News Industry ferroalloys 2368 22 February 2024

During the month, ferroalloy producers exported only 0.2 thousand tons of products, which is a consequence of the complete shutdown of existing enterprises

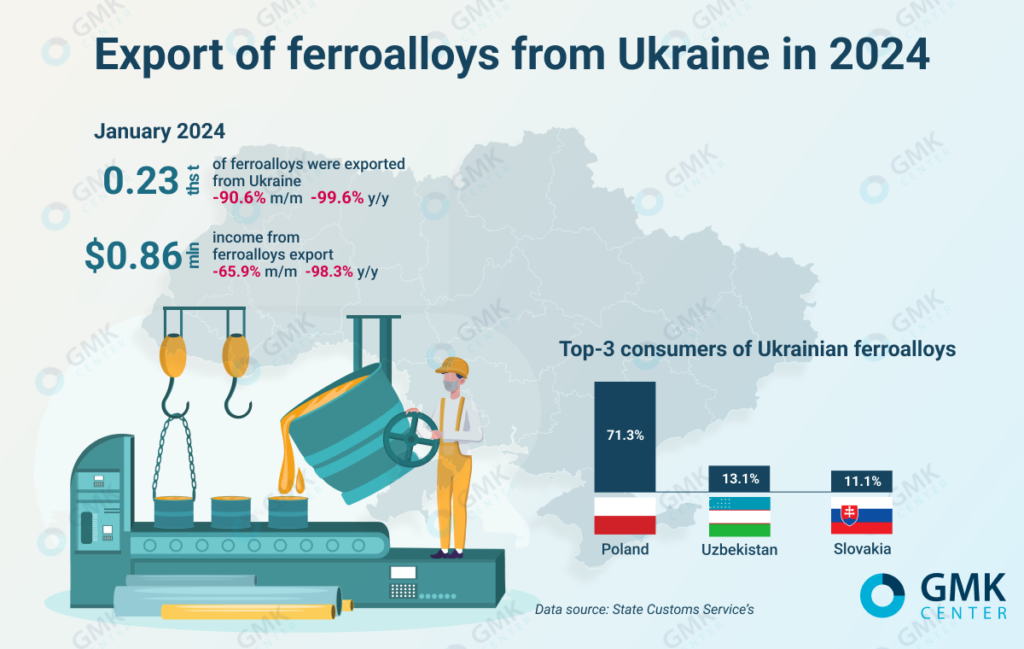

In January 2024, Ukrainian ferroalloy companies almost completely stopped exporting their products. During the month, 0.23 thousand tons of products were exported compared to 2.5 thousand tons in December and 55.9 thousand tons in January 2023. This is evidenced by the data of the State Customs Service.

Revenue of ferroalloy companies from exports in January amounted to $862 thousand. In January 2023, export revenues were $51.6 million, and in December – $2.23 million.

The main volume of products was shipped to Poland – 71.4% of total exports in monetary terms. Another 13.1% was exported to Uzbekistan and 11.1% to Slovakia.

The absence of exports, which have been gradually declining since August last year, is explained by the complete shutdown of Ukraine’s ferroalloy industry since November 2023, in particular due to proximity to the front line, falling prices for ferroalloys, high production costs and problems with reserving personnel from mobilization.

The combination of these factors led to a 57.4% decrease in ferroalloy production in 2023 compared to 2022. In 2024, according to Sergiy Kudryavtsev, Executive Director of the Ukrainian Ferroalloy Association UkrFA, the state of Ukraine’s ferroalloy industry will depend on three factors: shelling, logistics and affordable electricity.

As GMK Center reported earlier, in 2023, Ukraine reduced exports of ferroalloys by 4.9% compared to 2022, to 344.2 thousand tons. Compared to the pre-war year of 2021, shipments of ferroalloys abroad decreased by 48.5%, or 324.4 thousand tons. Poland was the largest consumer of Ukrainian-made ferroalloys in 2023, accounting for 52.8% in monetary terms. Turkiye accounted for 14.1% of export shipments and the Netherlands for 8.5%.