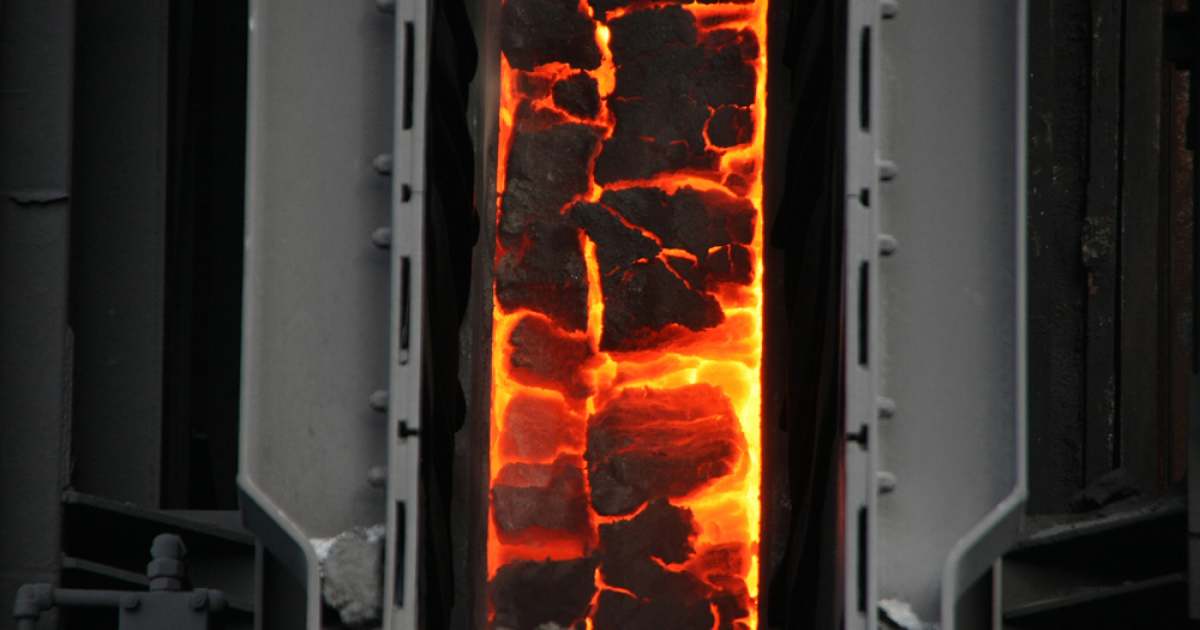

News Global Market coke 1455 01 August 2023

Total shipments decreased to 11.68 million tons in January-June 2023

Global trade in coke used in steelmaking fell by 11.7% y/y in the first half of 2023 – to 11.68 million tons. This is evidenced by data collected by CoalMint, informs SteelMint.

In 2022, steel plants around the world consumed about 576 million tons of coke. At the same time, the volume of its trade amounted to 28.45 million tons, which is 4% less than in 2021. So the global share of domestic production of coke for steelmaking is more than 95%, only about 5% of the total demand is met by commercial supply.

China remained the main sea exporter of coke in the first half of 2023 – the total volume of deliveries from this country amounted to 4.06 million tons, which is 2% less y/y. The second and third places in this period were occupied by Poland and Colombia – 3.51 million tons (-3% y/y) and 1.82 million tons (-23% y/y), respectively.

In January-June 2023, the volume of coke exports from the USA decreased sharply, falling by 51% in annual terms – to 570 thousand tons. At the same time, Indonesia in the first half of 2023 sharply increased the supply of this raw material abroad – to 310 thousand tons compared to 10 thousand tons in the same period of 2022.

The largest importer of coke during the first half of 2023 was the EU with a total volume of 2.45 million tons (-6% y/y). In January-June, India increased its import of these products by approximately 65% year-on-year – up to 2.13 million tons.

The reduction in global coke exports occurred amid a drop in global steel production in the first half of 2023. In addition, compared to last year, the total volume of supplies of these products from the USA and Colombia decreased.

In particular, the United States’ exports to its main market, the EU, fell due to low demand for steel in Europe and the impact of this factor on production. In addition, energy prices began to stabilize in 2023, so European market participants began to resell cargoes of coal and coke to Asia in order to minimize stocks accumulated due to excessive purchases after the beginning of the Russian invasion, gas supply restrictions and the general energy situation.

The global marine coke market is expected to gradually decrease due to significant expansion of domestic production capacity by countries, especially India and Brazil. In addition, the curtailment of steel production in China in the second half of the year is likely to lead to lower production and exports of coke, while its imports to the EU are unlikely to increase. So CoalMint expects global coke trade volumes in 2023 to be lower than a year earlier.

As GMK Center reported earlier, Ukraine in January-June 2023 reduced the import of coke and semi-coke by 70.5% compared to the same period in 2022 – to 89.35 thousand tons. During June, Ukrainian consumers imported 18.2 thousand tons of coke, which is 9.3% more than in June 2022, but by 53.4% less than the previous month – 18.2 thousand tons. The main supplier of coke and semi-coke to Ukraine in the first half of 2023 is Poland – 96.9% of supplies in monetary terms.