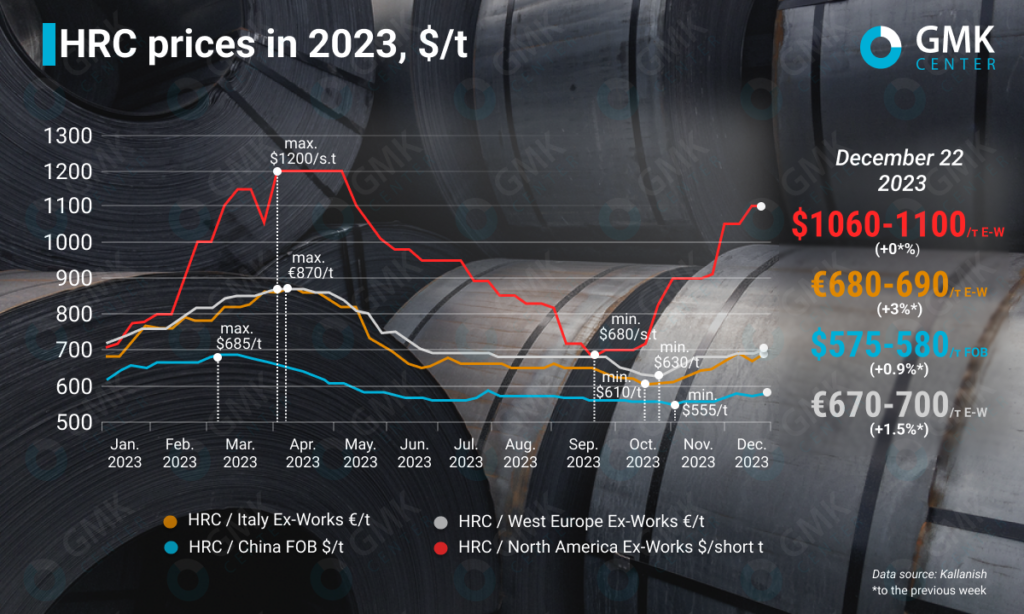

Global hot-rolled coil prices rose in December in major markets. In Europe, the trend is supported by limited supply and the absence of imports due to exhausted quotas, while in the US, the growth is driven by longer lead times and a firm stance on price increases by steelmakers. In China, prices also rose, but the trend was limited amid a decline in demand in the off-season.

Europe

In Western Europe, prices for hot-rolled steel products increased by €10/t, or 1.5%, compared to the previous week, to €670-700/t Ex-Works for the period December 15-22, 2023. Since the beginning of December, product quotations have increased by €50/t. At the same time, in December 2022, prices for hot-rolled steel in this region were at the same level.

In Italy, prices for hot-rolled steel during December 15-22 this year reached €680-690/tonne Ex-Works, up €20/tonne compared to the previous week. Since the beginning of December, prices have risen by €80/t, or 13.1%. As of the end of December 2022, prices for hot-rolled steel in Italy amounted to €650/t Ex-Works.

At the end of December, prices for hot-rolled coils in the EU market were on the rise, a similar trend to that of last year. The trade is supported by news of annual contracts for the supply of rolled products to the automotive industry and other major consumers. In particular, steelmakers have already signed contracts with BMW, Mercedes, Stellantis and Renault.

However, market participants are much more cautious in the economic recession, and some of them believe that the plants are speculating on prices contrary to real demand. At the same time, steelmakers hope to sell their products at the most favorable prices, relying on marginal production costs in the face of high energy costs and lack of strong demand.

Most market participants do not expect a repeat of the large-scale rise in hot-rolled steel prices seen in the first months of 2023, when prices reached €850/t. This surge eventually peaked in April, and by July prices had returned to the level seen in early December 2022. At the same time, in early 2024, after the quotas are exhausted, European producers will remain the main suppliers in the market, which will support prices.

Meanwhile, ArcelorMittal continues to increase its hot-rolled coil prices across Europe. During December 15-22, market sources noted that the company offered hot-rolled coils for the German market at €750/t Ex-Works. On the Italian market, the offer was €740/t Ex-Works. The Italian market is still far from responding to ArcelorMittal’s desired level, but prices are expected to continue to rise after the winter holidays.

USA

In the US market, prices for hot rolled coils for the week of December 15-22, 2023 remained at the level of the previous week – $1060-1100/t (N America Ex-Works). As of December 29, quotes rose to $1080-1110/t. At the same time, since the beginning of December, prices for the relevant products have increased by $200/t, or 18%.

Despite the slowdown in the market amid the holiday season, prices for hot-rolled coils in the US have been gradually rising since the beginning of December. This is driven by an increase in minimum quotation levels by some steel mills, including Cleveland-Cliffs. The producers are determined to raise prices, relying on long lead times and full order books through February.

«Prices continue to grow slowly. I think we will see them grow for at least another month or so, and then I assume they will reach an acceptable level in line with the market,» said a representative of one of the service centers.

During the last week of 2022, prices for hot-rolled coils (N America Ex-Works) fluctuated at $690-710/t.

China

In China, prices for hot-rolled coils for the week of December 15-22 increased by $5/t compared to the previous week to $575-580/t FOB. Since the beginning of December, quotes have increased by $10/t.

In the Chinese market, prices for hot-rolled coils support the global upward trend, but the pace is much slower.

Demand for products remains weak during the off-season. Most market players are still calm about postponed winter restocking. Only a few steel mills have clearly announced their winter stockpiling plans, while the rest of the producers and traders are maintaining a wait-and-see attitude. Steel production declined slightly in mid-December, but lower demand is putting more pressure on previously accumulated inventories.

China’s hot rolled coil prices are expected to rise in early 2024 as at least five major steel mills in Jiangsu, including Xuzhou Steel Group, Zhongxin Steel and Yaxin Steel, will begin maintenance that will last from late December to early January and are expected to gradually resume production from February.