News Global Market EU 1094 30 September 2024

The main volume is accounted for by steel semi-finished products, DRI and pig iron

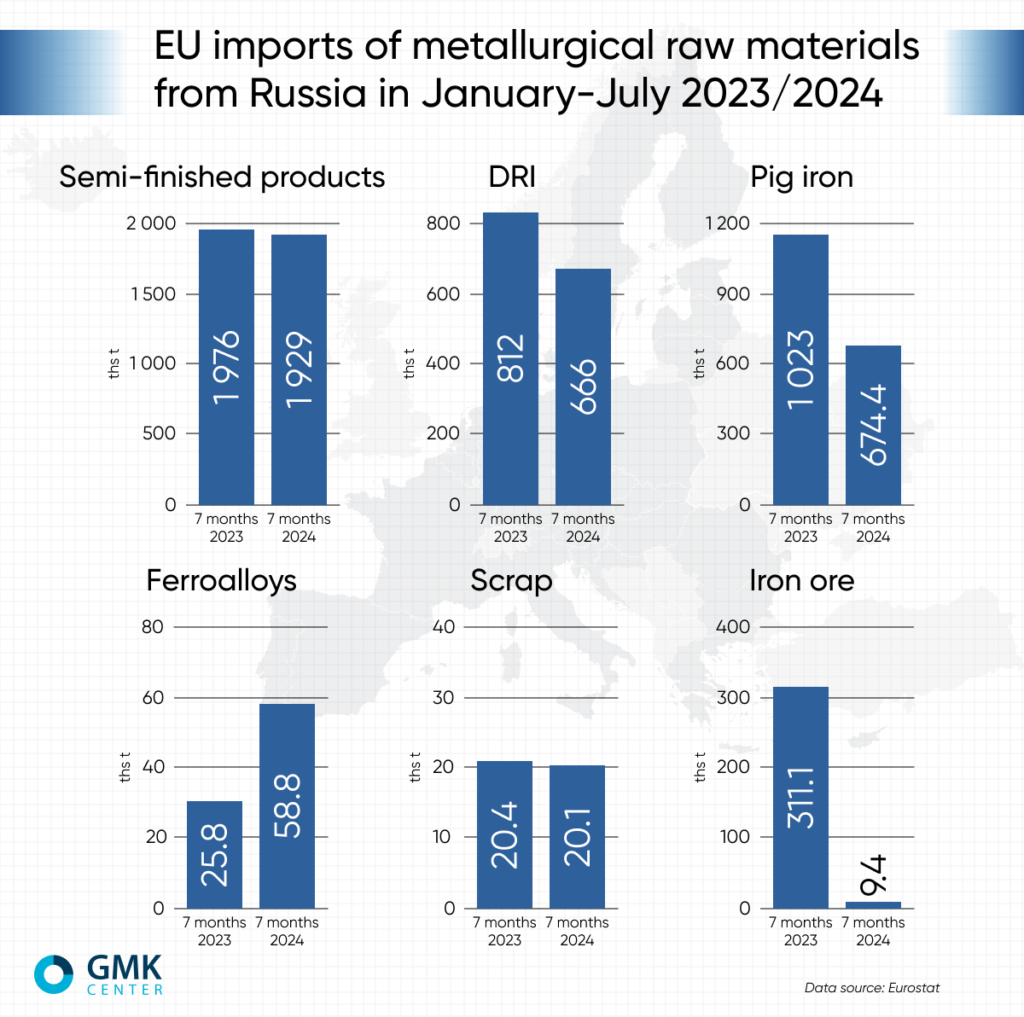

In January-July 2024, the European Union (EU) imported 3.36 million tons of steel raw materials of Russian origin. The cost of imports of these products amounted to €1.62 billion. This is according to GMK Center’s calculations based on Eurostat data.

Semi-finished products account for the bulk of imports. In 7 months of 2024, 1.93 million tons of slabs and billets were shipped to the EU. The cost of relevant imports amounted to €996.96 million. The largest consumers of semi-finished products from the Russian Federation are Belgium – 758.7 thousand tons, Italy – 416.26 thousand tons, Denmark – 296.39 thousand tons (+1.2% y/y), and the Czech Republic – 278.56 thousand tons (+22.9% y/y).

Pig iron also accounted for large import volumes – 674.44 thousand tons. Revenues of Russian iron and steel companies from the supply of pig iron to the EU market amounted to €275.32 thousand. The main volumes were sent to Italy – 501.33 thousand tons, and Latvia – 85.51 thousand tons (+71.9% y/y).

Supplies of Russian-made ferroalloys to the EU market in January-July 2024 increased by 128.4% compared to the same period in 2023, to 58.83 thousand tons. Import costs amounted to €110.91 million (+54% y/y). The Netherlands accounted for more than 81% of supplies – 48.06 thousand tons (+180.1% y/y).

Imports of scrap from Russia amounted to 20.14 kt, and collection costs amounted to €11.73 million. Iron ore supplies amounted to 9.36 kt and €1.33 million. At the same time, direct reduced iron imports for the period reached 666.02 kt for €227.52 million.

The European Union continues to import significant volumes of steel products from Russia. This trend is predictable, as Russian producers offer products at significant discounts, and most plants are dependent on this. In addition, the sanctions packages have not included a complete ban on such imports for a long time, or still do not include a complete ban on such imports. In the case of slabs, the European Commission decided to ease restrictions and allow imports from Russia to continue. There is a risk that this case will be used to lift restrictions on imports of pig iron from Russia. At the same time, Ukraine, as a future EU member, has every opportunity to replace Russian products on the European market.

As a reminder, in 2023, the EU reduced imports of steel and mining products from Russia by 39.5% compared to 2022, to 4.8 million tons. Import costs decreased by 38.5% y/y – to €2.4 billion. Semi-finished products accounted for the bulk of imports, accounting for 69.4% of total supplies.