News Global Market France 3350 25 March 2024

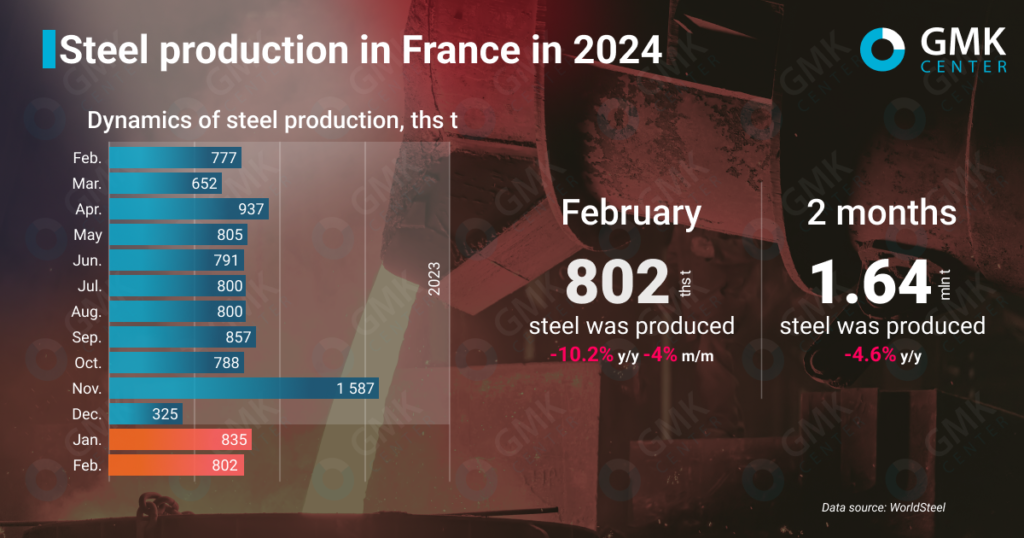

In January-February 2024, French steelmakers reduced steel production by 4.6% y/y

In February 2024, French steelmakers reduced steel production by 10.2% compared to the same month in 2023, to 802 thousand tons. The country was thus ranked 19th in the global ranking of steel-producing countries (71) by the WorldSteel Association.

French steelmakers’ steel production fell by 4% compared to the previous month.

In January-February 2024, steel production in France decreased by 4.6% compared to the same period in 2023 – to 1.64 million tons. Average monthly steel production for this period amounted to 818.5 thousand tons, compared to 858 thousand tons in January-February 2023 (-4.6% y/y).

Overall, steel production in the European Union in January-February 2024 decreased by 0.9% compared to January-February 2023 – to 21.1 million tons. Global steel production for 2 months amounted to 306.9 million tons, up 3% y/y.

As GMK Center reported earlier, in 2023, France reduced steel production by 17.4% compared to 2022, to 10.01 million tons. The average monthly steel production for the year amounted to 840.7 thousand tons, while in 2022 the figure was 1.01 million tons (-16.76% y/y).

Steel production in the European Union amounted to 126.3 million tons in 2023, down 7.4% y/y.

There are 10 steel mills in France, including Saarstahl Ascoval Saint-Saulve (capacity of 730 ktpa), LME Trith-Saint-Léger (850 ktpa), ArcelorMittal Dunkerque (6.75 million tpa), Kehler Baden Steel Works (2.5 million tpa), Riva Sam Neuves-Maisons (850 ktpa), Riva Sam Neuves-Maisons (850 ktpa), Riva Iton Seine Bonnieres Sur Seine (550 ktpa), Riva Alpa Gargenville (700 ktpa), Riva Sam Montereau (720 ktpa), ArcelorMittal Méditerranée Fos sur Mer (4 million tpa), Celsa France Boucau (1.2 million tpa). The total capacity of the plants is 18.85 million tons per year. Thus, in 2023, capacity utilization was 53.1%.

Low steel production last year was due to the weak market conditions that have been observed since the fall of 2022. The European steel industry is facing high production costs at a time when demand for domestic steel products is weak amid a flood of cheaper imported products. In the autumn and winter, many companies limit their capacity to balance supply and demand and stabilize product prices.