The transaction is expected to close in the third quarter of 2024

Commodities trader and mining company Glencore will lead the deal to buy the steel coal division of Canada’s Teck Resources – Elk Valley Resources or EVR. This is stated in a statement on the company’s website.

Glencore will acquire 77% of Teck’s coal business for $6.9 billion. Japanese steelmaker Nippon Steel, which already owns 2.5% of the shares, will receive 20% by acquiring additional capital from EVR, and South Korea’s Posco will exchange its stake in two Teck coal companies for 3% in the steelmaking coal business of Elk Valley Resources.

The transaction is expected to be completed in the third quarter of 2024, with a total transaction value of $9 billion.

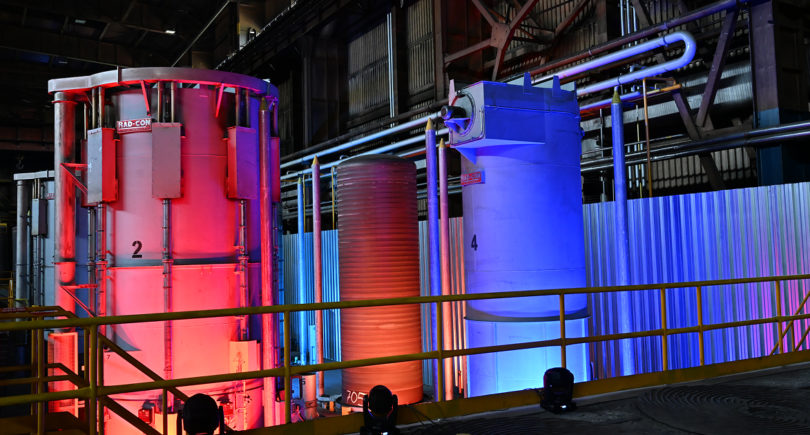

“We are pleased to have reached agreement to acquire Teck’s steelmaking coal operations in the Elk Valley. These world-class assets and the experienced people that operate them are expected to meaningfully complement our existing thermal and steelmaking coal production located in Australia, Colombia and South Africa,“ said Gary Nagle, CEO of Glencore.

The sale agreement will end the conflict between Teck and Glencore, Bloomberg reports. It was provoked by the commodities giant’s proposal to acquire the entire Canadian mining company and then split its metals and coal divisions.

In June 2023, Glencore offered to acquire Teck’s coal business as an alternative.

The addition of Teck’s business will further strengthen Glencore’s position as one of the world’s largest mining businesses. In June, the company said that if its proposal is approved, it plans to spin off its coal operations and merge them with Teck’s assets.

Investors and lawyers, Reuters writes, are optimistic that Canada will approve the deal, despite the fact that the government has tightened controls over foreign investment to ensure that it does not harm national security.

The Federal Ministry of Innovation declined to comment specifically on Glencore’s proposal, citing confidentiality provisions, but said that any transaction involving a Canadian and a foreign company would be subject to review under the ICA (Investment Canada Act).

Earlier, EcoPolitic wrote, that in July the Indian steel producer JSW Steel considered the possibility of acquisition of up to 20% of shares in the Canadian steelmaking coal business Teck Resources.